Broader market indices continued to outperform their main counterparts for the second consecutive week, even as benchmark indices faced pressure due to ongoing geopolitical tensions and aggressive selling by foreign institutional investors (FIIs) amid anticipation of further Chinese fiscal measures.

The BSE Sensex fell by 307.09 points, or 0.37 percent, to close at 81,381.36, while the Nifty50 index slipped 50.3 points, or 0.20 percent, ending at 24,964.30.

In the broader market, both the BSE Small-cap and Mid-cap indices gained 1 percent each, while the Large-cap index remained largely flat.

Sectoral performance was mixed. Nifty Pharma and Auto indices each rose by 2 percent, the Nifty IT index gained 1 percent, and the Nifty Realty index also saw a nearly 1 percent increase. In contrast, the Nifty FMCG index dropped 2 percent, while the Nifty Metal and PSU Bank indices each declined by 1.5 percent.

Foreign institutional investors (FIIs) extended their selling streak, offloading equities worth Rs 27,674.99 crore during the week. However, Domestic Institutional Investors (DIIs) remained net buyers, purchasing equities worth Rs 31,363.61 crore.

"The Nifty 50 and the Sensex 30 index ended the week marginally lower. However, the BSE midcap and the BSE small-cap index witnessed some rebound post the sharp decline in earlier week. On the sectoral front, the performance remained mixed. BSE Capital Goods, BSE Healthcare and BSE Auto indices gained close to 2%. On the other hand, BSE FMCG and BSE Metals declined around 2%," said Shrikant Chouhan, Head of Equity Research, at Kotak Securities.

"In recent weeks, the equity markets have turned volatile amid increased geo-political concerns. In the US, the September consumer price index rose 0.2% on a monthly basis and 2.4% annually, and was slightly higher than economist polls. Global investors will be keenly looking forward towards the press conference to be held by China’s Ministry of Finance on Saturday."

"With the start of Q2FY25, we could see stock-specific action over the next few weeks based on earnings and management commentary. Risk sentiments is expected to be influenced by volatile commodity prices, geopolitical turmoil, global monetary easing cycle and flows to China," he added.

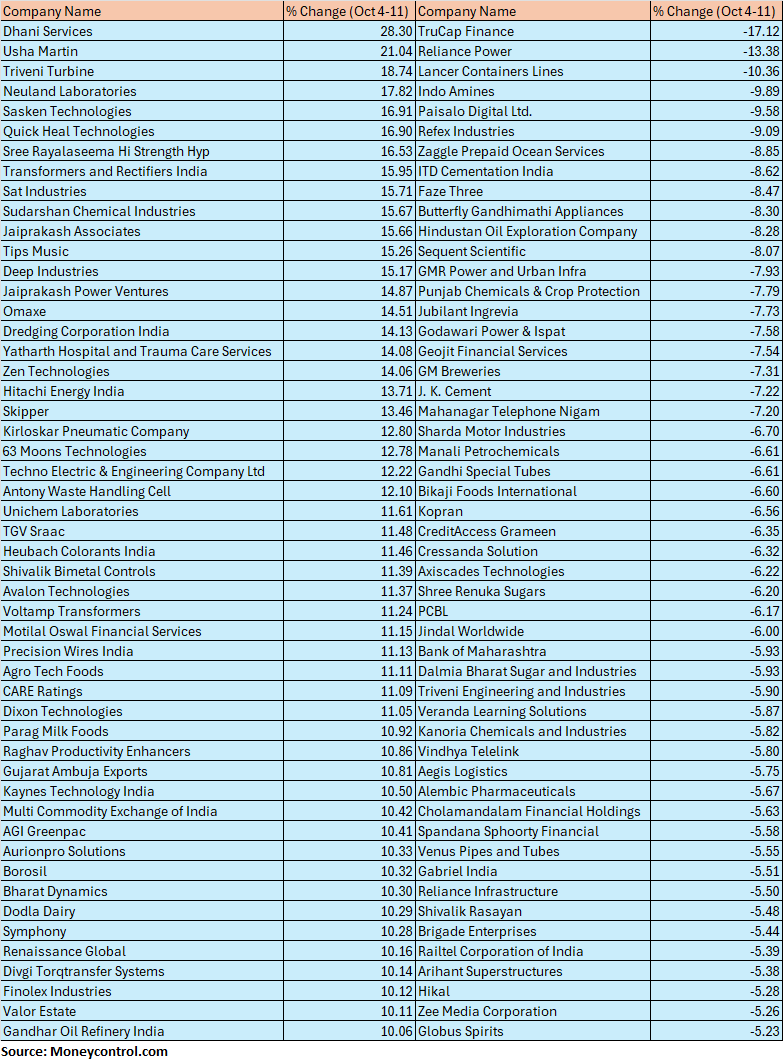

The BSE Small-cap index rose 1 percent with Dhani Services, Usha Martin, Triveni Turbine, Neuland Laboratories, Sasken Technologies, Quick Heal Technologies, Sree Rayalaseema Hi-Strength Hyp, Transformers and Rectifiers India, Sat Industries, Sudarshan Chemical Industries, Jaiprakash Associates, Tips Music, Deep Industries rising between 15-28 percent.

On the other hand, TruCap Finance, Reliance Power, Lancer Containers Lines, Indo Amines, Paisalo Digital, Refex Industries, Zaggle Prepaid Ocean Services, ITD Cementation India, Faze Three, Butterfly Gandhimathi Appliances, Hindustan Oil Exploration Company, Sequent Scientific fell between 8-17 percent.

The Nifty has been consolidating in the range of 25250 – 24900 since the last three trading sessions. We expect this consolidation to break out on the upside and rally towards 25350 – 25500 from a short-term perspective. A breach below 24800 shall weaken the structure and hence should be kept as a stop loss for the long positions.

Bank Nifty has been consolidating in the range of 50900 – 51500 since the last three trading sessions. We expect this consolidation to break out on the upside and rally towards 52000 from short-term perspective.

Tejas Shah, Technical Research, JM Financial & BlinkXThe psychological support of 25,000 was breached on a closing basis for two consecutive days, which indicates that the weakness is likely to continue. At the current juncture, the bears are in full control of the markets and are using every pull back rally to create short positions.

Support for Nifty is now seen at 24,920 and 24,750. On the higher side, the immediate resistance for Nifty is at 25,000-050 levels & the next resistance is at 25,250-275 levels.

Nagaraj Shetti, Senior Technical Research Analyst at HDFC SecuritiesNifty on the weekly chart formed a small negative candle with upper and lower shadows, which signalled the formation of a high wave type candle pattern. After a sharp weakness last week, the selling momentum seems to have reduced on follow-through weakness during this week. This could be a sigh of relief for the Bulls to make a comeback.

The underlying trend of Nifty remains choppy. Having placed near the crucial supports around 24500 levels, there is a higher possibility of an upside bounce in the market from here or from lower supports. Immediate resistance is placed at 25250.

Amol Athawale, VP-Technical Research, Kotak Securities:We are of the view that soon 50-day SMA (Simple Moving Average) or 25050/81900 would act as a sacrosanct level. If the market succeeds in trading above the same, then it could move up till 25250 -25400/82500-83000. On the flip side, as long as it is trading below the same, the weak sentiment is likely to continue.

Below which, it could retest the level of 24700/80700. Further downside may also continue which could drag the index to 24550/80200.

For Bank Nifty, a 50-day SMA or 51500 would be the trend decider level. Above the same, it could bounce back to 52000-52300. On the flip side, below 50900 it could slip till 50500-50250.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.