Stallion India Fluorochemicals IPO GMP: Check Day 2 subscription, GMP, listing date and more

Stallion India Fluorochemicals IPO Share Price Latest News Today (January 17): Today is Day 2 of the public offer for Stallion India Fluorochemicals Ltd., which aims to raise Rs 199.45 crore. The company's shares will be listed on both the BSE and NSE. Ahead of the IPO opening, Stallion India secured Rs 59.83 crore on January 15 from six institutional investors through its anchor book.

-330

January 17, 2025· 18:29 IST

Stallion India Fluorochemicals IPO GMP: Stallion India Fluorochemicals IPO gets 32 times subscription on Day 2 of offe

The initial public offer of Stallion India Fluorochemicals Ltd received 32.06 times subscription on the second day of bidding on Friday.

The initial share sale got bids for 49,73,74,020 shares against 1,55,12,978 shares on offer, as per NSE data.

The portion for non-institutional investors fetched 76.33 times subscription while the quota for Retail Individual Investors (RIIs) got subscribed 30.93 times. The category for Qualified Institutional Buyers (QIBs) received 31 per cent subscription.

Refrigerants supplier Stallion India Fluorochemicals on Tuesday fixed a price band of Rs 85-90 per share for its initial public offering (IPO).

The IPO has a fresh issue of 1.78 crore equity shares and an offer-for-sale (OFS) component of 43.02 lakh shares by its promoter Shazad Sheriar Rustomji.

At the upper end of the price band, the IPO is pegged at Rs 199.45 crore.

The public issue will conclude on January 20.

Proceeds from the issue will be used towards funding working capital requirements, capital expenditure for its proposed facilities in Maharashtra and Andhra Pradesh, and general corporate purposes.

-330

January 17, 2025· 15:53 IST

Stallion India Fluorochemicals IPO Day 2 GMP Live: Stallion India Fluorochemicals IPO grey market premium today

The last reported GMP (Grey Market Premium) for the Stallion India IPO is Rs 42, updated on January 17, 2025, at 12:56 PM. With a price band of Rs 90, the estimated listing price is Rs 132 (cap price + today's GMP), reflecting an expected gain of 46.67% per share.

-330

January 17, 2025· 15:48 IST

Stallion India Fluorochemicals IPO Day 2 GMP Live: Stallion India Fluorochemicals IPO subscription status so far

- Qualified Institutional Buyers (QIBs) -- 0.22 times

- Non Institutional Investors(NIIS) -- 64.17 times

- Retail Individual Investors (RIIs) -- 28.57 times

- Total -- 28.10 times

-330

January 17, 2025· 14:17 IST

FEMA changes may bolster Rupee, say analysts

The Reserve Bank of India (RBI) is aiming to make the Rupee more popular in global trade as the Indian currency continues to weaken against the US Dollar. On Thursday, the RBI proposed several key changes to the Foreign Exchange Management Act (FEMA) rules to provide greater flexibility for Indian exports and global traders to settle their transactions in Rupees instead of Dollars. (Read More)

-330

January 17, 2025· 13:15 IST

Cabinet has approved refarming of spectrum, 328 MHz spectrum to be released immediately: Scindia

Union Minister for Communications Jyotiraditya Scindia, on January 17, said that the Cabinet has approved refarming of spectrum and 328 MHz spectrum will be released immediately to the telecom industry. “For 4G and 5G, we have roughly about 900 Mhz. What does that mean? That means that we have a deficit of 1100 MHz spectrum by 2030. So Prime Minister put together a committee of secretaries to look at how much spectrum stakeholders have has. And through this study, in the yesterday’s cabinet we have approved 687 Mhz of spectrum to be refarmed to the industry,” the minister said. (Read More)

-330

January 17, 2025· 12:39 IST

Stallion India Fluorochemicals IPO Day 2 GMP Live: Stallion India Fluorochemicals IPO subscription nears 17 times

- Qualified Institutional Buyers (QIBs) -- 0.05 times

- Non Institutional Investors(NIIS) -- 31.55 times

- Retail Individual Investors (RIIs) -- 20.10 times

- Total -- 16.82 times

-330

January 17, 2025· 11:46 IST

Stallion India Fluorochemicals IPO Day 2 GMP Live: Who is the BRLM for Stallion India Fluorochemicals' public offer

Sarthi Capital Advisors Private Ltd is the book running lead manager for the issuance, while Bigshare Services Private Ltd has been appointed as the Registrar for the issuance.

-330

January 17, 2025· 11:27 IST

Stallion India Fluorochemicals IPO Day 2 GMP Live: Here's what Bajaj Broking says about Stallion India Fluorochemicals' public offer

The company, specialising in refrigerants and industrial gases, has secured a strong market position by providing high-quality, cost-effective products. Its strategic shift towards high-margin offerings is expected to boost profitability. Management remains confident about future earnings growth. Given its solid financial track record, the issue appears reasonably priced, making it a suitable option for medium to long-term investment.

-330

January 17, 2025· 11:09 IST

Stallion India Fluorochemicals IPO Day 2 GMP Live: Stallion India Fluorochemicals gets 'SUBSCRIBE' tag from Stoxbox

- According to Prathamesh P Masdekar, Research Analyst at Stoxbox, the company has been focusing on expanding its operations across various domestic locations to tap into market demand in different industry hubs. Additionally, the company is committed to increasing product accessibility to broaden its customer base and drive revenue growth. This approach optimizes the use of processing facilities and enhances cash flow.

- The company has also shifted its focus toward expanding its product range to include high-margin offerings. With a solid strategic plan in place, management is optimistic about improving profitability. Based on its recent financial results, the company’s valuation appears reasonable, with a P/E ratio of 35.4x at the upper price band based on FY24 earnings. As a result, Prathamesh has given the issue a SUBSCRIBE rating.

-330

January 17, 2025· 10:52 IST

Stallion India Fluorochemicals IPO Day 2 GMP Live: Stallion India Fluorochemicals IPO subscription status so far

- Qualified Institutional Buyers (QIBs) -- 0.05 times

- Non Institutional Investors(NIIS) -- 18.25 times

- Retail Individual Investors (RIIs) -- 15.18 times

- Total -- 11.51 times

-330

January 17, 2025· 10:15 IST

IPO News Live: Sat Kartar Shopping shares list at 90% premium over IPO price on NSE Emerge

Sat Kartar Shopping IPO shares debuted on the stock exchange with a 90% premium on January 17. The SME IPO, which was open for subscription from January 10 to 14, saw an overwhelming response with a subscription of over 300 times in the primary market. The shares were listed at Rs 153.90 per share on the NSE Emerge platform, a 90% premium over the issue price, which was set in the range of Rs 77-81. (Read More)

-330

January 17, 2025· 10:10 IST

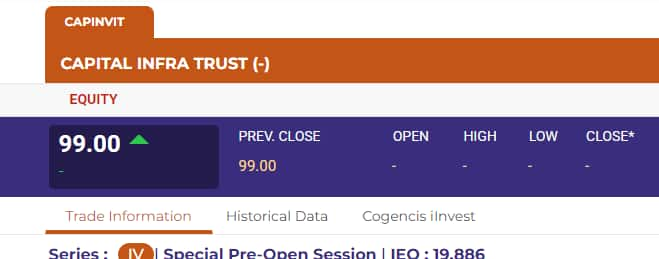

Capital Infra Trust Invit IPO Share Price Live: Check latest stock prices

-330

January 17, 2025· 10:09 IST

Capital Infra Trust Invit IPO Share Price Live: Capital Infra Trust IPO makes muted debut; lists at par versus issue price

Capital Infra Trust IPO makes muted debut; lists at par versus issue price

-330

January 17, 2025· 09:24 IST

IPO News Live: Temasek-backed Manipal Health Enterprises to meet bankers for $1 bn IPO: Report

Temasek-backed hospital chain Manipal Health Enterprises Ltd is set to meet with bankers to discuss their pitches for a potential $1-billion initial public offering (IPO) in February, according to a Livemint report. Citing sources, the news portal stated that the company could go public within the next year, with formal pitches from bankers scheduled for early next month. (Read More)

-330

January 17, 2025· 09:19 IST

Capital Infra Trust Invit IPO Share Price Live: Capital Infra Trust Invit trades at Rs 99.00 in NSE pre-open

-330

January 17, 2025· 08:50 IST

Capital Infra Trust Invit IPO Share Price Live: What you should know about Capital Infra Trust Invit - Company profile

- Established in September 2023, Capital Infra Trust is an infrastructure investment trust sponsored by Gawar Construction Limited. The InvIT was created to undertake activities and investments permitted under SEBI InvIT Regulations.

- The sponsoring company specialises in executing road and highway projects across 19 Indian states for various government agencies, including the NHAI, MoRTH, MMRDA, and CPWD.

- As of December 2024, the sponsor's portfolio includes 26 road projects under the hybrid annuity model (HAM) with NHAI. Of these, 11 are completed projects, including five acquired assets previously owned by Sadbhav Infrastructure Project Limited, and 15 are under construction.

- On November 11, 2024, the Trust received a ‘Provisional CRISIL AAA/Stable (Assigned)’ rating from CRISIL Ratings Limited for its NCDs and proposed long-term bank loan facility.

-330

January 17, 2025· 08:28 IST

Capital Infra Trust Invit IPO Share Price Live: Why there is no grey market premium for Capital Infra Trust Invit IPO?

- The units of Capital Infra Trust InvIT, which recently concluded an IPO with a subscription of just over 2 times, are set to debut on the exchanges on Friday. Notably, the company's shares have no grey market premium (GMP) ahead of the listing.

- This absence of GMP is common for InvIT units, as they are not actively traded in the grey market like the shares of traditional IPOs. InvITs are typically structured as investment vehicles focused on infrastructure assets such as roads, transmission lines, and renewable energy projects.

-330

January 17, 2025· 08:13 IST

Business news live: Oil prices climb on supply fears, Fed rate cut hopes

- Oil prices rose on Friday, heading for a fourth consecutive weekly gain, driven by concerns over tighter supply due to US sanctions on Russian oil producers and hints from a Federal Reserve official about potential interest rate cuts.

- Brent crude futures gained 13 cents, or 0.2%, reaching $81.42 per barrel by 0113 GMT, following a 0.9% drop in the previous session. US West Texas Intermediate crude futures increased by 27 cents, or 0.3%, to $78.95 a barrel after a 1.7% decline on Thursday. (Read More)

-330

January 17, 2025· 08:06 IST

Stocks to Watch Today

Stocks To Watch, Jan 17: Stocks like Hatsun Agro Products, Metro Brands, Bharat Petroleum Corporation, Mastek, One Mobikwik Systems, Jammu & Kashmir Bank, Satin Creditcare Network, IRCTC, Power Finance Corporation, Suraksha Diagnostic, Indian Bank, TVS Motor Company, and Bajaj Healthcare will be in focus on January 17. (Read More)

-330

January 17, 2025· 07:52 IST

IPO News Live: Denta Water sets price band of Rs 279-294 a share for IPO

Denta Water and Infra Solutions Ltd has announced a price band of Rs 279-294 per share for its upcoming initial public offering (IPO), which will open for subscription on January 22. Anchor bidding is scheduled to begin on January 21, and the issue will close on January 24. The basis of allotment will be finalized on January 27, with refunds initiated and equity shares credited to demat accounts on the same day. The shares are set to be listed on January 29. (Read More)

-330

January 17, 2025· 07:50 IST

Capital Infra Trust Invit IPO Share Price Live: Who are the BRLMs for the Capital Infra Trust Invit IPO

SBI Capital Markets Ltd and HDFC Bank Ltd are the lead managers for the Capital Infra Trust InvIT, with Kfin Technologies Ltd. serving as the registrar for the offering.

-330

January 17, 2025· 07:36 IST

China GDP Live: China's GDP grows 5% YoY in 2024, shows data by National Bureau of Statistics

- China October-December GDP up 5.4% YoY vs estimates of 5.1%

- China's GDP grows 5% YoY in 2024, shows data by National Bureau of Statistics

-330

January 17, 2025· 07:22 IST

Capital Infra Trust Invit IPO Share Price Live: What will Capital Infra Trust Invit do with the IPO proceeds?

The Capital Infra Trust public offering, previously known as National Infrastructure Trust, marks the first InvIT IPO of 2025. As outlined in its prospectus, the proceeds from the fresh issue will be utilized to provide loans to the project’s special purpose vehicles (SPVs) for settling external debts. Additionally, a portion of the funds will be allocated to extend loans to SPVs for repaying unsecured loans taken from the sponsor.

-330

January 17, 2025· 07:20 IST

Capital Infra Trust Invit IPO Share Price Live: Capital Infra Trust Invit public offer - an overview

The company's initial public offering comprises a fresh issue of units totaling Rs 1,077 crore, along with a sale of units worth up to Rs 501 crore by the selling unitholder, Gawar Construction Ltd, bringing the total offering to Rs 1,578 crore.

-330

January 17, 2025· 07:19 IST

Capital Infra Trust Invit IPO Share Price Live: Know about the sponsor of Capital Infra Trust Invit - profile of Gawar Construction

Gawar Construction, the sponsor, undertakes road and highway projects across 19 Indian states. Its clients include various governmental and semi-governmental organizations, such as the Central Public Works Department (CPWD), the Mumbai Metropolitan Regional Development Authority (MMRDA), the Ministry of Road Transport and Highways (MoRTH), and the National Highways Authority of India (NHAI).

-330

January 17, 2025· 07:18 IST

Capital Infra Trust Invit IPO Share Price Live: Capital Infra Trust Invit subscription details

The Capital Infra Trust, an infrastructure investment trust (InvIT), saw its initial public offering (IPO) subscribed 2.80 times on the final day of bidding, Thursday, January 9. The portion reserved for non-institutional investors was subscribed 5.08 times, while institutional investors subscribed to 93% of their allotted portion. Sponsored by Gawar Construction, the trust raised ₹703 crore from anchor investors. The price band for the issue was set at ₹99-100 per unit.

-330

January 17, 2025· 07:17 IST

Capital Infra Trust Invit IPO Share Price Live: Capital Infra Trust Invit to make D-Street debut today

The Capital Infra Trust InvIT IPO is set to debut on the market today. The share allotment was finalized on Tuesday, January 14. Shares for successful applicants have been credited to their demat accounts as of today, Thursday, January 16. Refunds for those who were not allotted shares will also be completed today. The InvIT adheres to a T+7 settlement cycle.