Warburg Pincus-backed Computer Age Management Services (CAMS) will hit the Street with initial public offering in the coming week.

Equity shares are expected to list on the BSE on October 1. The book running lead managers to the issue are Kotak Mahindra Capital Company, HDFC Bank, ICICI Securities and Nomura Financial Advisory and Securities (India).

Here are 10 key things you should know before applying for public issue:

1) IPO Dates

The public issue will open for subscription on September 21 and close on September 23. The finalisation of basis of allotment is expected to be completed by September 28, followed by initiation of refunds on September 29, and equity shares are likely to be credited to eligible investors by September 30.

2) Public Issue Details

The IPO consists an offer for sale of up to 1,82,46,600 equity shares by NSE Investments, the subsidiary of National Stock Exchange. This offer includes a reservation of up to 1,82,500 equity shares for purchase by eligible employees.

The offer would constitute at least 37.40 percent of post-offer paid-up equity share capital. Minimum bid lot is 12 equity shares and in multiples of 12 equity shares thereafter.

3) Price Band

The company in consultation with merchant bankers has fixed IPO price band at Rs 1,229–1,230 per equity share.

4) Issue Size

The Chennai-based registrar and transfer agent of mutual funds is expected to raise Rs 2,242.5 crore at lower price band and Rs 2,244.3 crore at higher end of price band.

5) Objects of Issue

The objects of the offer are to carry out the offer for sale by the selling shareholder; and achieve the benefits of listing the equity shares on the BSE. Company will not receive any proceeds from the offer and all such proceeds will go to the selling shareholder.

CAMS expects that listing of the equity shares will enhance its visibility and brand image and provide liquidity to shareholders and will also provide a public market for the equity shares in India.

6) Company Profile

CAMS is a technology-driven financial infrastructure and services provider to mutual funds and other financial institutions with over two decades of experience. It is India's largest registrar and transfer agent of mutual funds with an aggregate market share of approximately 70 percent based on mutual fund average assets under management (AAUM) managed by its clients and serviced by itself during July 2020.

Over the last five years, company has grown its market share from approximately 61 percent during March 2015 to approximately 69 percent during March 2020, based on AAUM serviced. Its mutual fund clients include four of the five largest mutual funds as well as nine of the 15 largest mutual funds based on AAUM during July 2020.

Company also provides certain services to alternative investment funds, insurance companies, banks and non-banking finance companies. As of July 2020, it serviced Rs 19.2 lakh crore of AAUM of 16 mutual fund clients, according to the CRISIL Report.

The growth of the assets under management of mutual fund clients is important to the company, as a substantial portion of its mutual fund revenues are based on the mutual fund AAUM of clients. As a result of the nature of the funds and services provided, CAMS charges more fees from equity mutual funds as compared to other categories of mutual funds.

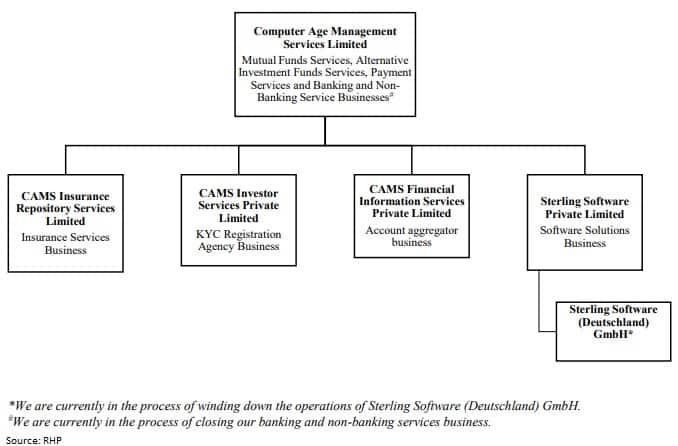

Corporate Structure Chart

CAMS offers an integrated and customized portfolio of services through its pan-India physical network comprising 271 service centers spread over 25 states and five union territories as of June 2020, and which are supported by call centers in four major cities, four back offices (including a disaster recovery site), all having real time connectivity, continuous availability and data replication and redundancy.

7) Strengths

>> Largest infrastructure and services provider in a large and growing mutual funds market;

>> Integrated business model and longstanding client relationships in mutual funds services business;

>> Scalable technology enabled ecosystem;

>> Strong focus on processes and risk management;

>> Experienced management and board and marquee shareholders.

8) Management, Promoters and Shareholding

Dinesh Kumar Mehrotra is the Chairman and Independent Director of the company. He has previously served as the chairman and the managing director of Life Insurance Corporation of India.

Anuj Kumar is the Whole time Director and CEO of firm. He was previously associated with Godrej & Boyce Manufacturing Company, Blow Plast, Escorts Finance, BillJunction Payments, IBM India and Concentrix Daksh Services India.

Narendra Ostawal and Zubin Soli Dubash are Non-executive Directors and also nominees of Great Terrain, the promoter entity.

Vedanthachari Srinivasa Rangan is Non-executive Director on the board and also nominee of HDFC entities.

Natarajan Srinivasan and Vijayalakshmi Rajaram Iyer are Independent Directors.

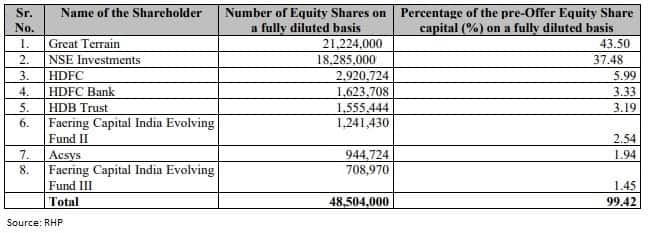

Its marquee shareholders include Great Terrain (an affiliate of Warburg Pincus), HDFC, HDFC Bank and NSE Investments (NSEIL), among others.

Great Terrain is the promoter of the company, which held an aggregate of 2,12,24,000 equity shares, aggregating to 43.50 percent of the pre-offer paid-up capital, at the time of filing RHP on September 11. After the transfer of shares to Great Terrain SPA (share purchase agreement), Great Terrain held 1,51,15,600 equity shares, i.e. 30.98 percent of the pre-offer and post-offer paid-up capital.

HDFC, HDFC Bank, Acsys, NSE, NSE DAL, NSECL and NSE Investments are the group companies of CAMS.

All others, excluding Great Terrain, are public shareholders. Shareholding as of RHP filing Date - September 11, 2020:

9) Strategy

>> Maintain leadership position by enhancing service offerings to mutual fund clients;

>> Continue the technology-led services innovations;

>> Achieve leadership in individual businesses and then target scale;

>> Improve automation in businesses.

10) Financials, Peers and Dividend

CAMS has delivered a robust financial performance with revenue growing at a 14 percent CAGR during FY17-FY20. Focus on operating expenses has helped the company report profit growth at 12 percent CAGR.

CAMS has delivered consistent EBITDA margin in the range of 35-40 percent in FY17-FY20. Its return on equity (RoE) has remained strong around 30 percent during FY17-FY20.

CAMS says there are no listed companies in India that engage in a business similar to that of company.

Company paid dividend of Rs 22.47 per equity share in FY19 and 12.18 per share in FY20. CAMS said it would endeavor to declare and distribute a dividend of 65 percent of the consolidated profit, net of tax, for the relevant financial year subject to availability of cash and equivalents and after taking into consideration capital expenditure and working capital requirements.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!