"Copper's growth story is simple," American billionaire Stanley Druckenmiller remarked recently. "It takes about 12 years from greenfield to production. With the rise of EVs, expanding grids, data centres, and global warming, the supply-demand dynamics for copper look incredible for the next five to six years," Stanley added, perfectly encapsulating the growing demand for the industrial metal.

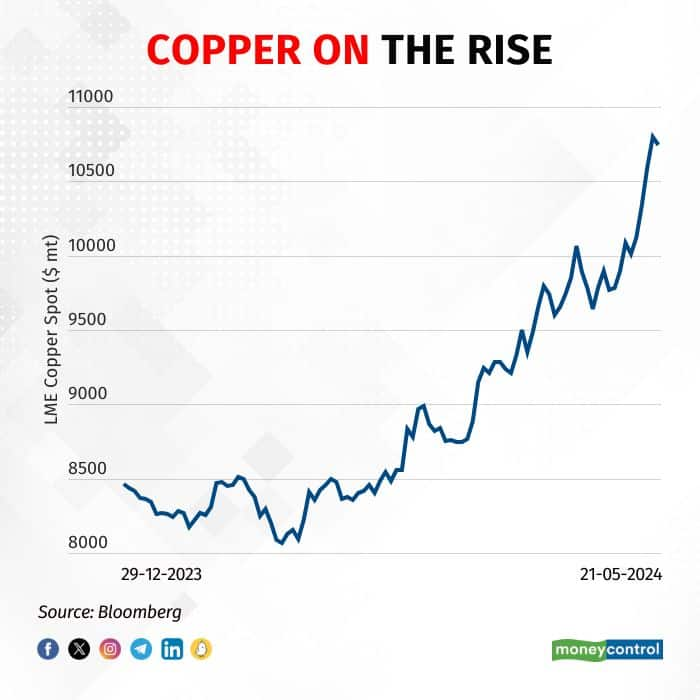

This explanation is particularly significant as Goldman Sachs recently warned of a potential "stockout episode" by the fourth quarter, where inventories could become critically low, indicating rising supply stress. Consequently, copper prices surpassed the $10,000 mark, with investors anticipating further gains from this essential metal.

Follow our live blog for all the market updates

But why the drop in supply? First, the closure of the Cobre Panama mine, which accounts for 1 percent of the total copper production in December last year. Further, rising demand from the Electrical Vehicle (EV) segment is a huge factor causing the crunch in the market. According to Goldman Sachs, supply-demand estimates point to a 454,000-ton metal deficit for this year and a 467,000-ton deficit for 2025.

ALSO READ: Nifty 50 to hit 1,50,000 in next 15-17 years but not without corrections, says Raamdeo Agrawal

"The geopolitical factors like fresh sanctions on Russia have also increased speculative long positions in copper," Bhavik Patel, Senior Commodities Analyst at Tradebulls Securities told Moneycontrol. "The sentiment is expected to continue amid a revival in China's housing market which will also be a key driver for increased copper usage," he said. Last month, the US and the UK imposed new sanctions on importing Russian aluminium, copper, and nickel.

READ MORE: IPOs soar to 8-month high in May with Rs 9,600 crore raised

"We think the rally is sustainable, except for the strong dollar. London Metal Exchange's copper crossing $10,000 per tonne is a crucial level and it can travel up to $12,000 a ton in the second half of the year," Jigar Trivedi, Senior Commodities Analyst at Reliance Securities said in a conversation with Moneycontrol.

Trivedi also added that uncertainty related to the timing of the first Fed rate cut coupled with inflation in developed countries like the UK, Japan, and China suggests that the outlook for industrial metals and copper is positive.

While Canada's First Quantum, which operates the Cobre Panama mine, will hold discussions with Panama's newly elected president Jose Raul Mulino, analysts believe that the supply-demand mismatch is expected to linger.

As that unfolds, multiple sectors will face a ripple effect of the same. Renewable energy and EV manufacturers will be most affected by the sharp rise in copper prices. "Mining sectors are likely to benefit and we believe the outlook for the metal’s future is promising looking at a deficit for copper this year due to supply disruption and increase in demand keeping in mind the revival coming from China and shift in clean energy globally," Patel added.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions."

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.