When Rakesh and Reshmi Verma returned to India in the 1990s, after spending 12 years in the US, they wanted to start something unique, and stumbled upon digital maps, something that India did not have.

“We realised that there were no digital maps in India. From our experience in the US, we pegged that in the future 80 percent of any data could have a location component,” Rakesh Verma said. The company, founded in 1995, spent 10 years working on the map product and finding the right market fit, first with automotives, and later consumer technology companies, and enterprises.

The company currently has a market share of 90 percent in the automotive space and counts top firms like Hyundai and MG Motors as its clients. On consumer tech, maps of Apple, Alexa, PhonePe, Yulu, and Ola are powered by MapMyIndia. However, it missed the opportunity to dominate the consumer maps, where Google is the clear leader, a territory it continues to tread carefully.

Now, over 25 years later, the company is going for an initial public offering (IPO) and is one of the few profitable companies to do so in the last few weeks. It also has Rs 388 crore in cash and investments. The IPO will open on December 9 with an issue price of Rs 1,000-1,033 per equity share, taking the issue size to Rs 1,040 crore.

In this interaction with Moneycontrol, Rakesh Verma, Chairman & Managing Director, and Rohan Verma, CEO, share why the company decided to go for IPO now, will it go head-on with Google, and valuation in the aftermath of the Paytm listing.

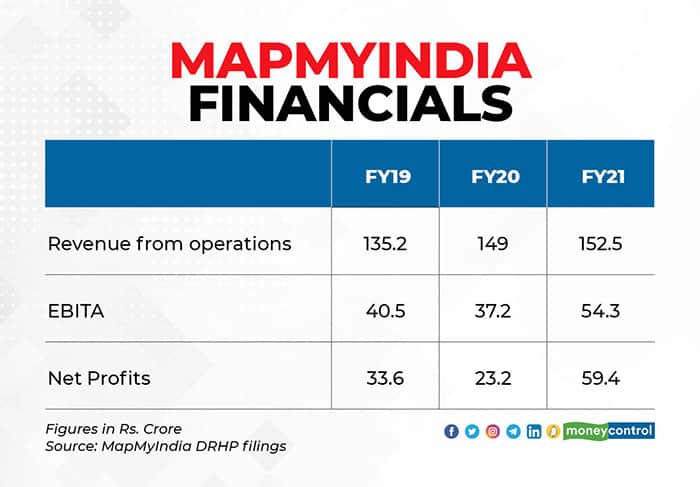

MapMyIndia financials for the last three years. It is one of the few internet companies that are profitable.Edited excerpts: It has been 25 years since you started the company and now you are going for the IPO. A long time to create a totally new category.

MapMyIndia financials for the last three years. It is one of the few internet companies that are profitable.Edited excerpts: It has been 25 years since you started the company and now you are going for the IPO. A long time to create a totally new category. Rakesh Verma: We got started with a division that did not exist in 1995 in India. It took us 10 years to develop the product and India is a very complex geography. That is the first part. The next part was how to take this great product that we had built in the first 10 years. That was also a timeframe when the other maps came into the marketplace. When I say other maps, it is in terms of the devices, which were going into the cars like Garmin and TomTom. And after a few years, other phone-based applications came up. We have to watch ourselves very carefully about what we need to do, what business model we create so that we will be successful since we've believed that our product is far superior to others. One, we had to make investments, so venture capitalists came on board so that we could accelerate. The second was to go to the market so that our brand gets established and people will know us. And that's where MapMyIndia navigator came in and it was a very successful product. The other challenge of the phone-based app, and we felt that we can go to the automotive OEMs directly and get our software and map embedded into the vehicle. But that's where the competition was at that time from the two world giants HERE (technologies) and TomTom, who had worldwide contracts with every automotive company. But we started with BMW, we could get into the automotive OEM space, one after the other, and now we have 80-90 percent market share.

Rohan Verma: Outside of the automotive side has also been an incredible journey. We have been able to serve so many consumer tech as well as large, enterprise organisations in both the private and public sector for a wide variety of use cases. So I think that's a very interesting thing that hundreds of customers, whether it's a banking company or a fintech app, Apple Maps, food delivery, e-commerce, telecom, the drone platform of the government of India, all use mapping. I think this kind of has helped us build this diversified portfolio, expanding business around the automotive sector, mobility sector, and consumer.

The company is not raising any funds through the IPO rather the proceeds will go through the selling shareholders, which includes your investor Qualcomm Ventures. You also have a free cash flow of Rs 388 crore. Was the intention of the IPO to give an exit to existing customers?Rakesh: Nobody is exiting. There is only one Qualcomm Ventures, who have been there with us for 13 long years (who is getting an exit). But PhonePe and Zenrin are not exiting. They are very keen to stay. So, the fundamental reason for IPO has been that when we look at the addressable markets so large, Rs 47,000 crores by 2025 going by market intelligence platform Frost and Sullivan estimates, we believe that we have enough headroom to grow. Certainly, at some point of time, we will require a large amount of money. So we felt that if we go public through the IPO process, then at the right time, we'll be able to tap the capital market in a much more efficient way, than the private equity market. So, these have been the reasons why we decided to go.

Rohan: Even the promoters have to up their stake, from 31 percent and post-IPO it will become 53 percent. So, the promoters upping stake in the company should show that the confidence we have.

You were talking about raising money from the capital market. What is next for MapMyIndia, and what is your roadmap?Rohan: We divide our market opportunity in automotive and mobility, and consumer tech and enterprise digital transformation. If you look at our kind of the last few years, the consumer tech and enterprise digital transformation revenue has been growing exponentially whether it is the order bookings that we do every year, or the revenue from operations. So we see a lot of headroom in consumer tech and enterprises. On the automotive and mobility front, we have upgraded ourselves by offering not just navigation but advanced kind of connected vehicle telematics and services, and shared electric mobility platforms, which is what four-wheelers, two- wheelers and electric-vehicle companies will need in the future and also what mobility kind of passenger and goods transport organizations are looking for. So, in that sense, we've created a roadmap for how we can generate money, either per vehicle, or even per kilometre. Going forward, as you know, the industry kind of evolves. We see both of these as kind of independent growth vectors both have their own opportunity to grow. And we are well positioned in both underlying our maps.

While the consumer and enterprise side of the business is growing fast, automotive continues to be one of the largest revenue generators for you at 53 percent in FY21. Are you seeing this as a concern?Rakesh: Let me give you some understanding why we moved into automotive OEMs. In 2008, it was primarily for passenger cars. But did anyone realise that even at that time that the two-wheelers should be a very interesting proposition? Probably not. I'm talking worldwide. So, we kept innovating the technology. Say, if there are 20 million vehicles which are produced every year, 3 million are four-wheelers and 16 million are probably two-wheelers, and 1 billion is commercial range vehicles. Now, this 16 million vehicles is a pretty large size and two years back, we had a breakthrough in the two-wheeler. We are very confident that the adoption in two-wheelers will also start growing. So that also gives headroom for our automotive business

Rohan: We are seeing an inflection point in the consumer tech and enterprises side. From 80 percent three years ago, automotive has gone down to 53 percent in FY 21 and actually 46 percent in the first half of this year. So we are already seeing that growth of the consumer tech and enterprises segment over the automotive. Having said that, we see opportunities in both segments. So it's hard to say which one will be larger or not. There are opportunities across our industry verticals.

At the issue price of Rs 1,000-1,033, is valuation a concern, especially considering the tepid response to Paytm’s IPO?Rakesh: We are not as big as Paytm or somebody else. We are a niche market and the market leader there. We have hardly any peers here. Our advisors were the ones who discussed with investors of all kinds, whether it was domestic, FIIs, insurance or even a channeL. And they came up with this number and asked us if we are okay with this. So it (the price) was not something we told them.

Rohan: If you look at the company profile in terms of the high profitability metric, it is kind of an 85 percent contribution margin. Our bookings have grown 3.3 times in the last year. We are the market leader in our space, and IP driven company. I think all of these things also positioned us relatively uniquely.

Last time we spoke, you had talked about playing in the consumer space going head-on against the market leader Google. What has happened in that space and what is your road map going to be for the consumer segment?Rohan: We want to look at consumers in a different way. The core business of B2B and B2B2C has been quite strong. There's a huge headroom for growth. As we said, the market estimates for B2B and B2B2C for digital maps and location intelligence is Rs 47,000 crore opportunity by 2025. So I think we are very laser focused on ensuring we execute on that. Now on the direct to consumer side, we can have two different approaches. One is that we can align very nicely with governments like ISRO and CoWIN partnership, where we can provide an indigenous solution to the Indian citizens. I'm talking about efficient paths towards consumers. Of course, there's another path towards the consumer segment, which can be a high burn, high acquisition cost driven way of going about it. We are not looking at that right now. So, we also believe that, in future, governments will look to ensure that consumers have choice, and cannot be forced to preload a particular app on a mobile phone. You are seeing this play out in Korea, Russia, and in Europe. At the right time in the right way, we will look at consumers. But for now, we are quite happy with B2B and B2B2C business doing well and executing on that.

Are you waiting for some kind of regulatory changes to happen before you can focus on the pure consumer side of the business?Rohan: We are focused on ensuring our product is good. So when people use our app, I think they find it good. That's why we won the Atma Nirbhar app innovation challenge last year. It is not that we are waiting for the regulation. I think it is a choice. When you see a very large B2B and B2B2C opportunity, then you should execute well on that it leads to high profitability. The other one at the right time, right way, where there might be a confluence of factors, maybe not just one that might determine our direct to consumers reach.

Rakesh: Every company when they are in a growth stage or the maturity stage, we are definitely a young growing company, they always looked for the right timing and right opportunity about when to bring out a product for a specific market. The market is very right for us for B2B and B2B2C business today. So certainly we will focus on that other one, if the market is right for us, whether because of regulatory changes or otherwise.

MapMyIndia was one of the first digital map products even before Google came into the picture. You were focused on the B2B side of the business, and missed the opportunity on the consumer side. Google Maps is now a market leader in the space. Now, by not focusing on the consumer side of the business, do you see yourself missing the opportunity to tap into the consumer segment?Rakesh: There are other factors also. Rohan mentioned that the loading of some apps in a device is detrimental for anyone to enter. I can make a very honest statement at the right time, which is determined based on the market factors, product readiness is all there is with us. At some point of time, if somebody and we also believe that (we should) go ahead and burn the cash and go head-on (in the customer space), we will look at that opportunity also. At this time, we wanted to be clear that these are two distinct kinds of opportunities and what we are focused on executing so that we don't also confuse potential investors or the market about what our strategies are.

PhonePe will have 18 percent stake even post the IPO. Can you share the kind of role they will be playing?Rakesh: The special rights they have vis-à-vis other investors is they can have one director on the board out of eight directors. It will be as a non-executive Director, that's the only time they have nothing else. And it's a great relationship from that point of view, and they've been supportive. They are building innovative services themselves.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.