The market finally surpassed the psychological mark, 12,000, on October 12 on an intraday basis on the back of hopes of another fiscal stimulus by the government, expectations of better September quarter earnings and positive global cues. The additional liquidity and regulatory measures by RBI also lifted sentiment.

The benchmark indices staged strong performance in last 12 trading sessions, rising more than 10 percent or over 1,000 points rally on the Nifty50 itself.

The Nifty50 touched psychological 12,000 mark intraday, for the first time since February 20 this year while the BSE Sensex also traded above 40,000 mark.

Given the strong rally in past several sessions, the momentum may remain in favour of bulls but the consolidation is largely seen before further upside, experts feel.

Ajit Banerjee, Chief Investment Officer at Shriram Life Insurance Company feels that the market will stabilise further from here with some sideways movement in the interim.

"The government's focus on Atma Nirbhar Bharat coupled with the availability of cheap credit and additional fiscal measures will bring in all-round development in the country which will propel the economic and market growth," he told Moneycontrol.

The benchmark indices rallied around 58 percent from March lows, while the Nifty Midcap index climbed 55 percent and Smallcap jumped 74 percent.

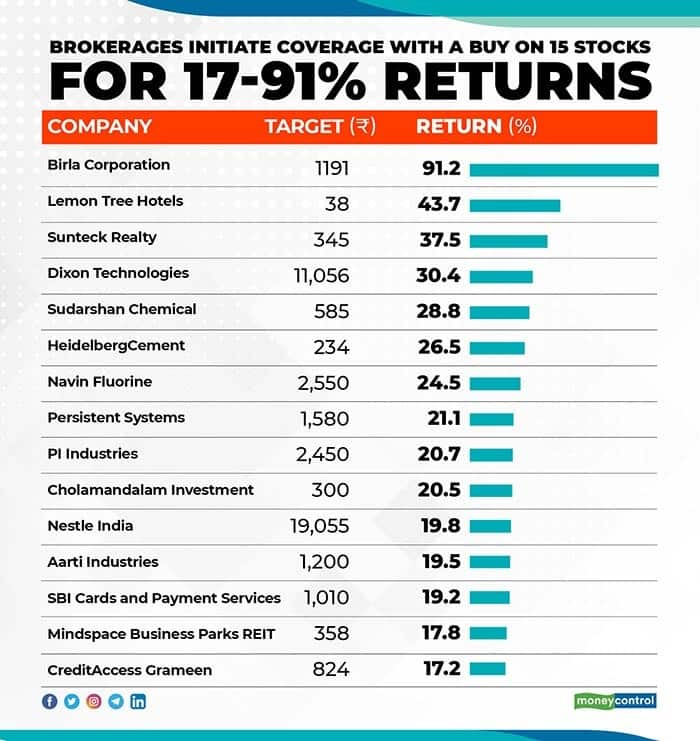

Given the gradual unlocking of India, sectors which had left aside in previous rally have started participating in the current run up. Hence brokerage houses also initiated coverage with a buy call on several stocks.

Axis Securities initiated coverage on Persistent Systems with a buy rating and target Price of Rs 1,580 valuing at 21x to its FY23E EPS. The brokerage believes Persistent is well placed to bounce back post COVID-19 pandemic led by 1) Better vertical mix (having minimal impact of COVID-19) thereby faster recovery in terms of IT spending 2) Significant growth opportunities in Technology Services and Allied Services. "Robust IBM portfolio will help to gain the momentum 3) Sustainable operating margins led by better services mix and efficient execution 4) Healthy balance sheet, strong return ratios and free cash flow generation 5) Ramp up in new deal wins and strong client addition will help Persistent to attain long term sustainable growth," it said.

SBI Cards and Payment Services

Axis Securities valued SBI Card at 35x FY23E EPS basis given the long runway for sustainable growth on the back of industry tailwinds, strong parentage, robust business model and effective credit underwriting and collection mechanism. The brokerage initiated coverage with a buy rating with a target price of Rs 1,010.

"One of the largest pigment manufacturers in its home market (with a 35 percent market share) and the fourth-largest globally, Sudarshan's strong brand equity, leading position, regular capacity additions and focus on high-margin products have been its key strengths," said Anand Rathi which believes that the exit of global players (BASF, Clariant), coming capex (Rs 800 crore over FY20-23), product launches and focus on the global market will be its future growth drivers. The brokerage initiated coverage on Sudarshan Chemicals with a buy at a TP of Rs 585 (22.3x FY23e EPS). The auto-sector slowdown and ban on single-use plastic would trim its short-term performance, Anand Rathi feels.

Sharekhan initiated coverage on Nestle India with a buy rating and price target of Rs 19,055 as it is the largest food company with strong growth prospects, steady earning visibility and a sturdy balance sheet. Sustained new launches (71 new products over CY2016-19), adoption of cluster-based approach and sustained strong demand for ready-to-cook products to be key revenue drivers in near to medium term, said the brokerage.

Birla Corporation, HeidelbergCement

HDFC Securities believes the north and central cement markets in India are in a sweet spot. Despite muted demand, cement prices in these regions have been buoyant, driven by troika of considerable regional consolidation, high clinker utilisation, and a limited influx of new entrants.

Companies in these regions are also enjoying low input cost inflation (high PPC sales and higher usage of low cost WHRS power), said the brokerage which believes these benefits will continue to sweeten profitability, validating preference for companies in these regions. The brokerage initiated coverage on two prominent names in these regions: Birla Corporation (target price Rs 1,191) and Heidelberg Cement (target price Rs 234) with buy recommendations.

Global brokerage house Citi has initiated with buy rating and target of Rs 300 per share. "The product mix and strong processes helped drive 19 percent AUM CAGR in FY15-20. We see return on equity (RoE) recovering to 10 percent/16 percent in FY22 and expect RoE compounding & rerating over two years to drive strong returns," said the brokerage.

"Dixon Technologies, India's largest EMS player is currently in a sweet spot given a confluence of rising demand, import substitution and favourable regulatory support at the same time. The company is preparing for aggressive scale-up across product segments by investing in increasing management bandwidth, adding export markets as a key growth engine and continuously increasing the value addition in products like lighting, washing machines and now televisions," said Yes Securities.

"High asset turns and low capex requirement should take ROCE above 40 percent despite an expected revenue and PAT CAGR of 35 percent/39 percent over FY20-25E. Given the sharp run-up, further upside is dependent on the company getting one or two mobile PLI licenses, which can be transformational. We initiate coverage with buy with a PT of Rs 11,056 based on 32x FY23E earnings (factoring in one PLI license), which would increase to Rs 13,763 in case the company gets both," the brokerage added.

ICICI Securities initiated coverage on Mindspace Business Parks REIT with a buy rating based on March 2022 DCF based target price of Rs 358 per unit.

"The REIT has a stabilised rent-yielding office portfolio spread across Hyderabad, Mumbai Metropolitan Region, Pune and Chennai. With 92 percent committed occupancy and in-place rent of just Rs 52 per psf per month, we like the company given 16 percent NOI CAGR over FY20-23E, a resilient leasing cycle for office assets in India’s tier I cities and low leverage of 0.2x net debt/equity which leaves headroom for injection of new assets in the REIT portfolio," said the brokerage which feels the key risk to its thesis is the large-scale adoption of Work-from-Home by occupiers over the long term.

"The growth of microfinance industry in India is a huge opportunity for NBFC MFIs as 41 percent of households in the country do not avail any banking services. We expect Net Interest Income to grow at 33 percent CAGR over FY19- FY22E driven by acquisition of Madura microfinance. Although 100 percent customers took moratorium for 3 months, 75 percent to 80 percent have started repayments, as rural areas were less impacted by lockdown," Geojit Securities said.

The brokerage expects PAT to grow to Rs 745 crore in FY22E at 32 percent CAGR over FY19 to FY22.

Dolat Capital initiated coverage on Lemon Tree Hotels (LTH) as a post-COVID recovery play. "The worst phase for the hotel industry is likely behind. Revival may be gradual over 18-24 months to hit the historic 70-75 percent occupancies and Rs 4,000+ ARR for LTH. But, operating performance to improve from hereon and cost rationalization benefits may be structural. Low-inventory supply and consolidation are likely to be other benefits," said the brokerage.

"LTH steep price correction of around 67 percent from all-time high provides an opportunity to buy into a franchisee that is steadily expanding its addressable opportunities, promoters with superior execution track record reflected in industry leading growth, occupancies and lower capex-opex, healthy reporting and governance standards," the brokerage added.

CLSA has initiated coverage with a buy call on Sunteck Realty and target of Rs 345 per share.

"Company has a track record of accretive acquisitions via efficient capital management. It is generating healthy project IRRs in legacy projects, and it has shifted focus from value to volume and gained market share in Mumbai. It has ramped up its portfolio using an asset-light approach," said the global brokerage which is positive on its value-accretive acquisition potential.

Going ahead, ICICI Direct expects an increase in CRAMS revenue along with better growth visibility from speciality chemical business owing to higher share of fluorine consumption across pharma and agrochemical, recent deal win in high performance product (HPP) to translate into speciality business revenue share inching up to 75-80 percent in the medium term from 54 percent in FY20.

"This bodes well in terms of operational performance given that high value business generates high thirties margins against legacy being into mid-teens. In turn, this would improve free cash flow (FCF) and return ratios in the years to come," said the brokerage which initiated coverage on the stock with a buy recommendation.

The revenues of the company can be subdivided into custom synthesis manufacturing (CSM, CRAMs) and domestic formulation business with the former contributing around 73 percent to overall revenue in FY20 and rest coming from domestic formulation business.

"Going ahead, order backlog of $1.5 billion in the CSM business along with increasing presence in the pharma value chain through recent QIP should bode well for the future growth of the high value business. We expect pharma, the better RoCE business, to inch up group margins and return ratios in the years to come, thereby aiding the company in demanding better valuations in the medium to long run," said ICICI Direct which initiated coverage on the stock with a buy rating.

"The company is a key beneficiary of China substitute factor besides improving domestic demand. Leveraging on core knowledge of benzene-based derivatives, Aarti is expanding its product basket towards value added products up the value chain. In pharma, it expects strong growth from developed markets backed by integrated model and new launches. Margins are also expected to improve due to incremental addition of high-value products. We like the company’s leadership position and strong visibility on order book," said ICICI Direct which assigned buy with a target of Rs 1,200.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.