The newly launched India Post Payments Bank (IPPB) has replaced ATM and debit cards for cash and cashless transactions with new quick response (QR) cards. These will work on biometric authentication instead of a password or personal identification number (PIN).

IPPB offers three kinds of savings account—regular, digital and basic—apart from a current account. None of them offer an ATM card. The IPPB mobile app has also been launched, which can be used for mobile banking. One can also open an Aadhaar-based account without visiting a branch.

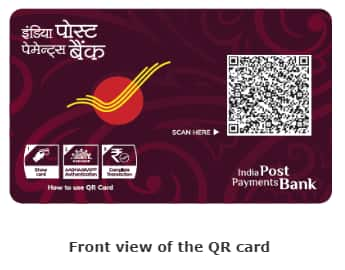

About the QR card and how to use it IPPB uses a QR card, which has a QR code or barcode, to identify account holders. All QR codes are unique and can be deciphered to identify an account holder through micro-ATMs or even a smartphone. Micro-ATMs are handheld devices that postmen will soon use.

After identifying the customer through the QR code, the postman or bank correspondent will authenticate the biometric data. After this two-step verification process, the customer will be paid in cash carried by the postman.

This doorstep banking service is the main feature of IPPB, which will be especially helpful in rural areas and costs Rs 25 per transaction.

QR cards can be used for transactions through postmen or Grameen Dak Sevaks (GDS). Unorganised retailers like small kirana stores and merchants will soon be a part of IPPB. After this, people can pay in these small stores through the QR code.

Advantages of a QR card QR cards are much more secure as every transaction requires a two-step authentication involving your biometrics. It saves you the effort of remembering your pin. Even if you forget the pin or lose your card, your money will be safe in your card since no one can use the card without your biometric data.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.