Prices are skyrocketing across the globe. According to a recent World Bank blog, 15 of the 34 advanced economies (classified by the International Monetary Fund) experienced inflation upwards of 5 percent for 12 months through December 2021.

Seventy-eight out of the 109 emerging markets developing economies also saw inflation above 5 percent, wrote Carmen Reinhart, Senior Vice President and Chief Economist at the World Bank Group, and Clemens Graf Von Luckner, an economist with the bank.

With economies just recovering from Covid-19 and tackling supply chain disruptions and the Russia-Ukraine war, central banks are treading a fine line—between boosting growth and lowering inflation.

Also read: Repo rate to increase to 5.50% by FY24 end: Deutsche Bank

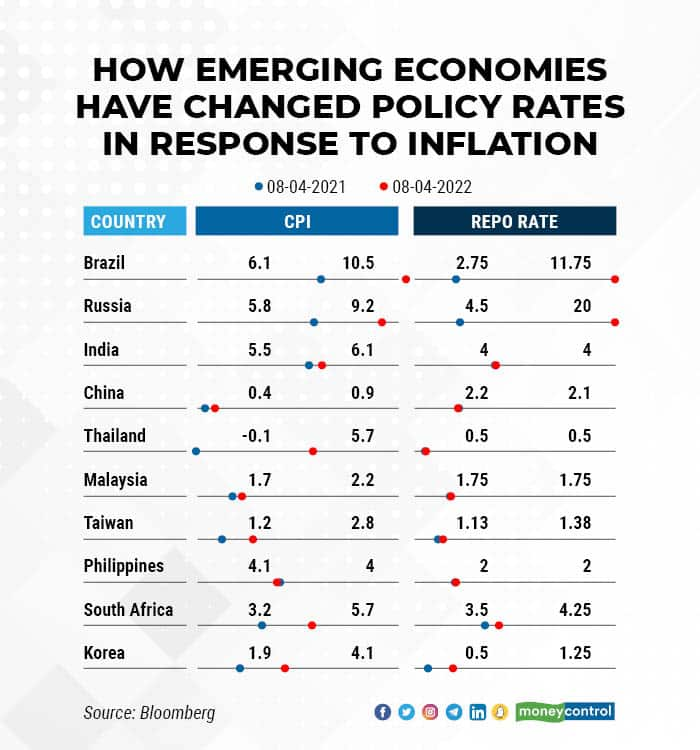

A comparison of inflation and policy rates for the past one year shows that central banks have been slow to raise rates in the face of rising inflation.

Russia more than doubled its repo rate to arrest the depreciation of the rouble and avoid hyper-inflation in the aftermath of crippling sanctions slapped by the US and its allies following its invasion of Ukraine. Brazil has been tightening sharply as inflation rises rapidly above its stated target of 3.5 percent.

Korea has been the most aggressive in raising rates and the won has been the best performing currency during the period.

(Graphics: Upnesh Raval)

(Graphics: Upnesh Raval)In emerging economies, Brazil and Russia are the outliers. A beleaguered Sri Lanka, too, recently raised its rates by 700 bps, to touch 14.5 percent.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.