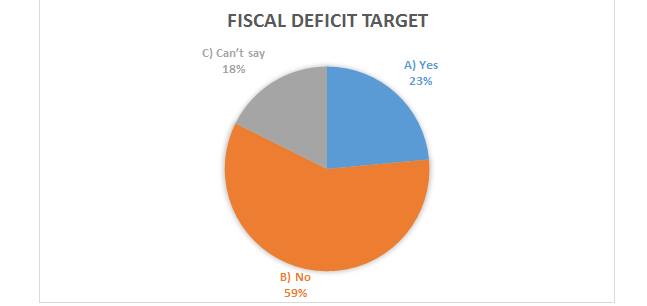

Although the government looks confident of meeting its 3.3 percent fiscal deficit target in the current financial year, but analysts feel otherwise, according to a poll conducted by Moneycontrol from January 9-11.

We spoke to 17 analysts, fund managers and money managers last week to assess the sentiment of investors and get some idea of what to expect from the interim Budget.

The government will present an interim budget, or vote on account, on February 1. The new government will present a full-fledged budget in July 2019.

As many as 59 percent of the poll respondents feel that the government is likely to miss its fiscal deficit target for the current financial year, while 24 percent of them feel that the Centre should be able to meet, and the rest 18 percent preferred not to comment.

Fall in GST collections as well as lower divestment receipts on the income side and unaccounted expenditure heads like the MSP hike are likely to lead to the shortfall, suggest experts.

“The government had budgeted a 3.3% GFD/GDP for FY19 while we expect it to be around 3.5% for FY19. While GST collections are expected to be lower than the government’s initial target, but with a monthly run rate of Rs 90,000 crore, overall net tax collections are likely to grow 12% in next year,” Teena Virmani - Vice President – Research - Kotak Securities said.

“On the expenditure side, we expect expenditure growth of 10 percent led by 10 percent growth in revenue expenditure and 10% growth in capital expenditure,” she added.

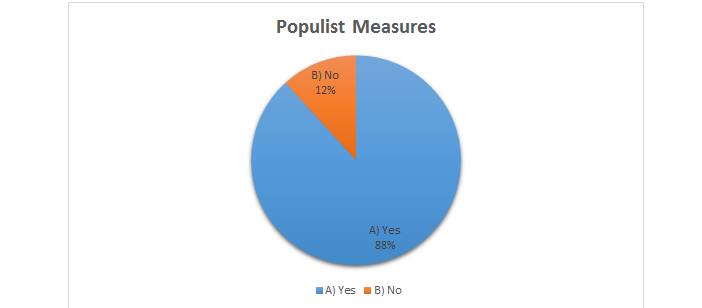

It is the year of general elections and talks of populist measure have already begun. Most experts feel that the government is likely to announce populist measures to woo rural voters but will it include farm loan waivers? Maybe not.

Various media reports highlighted that after the recent defeat in three major states, the BJP government has ramped-up efforts to woo rural voters, but Prime Minister Narendra Modi is not looking at farm loan waivers as being demanded by Rahul Gandhi and the Congress Party.

Modi's key focus in the meetings held so far has been on the Pradhan Mantri Fasal Bima Yojana, commonly known as the crop insurance scheme, a report said.

As many as 88 percent of the poll respondents feel that the interim Budget will have populist measures to woo rural voters while the rest 12 percent feel otherwise.

“Notwithstanding concerns around fiscal profligacy in years of general election, we expect the current government to stick to its fiscal glide path and not to announce universal farm loan waivers in budget 2019,” Elara Capital said in a report.

“However, many of the states which went to polls in CY2018 have lived up to their election promise of doling out farm loan waivers (Uttar Pradesh, Madhya Pradesh, Rajasthan, Chhattisgarh) which collectively is in excess of Rs 1 trillion. Hiccups in implementation apart, the pace of delivery and percolating effect of loan waiver will boost rural income and consumption in CY19,” it said.

Can PM Modi make a comeback?With the recent setback suffered in three state elections, BJP is likely to up its preparations for the Lok Sabha elections in April-May 2019. But, can we sat that it dented Modi’s popularity? Well, to a certain extent, yes.

“In wake of the recent performance of the ruling party in several state elections, the odds have gradually been rising in favour of a much interesting political showdown than what was anticipated a year ago,” Jayant Manglik, President, Religare Broking told Moneycontrol.

“However, we believe the incumbent government (NDA) will be able to squeeze in another term, even as the BJP’s standalone tally may get somewhat impacted,” he said.

As many as 59 percent of the poll respondents feel that they are factoring in a second term for the Modi government but with a coalition, while 35 percent of them are of the view that the BJP will be back to power without any outside support. The rest 6 percent feel that BJP might not be able to gain majority in the upcoming general elections.

Being an election year, most experts are not ruling out a possibility of an increase in volatility ahead of the big event. Kotak Securities highlighted three possible scenarios and its relevant impact on markets.

In a Bear case (i.e. a fractured mandate in Central elections), Nifty likely to hover in the range 10,000-10,500 by December 2019.

Bull case (i.e. either a clear mandate or BJP/Congress-led coalition government): Nifty is likely to hover in the 12,500-13,000 range by end of December 2019.

The general consensus is that the broader market will outperform largecaps in 2019. Hence, investors should stay put. The scope of valuation re-rating remains very high in a host of mid & smallcaps provided earnings are in-line with estimates.

As many as 71 percent of the poll respondents feel that investors should stay put in the small & mid-cap space ahead of elections, while the rest 29 percent feel that investors should ideally book profits and wait for clarity to emerge.

“As the Nifty inches upwards in 2019, we could see a strong bounce back in many midcaps and small-caps. However, this revival would still be part of a major bottoming-out process for this space,” Amar Ambani, President & Head of Research, YES Securities told Moneycontrol.

“This is an excellent time to accumulate interesting midcap and small-cap stories, not exactly from a 2019 perspective but for a horizon of three years or more. One should start identifying companies with credible management, those having sustained financial performance even during turbulent times,” he said.

Poll RespondentsSunil Jain – Head of Equity Research at Nirmal Bang Financial Services

Rusmik Oza, Sr. VP and Head of Fundamental Research, Kotak Securities Limited

DK Aggarwal is Chairman & Managing Director of SMC Investments & Advisors

Nikhil Kamath- Co- Founder, Zerodha

Naveen Kulkarni, Head of Research, Reliance Securities

Jayant Manglik, President, Religare Broking Ltd

Aruna Giri, Founder CEO & Fund Manager, TrustLine Holdings

Mayuresh Joshi, Fund Manager, Angel Broking Ltd

Mazhar Mohammad, Chief Strategist – Technical Research & Trading Advisory, Chartviewindia.in

Dinesh Rohira, CEO, 5nance.com

Raghavendra Nath, Managing Director, LadderUp Wealth Management

Vineeta Sharma HOR at Narnolia Financial Advisors

Vijay Singhania, Founder & Director, Trade Smart Online

V K Sharma, Head PCG & Capital Markets Strategy, HDFC Securities

Tejas Khoday, Co-Founder and CEO at FYERS

Vinod Nair, Head Of Research at Geojit Financial Services, and

Mustafa Nadeem, CEO, Epic Research

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.