Q1 Results Highlights: Bharti Airtel's net profit misses estimate; Adani Ports revenue rises 31%

Q1 Results 2025: Nearly 153 companies are announcing their results for the first quarter of the financial year 2026 today. Adani Ports, Bharti Airtel, Bharti Hexacom, Berger Paints India, Zinka Logistics Solutions (Blackbuck), Britannia Industries, Castrol India, CONCOR, Eveready Industries, Exide Industries, Gujarat Fluorochemicals, Gujarat Gas, Jindal Saw, KPI Green Energy, Lupin, Mazda, NCC, Prestige Estates Projects, Torrent Power and Transrail Lighting are some of the notable names among them.

-330

August 05, 2025· 17:36 IST

Bharti Hexacom Q1 Results LIVE: Net profit drops 23% to Rs 392 crore

Bharti Hexacom reported a net profit of Rs 392 crore for Q1 FY26. This marks a 23% YoY drop from the Rs 511 crore net profit reported in Q1 FY25. Revenue from operations meanwhile rose to Rs 2,263 crore.

-330

August 05, 2025· 17:32 IST

Bharti Airtel Q1 Results LIVE: Here's what Vice- Chairman and MD Gopal Vittal says

"We delivered another quarter of consistent growth, with consolidated revenues at 49,463 crores growing 3.3% on a sequential basis. Our India revenue, including Passive Infrastructure Services, increased by 2.3% sequentially. Africa reported solid performance with 6.7% growth in constant currency. India Mobile business recorded a sequential growth of 2.9%, driven by continued focus on portfolio premiumization and an additional day in the quarter. We added ~4 million smartphone data customers and maintained an industry-leading Average Revenue Per User (ARPU) of Rs. 250 for Q1FY26. Our Homes business reported solid performance with a life time high quarterly net additions of 939K, resulting in a sequential revenue growth of 7.6%. Our IPTV expansion is ramping up well with strong acceptance from customers as it delivers superior experience and convenience. Airtel Business revenue decline is reflecting full impact of portfolio restructuring undertaken last year. The underlying growth trajectory remains steady at a sequential growth of 2.0 % with continued improvement in funnel and orderbook. Our digital network across India and Africa now serves over 600 million customers. This is a testament to our passion for connecting customers through sustained investments and superior customer experience. Our balance sheet continues to demonstrate strength, supported by solid cash flow generation and disciplined capital allocation," said Bharti Airtel Vice- Chairman and MD Gopal Vittal.

-330

August 05, 2025· 17:24 IST

Bharti Airtel Q1 Results LIVE: How did the African market perform?

- Revenue (in constant currency) up 24.9% YoY

- EBITDA margin (in constant currency) at 48.1%, up 292 bps YoY. EBIT margin at 31.4%, up 244 bps YoY.

- Customer base stands at 169 million

- Capex for the quarter at Rs 1,034 crore

-330

August 05, 2025· 17:20 IST

Bharti Airtel Q1 Results LIVE: How did the Indian market perform?

- India revenue at Rs 37,585 crore, up 29.0% YoY

- EBITDA at Rs 22,352 crore, up by 43.4%YoY. EBITDA margin at 59.5%

- EBITDAaL at Rs. 20,539 crore, up 53.2% YoY; EBITDAaL margin at 54.6%

- EBIT at Rs 11,815 crore, up 80.1% YoY; EBIT margin at 31.4%

- Customer base stands at 436 million

- Capex for the quarter at Rs 7,273 crore

-330

August 05, 2025· 17:18 IST

Bharti Airtel Q1 Results LIVE: Mobile ARPU increases 18.5% to Rs 250

Bharti Airtel reported mobile average revenue per user (ARPU) at Rs 250 in Q1 FY26. This is nearly 18.5% higher than the Rs 211 ARPU reported in Q1 FY25. Smartphone data customers rose by 21.3 million YoY and 3.9 million QoQ, now representing 77% of overall mobile customer base. Mobile data consumption meanwhile rose 21.6% YoY, consumption per customer at 26.9 GB per month and homes business saw step- up in customer additions with 939K net adds in Q1 FY26.

-330

August 05, 2025· 17:12 IST

Bharti Airtel Q1 Results LIVE: Net profit rises 43% YoY to Rs 5,948 crore, revenue up 28%

Bharti Airtel reported a consolidated net profit of Rs 5,948 crore for Q1 FY26. This marks a 43% YoY rise from the Rs 4,160 crore net profit reported for Q1 FY25. However, the net profit fell more than 46% QoQ from the Rs 11,022 crore reported in Q4 FY25.

The firm's net profit is significantly lower than the Moneycontrol poll estimate of Rs 8,169 crore.

The telecom major's revenue from operations rose 28% YoY, and over 3% QoQ to Rs 49,463 crore. This is slightly higher than the Rs 49,279 crore estimated by brokerages polled by Moneycontrol.

-330

August 05, 2025· 16:56 IST

NCC Q1 Results LIVE: Net profit drops 8.5% to Rs 192 crore

NCC reported a net profit of Rs 192 crore for Q1 FY26. This marks an 8.5% YoY drop from the Rs 210 crore net profit reported in Q1 FY25. The firm’s revenue from operations meanwhile declined more than 6% YoY to Rs 5,179 crore.

-330

August 05, 2025· 16:51 IST

Raymond Realty Q1 Results LIVE: Net profit soars to Rs 16.5 crore, revenue jumps 189%

Raymond Realty, the recently demerged real estate firm from its parent organisation Raymond, reported a net profit of Rs 16.5 crore for Q1 FY26. This marks a strong surge of nearly 122% YoY from the Rs 7.44 crore net profit reported in Q1 FY25. The firm's revenue from operations soared 189% YoY to Rs 3,743.5 crore.

-330

August 05, 2025· 16:33 IST

Q1 Results LIVE: Gland Pharma net profit jumps 50% to Rs 215 crore

Gland Parma reported a net profit of Rs 215.48 crore for Q1 FY26. This marks a 50% YoY rise from the Rs 143.76 crore net profit reported in Q1 FY25. The firm’s revenue from operations meanwhile rose to Rs 1,505.62 crore.

-330

August 05, 2025· 15:56 IST

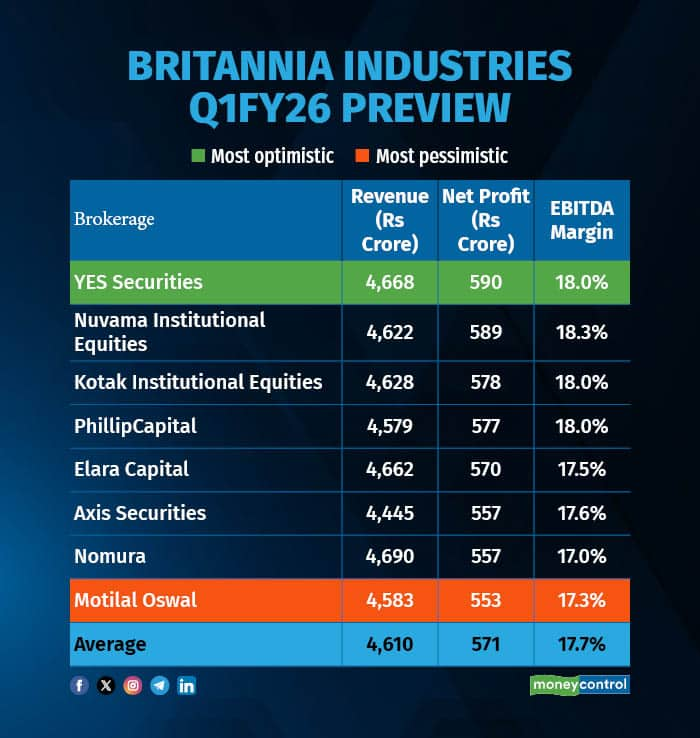

Britannia Industries Q1 Results LIVE: Take a look at the FMCG major's Q1 preview

-330

August 05, 2025· 15:55 IST

Britannia Industries Q1 Results LIVE: What to expect?

Marie Gold maker Britannia Industries will share its earnings report for the three months ended June on August 5, 2025. The biscuit maker will see a high-single digit growth in net profit, led by volume-driven growth and price hikes.

According to a Moneycontrol poll of eight brokerages, Britannia Industries is likely to report a 8.5 percent revenue growth at Rs 4,610 crore. Net profit is likely to come in at Rs 571 crore from Rs 530 crore from the corresponding quarter last year, rising 7.8 percent on-year.

Earnings estimates of analysts polled by Moneycontrol are in a narrow range, so any positive or negative surprises may elicit a sharp reaction in the stock. The most optimistic estimate sees Britannia’s net profit coming in higher by 11 percent, while the most pessimistic projection sees an 5 percent on-year gain.

-330

August 05, 2025· 15:19 IST

Q1 Results LIVE: Jindal Saw net profit falls 4% to Rs 424 crore

Jindal Saw reported a net profit of Rs 424 crore for Q1 FY26. This is nearly 4% lower than the Rs 441 crore net profit reported in Q1 FY25. The firm's revenue from operations meanwhile fell to Rs 4,085 crore.

-330

August 05, 2025· 14:54 IST

Q2 Results LIVE: Castrol India announces Rs 3.5 interim dividend

Along with the June quarter results, Castrol India announced an interim dividend of Rs 3.5 per equity share for its shareholders. The record date to determine the eligibility of the shareholders set to receive the payment has been set on August 11. The said dividend will be paid to the eligible shareholders on or before September 3.

-330

August 05, 2025· 14:51 IST

Q2 Results LIVE: Castrol India net profit 5% to Rs 244 crore

Castrol India reported a net profit of Rs 244 crore for the April-June quarter. This marks a 5% YoY rise from the Rs 232 crore net profit reported in the same period last year. The firm’s revenue from operations meanwhile rose to Rs 1,497 crore.

-330

August 05, 2025· 14:44 IST

Berger Paints Q1 results: Net profit falls 11%

Berger Paints reported 11% decline in net profit at Rs 315 crore for the June quarter. The firm's revenue rose 3.5% to Rs 3,201 crore in Q1FY26.

-330

August 05, 2025· 14:25 IST

Q1 Results LIVE: Eveready Industries net profit rises 3% to Rs 30 crore

Eveready Industries reported a net profit of Rs 30 crore for Q1 FY26. This marks a 3% YoY rise from the Rs 29 crore net profit reported in Q1 FY25. The firm’s revenue from operations meanwhile rose to Rs 374 crore.

-330

August 05, 2025· 14:24 IST

Q1 Results LIVE: Britannia Industries shares drop 3% ahead of earnings announcement

The shares of Britannia Industries dropped 3% to trade at Rs 5,632 apiece. The FMCG company is set to release its results for the first quarter of the financial year 2026.

-330

August 05, 2025· 14:03 IST

Adani Ports Q1 Results LIVE: Shares drop 1% post-results

Adani Ports shares dropped 1% to trade at Rs 1,373 apiece. This comes after the Adani Group company released its results for the first quarter of the financial year 2026.

-330

August 05, 2025· 14:00 IST

Q1 Results LIVE: Gujarat Fluorochemicals net profit jumps 70% to Rs 184 crore

Gujarat Fluorochemicals reported a net profit of Rs 184 crore for Q1 FY26. This marks a 70% YoY rise from the Rs 108 crore net profit reported in Q1 FY25. The firm’s revenue from operations meanwhile rose to Rs 1,281 crore.

-330

August 05, 2025· 13:52 IST

Adani Ports Q1 Results LIVE: 'Haifa port in Israel operated unhindered throughout'

"Haifa port operated unhindered throughout and reported 25% YoY growth in container volume and 38% YoY growth in other cargo volume during the quarter, leading to overall volume growth of 29% YoY. This led to the highest quarterly revenue and operating EBITDA for Haifa port since acquisition by APSEZ," said Adani Ports in its press release.

-330

August 05, 2025· 13:49 IST

Adani Ports Q1 Results LIVE: Firm re-designated Gautam Adani as Non-Executive Chairman

Adani Ports announced that its board has approved the redesignation of Gautam Adani as a Non-Executive Chairman of the company, from his current role as an Executive Chairman. He would cease to be key managerial personnel of the company, once the decision takes effect from August 5.

-330

August 05, 2025· 13:46 IST

Adani Ports Q1 Results LIVE: Net profit rises 6% to Rs 3,315 crore; revenue jumps 31%

Adani Ports reported a net profit of Rs 3,315 crore for Q1 FY26. This marks a 6.5% YoY rise from the Rs 3,113 crore net profit reported in Q1 FY25. This is higher than the MC poll estimate of Rs Rs 2,985.40 crore.

The firm's revenue from operations meanwhile rose 31% YoY to Rs 9,126.14 crore, also beating MC poll estimate of Rs 8,768.10 crore.

-330

August 05, 2025· 13:34 IST

Q1 Results LIVE: Exide Industries net profit rises 24% to Rs 273 crore

Exide Industries reported a net profit of Rs 273 crore for Q1 FY26. This marks a 24% YoY rise from the Rs 220 crore net profit reported in Q1 FY25. The firm’s revenue from operations meanwhile rose to Rs 4,695 crore.

-330

August 05, 2025· 13:26 IST

Q1 Results LIVE: Alembic Pharma net profit rises 15% to Rs 154 crore

Alembic Pharma reported a net profit of Rs 154 crore for Q1 FY26. This marks a 15% YoY rise from the Rs 135 crore net profit reported in Q1 FY25. The firm’s revenue from operations meanwhile rose to Rs 1,711 crore.

-330

August 05, 2025· 13:05 IST

Adani Ports Q1Results LIVE: What to expect?

Adani Ports and Special Economic Zone Ltd (APSEZ) is scheduled to release its financial results for the June quarter on August 5. The company is expected to deliver a strong performance, led by higher cargo volumes and improved realisations across its core business segments.

According to estimates from four brokerages polled by Moneycontrol, APSEZ is likely to report revenue of Rs 8,768.10 crore, reflecting a 16 percent year-on-year increase. This growth is expected to be broad-based, driven by solid momentum in ports, marine services, and logistics.

Net profit is projected at around Rs 2,985.40 crore, a 22 percent rise from the same period last year. EBITDA is expected at Rs 5,117.20 crore, up 6 percent year-on-year. However, the EBITDA margin is anticipated to contract by 130 basis points to 59.7 percent, primarily due to changes in the business mix.

-330

August 05, 2025· 12:19 IST

Bharti Airtel Q1 Results LIVE: Key things to watch in Q1FY26 earnings

- ARPU trajectory: Will Bharti sustain its premium ARPU lead over Jio, or has pricing momentum peaked?

- Update on tariff hike roadmap: Especially after TRAI's floor price consultations and the July 2024 revision effects have faded.

- Africa FX and cost commentary: Management’s outlook on margin protection in key African markets will be watched.

- Enterprise strategy evolution: Whether Bharti gives clarity on when the transition from legacy voice will bottom out.

- Indus Towers stake monetisation: Any update on Bharti's plan to sell its remaining stake could materially impact FCF outlook.

-330

August 05, 2025· 11:43 IST

Bharti Airtel Q1 Results LIVE: What’s driving Bharti’s Q1 performance

The Q1 performance is expected to reflect Bharti’s inherent business stability, supported by continued postpaid traction, broadband subscriber additions, and marginal ARPU gains. However, this is being offset by normalising tailwinds from previous tariff hikes, Africa’s FX volatility, and transition pains in enterprise.

BofA expects Bharti to report a stable quarter with modest QoQ revenue growth and flattish margins, with subscriber additions and home broadband helping offset enterprise drag, maintaining a Buy rating with a target of Rs 2,100.

UBS, which recently downgraded Bharti to ‘Sell’, flagged high valuation risks (13x FY27E EV/EBITDA) and warned that tariff hikes may be delayed, especially in lower-end plans.

-330

August 05, 2025· 11:42 IST

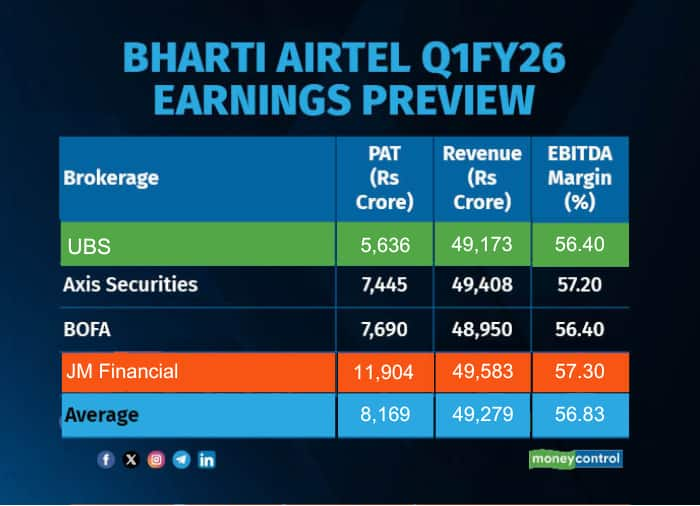

Bharti Airtel Q1 Results LIVE: Take a look at the telecom major's Q1 preview

-330

August 05, 2025· 11:41 IST

Bharti Airtel Q1 Results LIVE: Shares rise 1% ahead of June quarter earnings announcemnt

Bharti Airtel shares rose more than 1% to trade at Rs 1,934 apiece. The company is set to release its results for Q1 FY26.

-330

August 05, 2025· 11:40 IST

Bharti Airtel Q1 Results LIVE: PAT likely to fall sequentially; Africa, ARPU, enterprise drag in focus

Bharti Airtel is scheduled to release its Q1FY26 earnings on August 5, and analysts expect the telecom major to report resilient topline growth but a drop in sequential profitability, weighed down by margin pressure in Africa, muted gains in India mobile ARPU, and a continued clean-up in the enterprise segment.

According to a Moneycontrol poll of brokerages, Bharti’s consolidated revenue is likely to come in between Rs 49,200 crore and Rs 49,400 crore, registering 2.5 to 3.2% growth QoQ and nearly 28% growth YoY. However, net profit estimates vary sharply, with UBS forecasting just Rs 563 crore, while BofA Securities pegs it at a steep Rs 7,690 crore.