Bangalore-based micro-finance institution CreditAccess Grameen will open its initial public offer for subscription on August 8.

The company has fixed a price band at Rs 418-422 per share for the issue which will close on August 10 and it is likely to make a debut on August 20.

Equity shares are proposed to be listed on BSE and NSE. ICICI Securities, Credit Suisse Securities (India), IIFL Holdings and Kotak Mahindra Capital Company are book running lead managers to the issue.

Here are 10 key things that you should know before subscribing the issue:

Company Profile

CreditAccess Grameen is focused on providing micro-loans to women customers predominantly in rural areas in India. It provides loans primarily under the joint liability group (JLG) model.

CRISIL Research study said it was the third largest NBFC-MFI in India in terms of gross loan portfolio as of March 2017.

As of March 2018, it covered 132 districts in eight states (Karnataka, Maharashtra, Tamil Nadu, Chhattisgarh, Madhya Pradesh, Odisha, Kerala, Goa) and one union territory (Puducherry) in India through 516 branches and 4,544 loan officers.

Its customer base increased from 0.50 million active customers as of March 2014 to 1.85 million as of March 2018.

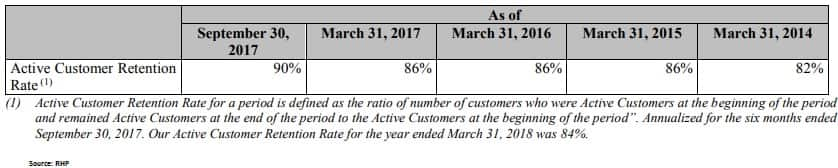

CRISIL Research said the company had a high active customer retention rate of 90 percent (annualised) for the six months ended September 2017, as shown in the table below, as compared with the median active customer retention rate of 15 leading micro-finance players which stood at 78 percent for the six months ended September 2017.

Its promoter CreditAccess Asia N V is a multinational company specialising in MSE financing (micro and small enterprise financing), which is backed by institutional investors and has micro-lending experience through its subsidiaries in four countries in Asia.

CAA is primarily engaged in providing, through controlled companies, financial services to micro and small businesses and self-employed people in emerging countries. Presently, CAA has investments in micro-finance institutions in India, Vietnam, Indonesia and the Philippines.

About the Issue

The public issue comprises a fresh issue of up to Rs 630 crore and an offer for sale of up to 1,18,76,485 equity shares by the promoter, CreditAccess Asia N V.

Bids can be made for a minimum lot of 35 equity shares and in multiples of 35 equity shares thereafter.

Amount of IPO

CreditAccess Grameen intends to raise Rs 1,126.43 crore-1,131.18 crore through the issue, at a price band of Rs 418-422 per share.

Objects of the Issue

Company proposed to utilise the net proceeds from the fresh issue (Rs 630 crore) towards augmenting its capital base to meet future capital requirements.

It will not receive any proceeds from the offer for sale and all the money raised through offer for sale will go to the promoter CreditAccess Asia N V.

Competitive Strengths

> Customer-centric business model allows company to retain a high proportion of existing customers and to attract new customers.

> Its deep penetration in rural areas, built through a contiguous district-based expansion strategy provides it with significant scale and diversification advantages.

> Company follows robust customer selection and risk management policies, which have resulted in healthy asset quality and lower credit costs.

> It has maintained a strong track record of financial performance and operating efficiency over the years through high rates of customer retention, geographical expansion, improved staff productivity, enhancement of individual loan portfolio, lower credit cost and growth in customer base led by branch expansion.

> It is a professionally managed company and senior management team has an established track record in the financial services industry. Key management personnel have an average experience of approximately eight years with the company.

> Diversified debt profile ensures that it is not overly dependent on any one type or source for funding. This enables it to optimise cost of borrowings, funding and liquidity requirements, capital management and asset liability management.

Strategy

> Company believes that it will be able to strengthen its position by tapping into this underserved market and are best placed to capitalise on strategy of having a deep penetration in the Indian rural markets.

> It intends to continue its strategy of contiguous expansion which will expand its district coverage in eight states (Karnataka, Maharashtra, Tamil Nadu, Chhattisgarh, Madhya Pradesh, Odisha, Kerala and Goa) and also potentially into neighbouring states.

> It intends to capitalise on its current strengths including geographical reach, customer base, robust risk management policies, strong financial track record and extensive domain expertise to diversify product and service offerings.

> It continues to invest in technology platform and technology-enabled operating procedures to increase operational and management efficiencies and ensure customer credit quality.

Financials and Comparison with Peers

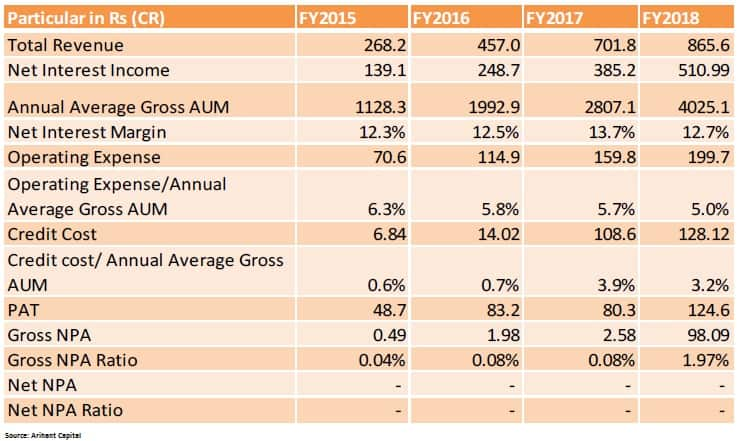

Company's total revenue grew by 48 percent CAGR (compounded annual growth rate) while net interest income grew by 54 percent CAGR from FY15-18.

Profit grew by 37 percent CAGR from FY15-FY18. Its CRAR (capital to risk (weighted) assets ratio) was 28.08 percent, 21.48 percent, 29.71 percent and 28.94 percent as of March 2015, 2016, 2017 and 2018, respectively. This is well above their regulatory requirement of 15 percent.

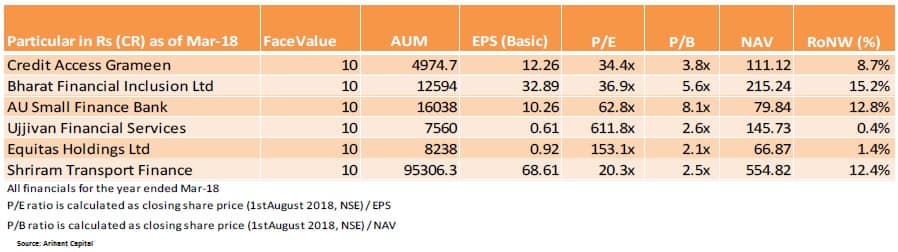

Peer Comparison

Shareholding

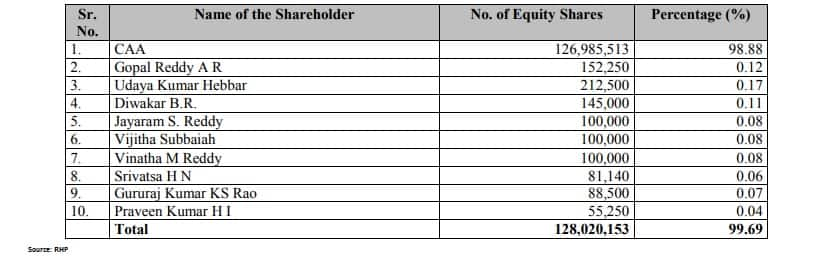

The Netherlands-based CAA is the promoter of the company, which holds 12,69,85,513 equity shares, equivalent to 98.88 percent of the pre-offer issued, subscribed and paid-up equity share capital.

Top 10 shareholders as of July 30, 2018:

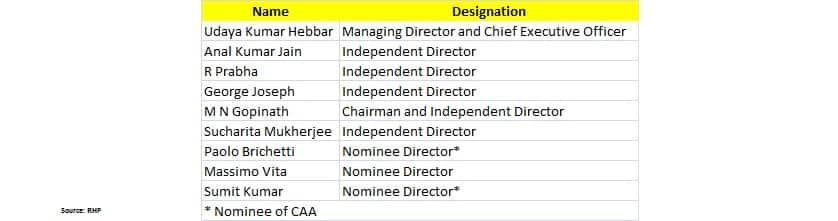

Management

Udaya Kumar Hebbar is the MD & CEO of the company and has over 25 years of experience in the banking industry. He has served as the head, commercial and banking operations at Barclays Bank PLC, Mumbai for three years. He also served at Corporation Bank for a period of over ten years. He was also associated with ICICI Bank for over eleven years.

M N Gopinath is the Chairman and Independent Director of company.

Board of Directors

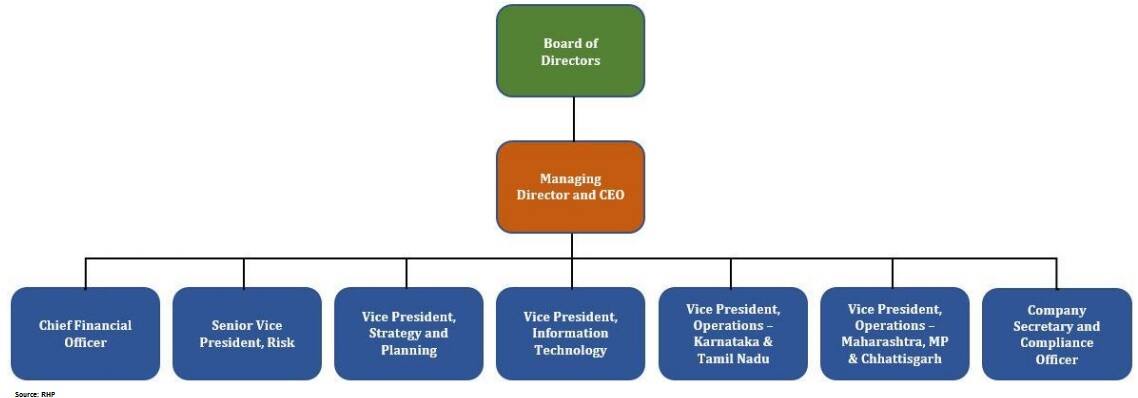

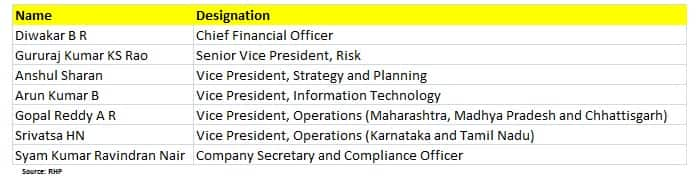

Management Organisation Chart

Chief Financial Officer, Diwakar BR, has over 20 years' experience in finance.

Key Management Personnel

Risks and Concerns

Here are some risks and concerns highlighted by several brokerage houses:

> Its operations are concentrated in Karnataka and Maharashtra and any adverse developments in these states could have an adverse effect on the business;

> Microfinance loans are unsecured and are susceptible to various operational and credit risks which may result in increased levels of NPAs;

> The company’s lending and collection operations involve handling of significant amounts of cash, including collections of instalment repayments in cash. Such large amounts of cash collection expose it to risk of loss, fraud, misappropriation or unauthorised transactions by employees responsible for dealing with such cash collections;

> Competition from banks and financial institutions may adversely affect its profitability and position in the Indian microcredit lending industry;

> Rise of digital platforms, payment solutions & fintech companies may adversely impact company’s business model;

> Industry specific concerns due to political interference;

> Risk of higher slippage in loan portfolio;

> Coming elections in country can disturb the credit discipline in rural areas.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.