Some of the biggest bets of Axis Mutual Fund in the domestic equity market have taken a beating on May 6 after corporate governance concerns emerged at the mutual fund.

Moneycontrol on May 6 reported that two fund managers at the asset management company have been put on leave on allegations of front-running the mutual funds trades on their personal accounts.

Earlier this week, Moneycontrol had also reported that mutual fund industry was abuzz with rumours of a possible audit by the Securities and Exchange Board of India at a top tier asset management company in front-running cases.

With increasing concern that Axis Mutual Fund may have been the AMC where the front-running took place, investors jumped to sell some of the biggest holdings in the stock market amid broader weakness.

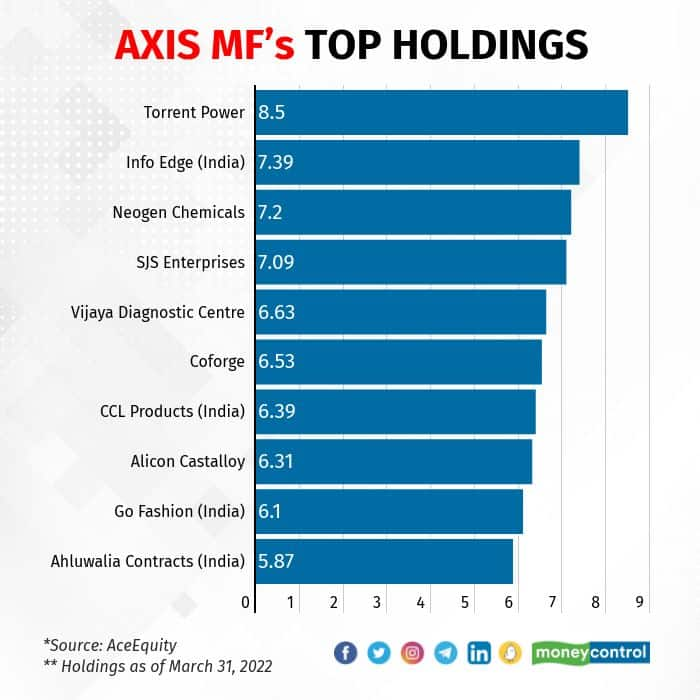

Shares of companies where Axis MF has its major holding plummeted 3-10 percent during the session including those of Coforge, Info Edge India, Neogen Chemicals, Go Fashion and Torrent Power.

In the top holdings of the mutual fund as a percentage of its assets, shares of Bajaj Finance, Avenue Supermarts, Tata Consultancy Services and ICICI Bank saw selling pressure and fell 2-5 percent during the session.

Market participants said that the report of the exit of the Chief Trader and Fund Manager Viresh Joshi, Chief Executive Officer and Managing Director Chandresh Nigam and Assistant Fund Manager Deepak Agarwal have likely triggered massive redemption pressure on all equity schemes of the mutual funds.

Some of the funds where Joshi and Agarwal were fund managers included Axis Quant Fund, Axis Arbitrage Fund, Axis Banking ETF, Axis Consumption ETF, Axis Nifty ETF and Axis Technology ETF.

Dealers said that traders were extensively shorting some of the top holdings of the mutual funds in anticipation of selling pressure from the mutual fund as it looks to meet rising redemption pressure from unit holders.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.