On day one of the largest initial public offer (IPO) the country has ever seen, the head of research at Capitalmind has released an interesting statistic.

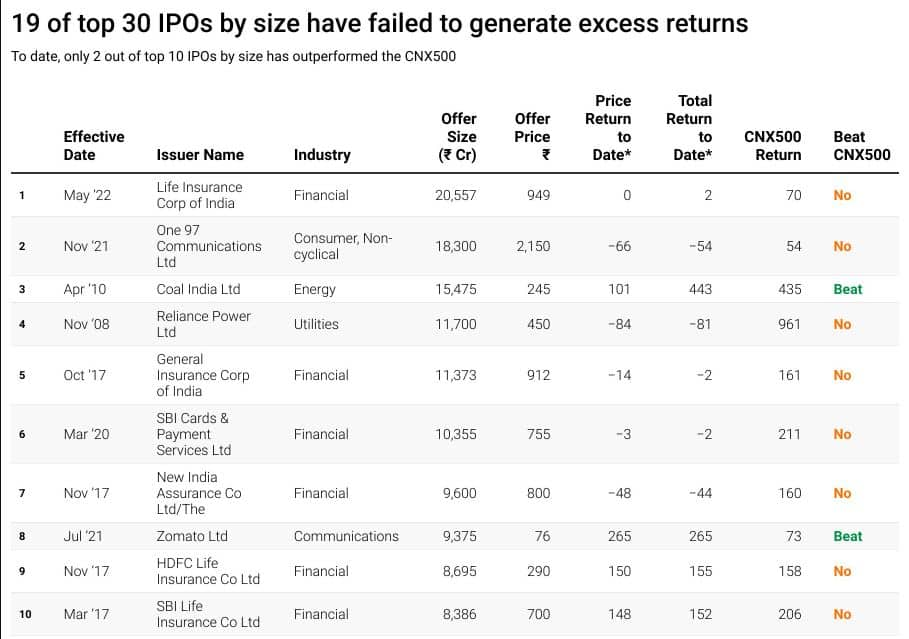

On platform, Anoop Vijaykumar has posted that big IPOs have not historically delivered.

He wrote, "19 of the top 30 IPOs by size have failed to generate excess returns."

Also read: Moneycontrol Pro Panorama | Hyundai's Listing: What changes for investors

He added, "Only 2 of the top 10 biggest IPOs have beaten the CNX500." CNX500 or Nifty500 is a broad-based index that is composed of the top 500 listed companies on NSE.

Vijaykumar shared the data on the performance of these IPOs.

Hyundai IPO's size is Rs 27,870 crore, with the issue priced between Rs 1,865 and Rs 1960 per share. It beats the earlier record of LIC's issue sized Rs 21,000 crore.

With Hyundai's IPO, which is an offer-for-sale, Hyundai Motor Company will reduce its stake in the Indian arm from 100 percent to 82.5 percent.

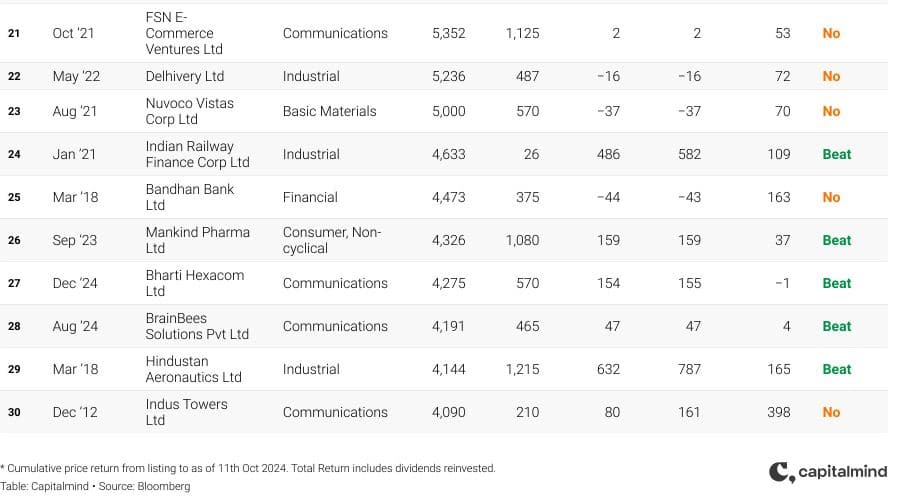

Vijaykumar also posted on the boom in IPOs the last year has seen.

He wrote that share sales (both IPOs and others) have "exploded" since 2003--nearly 600 such sales have been since since January 2023 and 335 sales year-to-date in 2024.

The chart shows a number of share sales by month

The chart shows a number of share sales by monthThis, he wrote, translates to over ₹5L Crores raised, of which 22 percent have been for new listings.

"The remaining have been additional share sales by existing companies," he added.

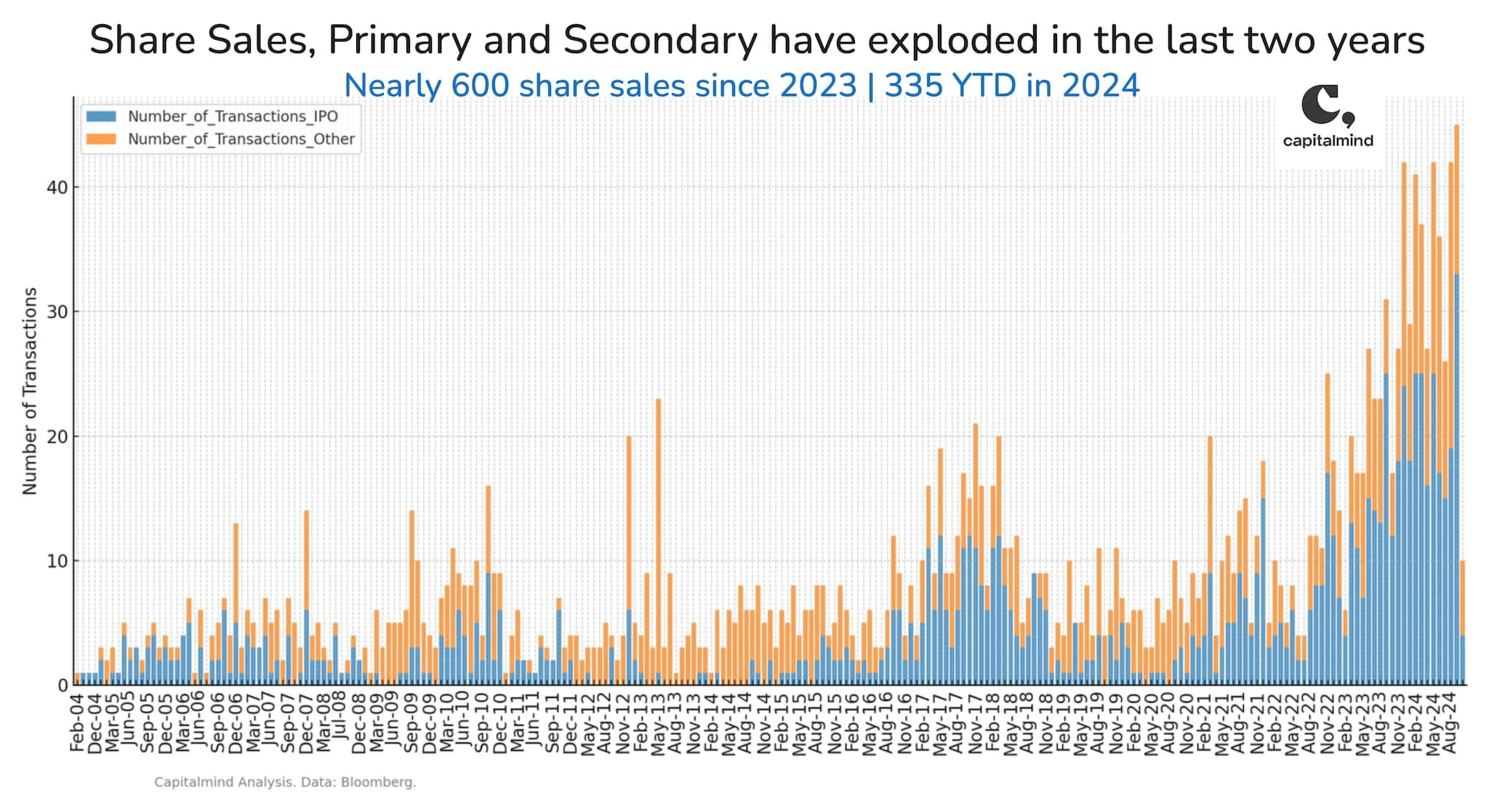

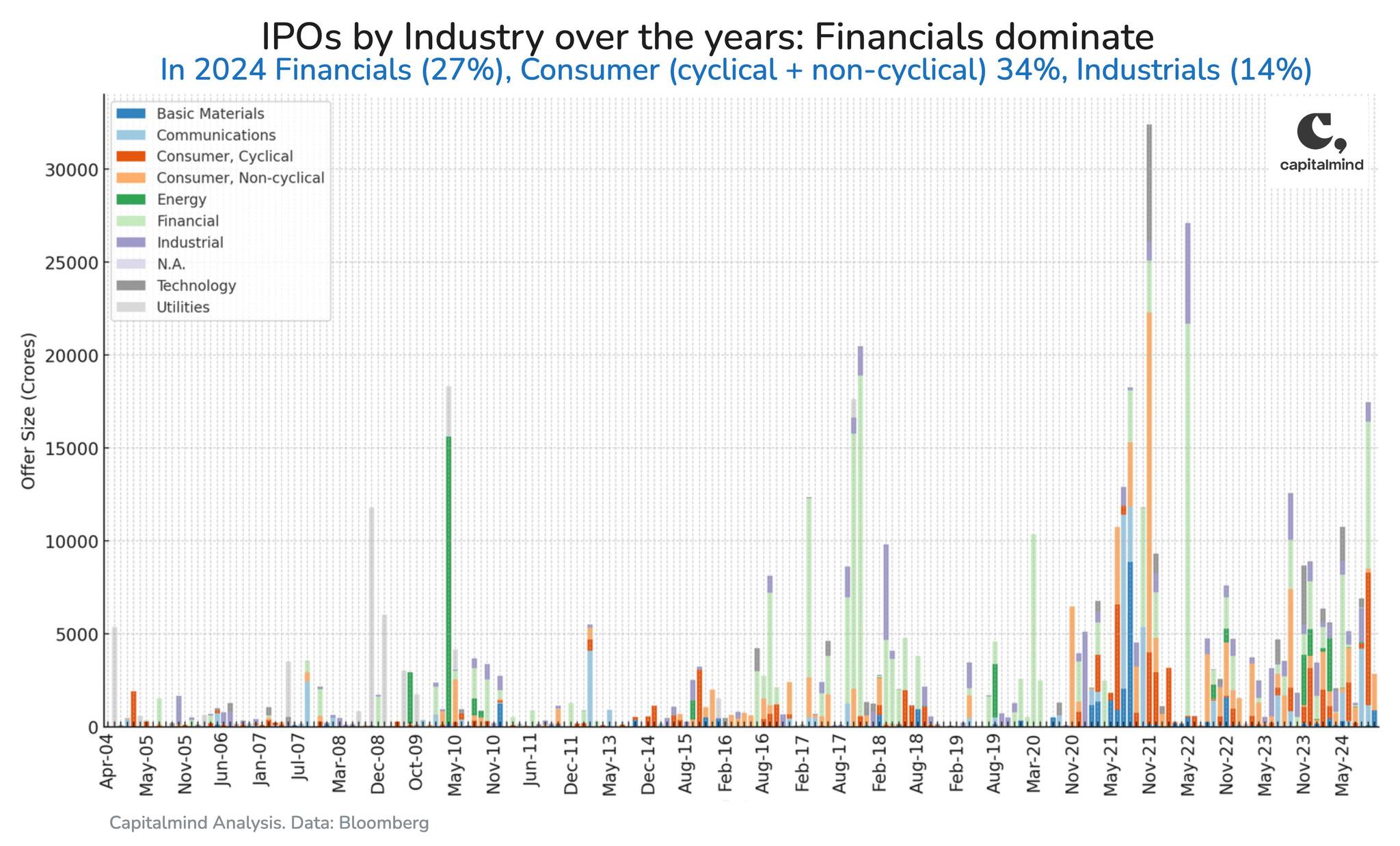

The chart shows the total offer size (₹ Crores) by month.

The chart shows the total offer size (₹ Crores) by month.Industrials and financials have dominated IPOs over the years, he pointed out.

He wrote, "Even in 2024, 27% funds raised have been by Financials.

"Consumer, cyclical (Auto, Hotels, etc) and non-cyclical (Pharma, FMCG, AlcoBev) account for 34%, followed by Industrials at 14%."

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.