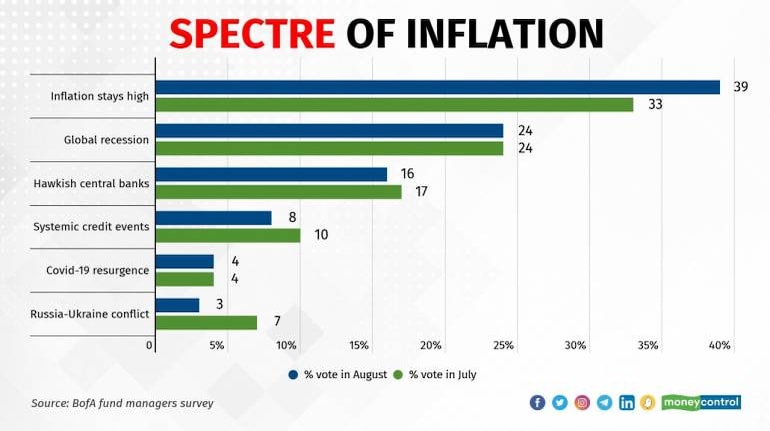

For global fund managers, the biggest tail risk remains a stagflation in the global economy even after six months of commodity price drop. The latest survey of them by Bank of America shows that investors are still holding on to cash but are not “apocalyptical” in their expectations as they were last month. The recent drop in commodity prices has done little to thwart the concerns over inflation or even reduce the odds of it easing. Fund managers still believe that the probability of inflation staying elevated along with a global recession continues to be high. That explains the large cash holdings and sitting on the sideline behaviour by investors. Investors are hoarding the dollar and perhaps even US equities but keeping off equity markets of Europe and emerging markets. From the energy crisis feared to get intense in Europe as Russia contemplates cutting off supplies even as winter sets there, it is difficult for fear of inflation to recede now. At the same time, the US Federal Reserve is in no mood to slow down its efforts to rein in inflation and is ready to risk a recession too. The only silver lining, if any, would be inflation coming down. For now, the sky is grey with worry

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.