Neha Dave

Moneycontrol Research

Edelweiss Financial Services, one of the fastest growing non-banking financial companies (NBFCs) in the country, reported strong earnings for the first quarter of FY19.

In an attempt to diversify its revenue stream, the Edelweiss group, which commenced operations as a capital market player, forayed into other segments like credit (wholesale and retail lending), distressed assets, insurance and wealth and asset management over the past few years.

We are enthused by the fact that over a period of time Edelweiss has evolved into a ‘bank-like’ structure, with diversified revenue streams, while carving out a niche in certain segment like distressed assets and rapidly gaining scale in the wealth and asset management space. Capital being employed in businesses, which are either low-yielding or loss-making at this point in time, along with costs associated with incubating new businesses is dragging down the group’s overall profitability.

We expect the group to build a significant market presence in its chosen lines of businesses, resulting in higher earnings and accruals to capital in the long term. Accordingly, investors can expect value creation, albeit in the long run.

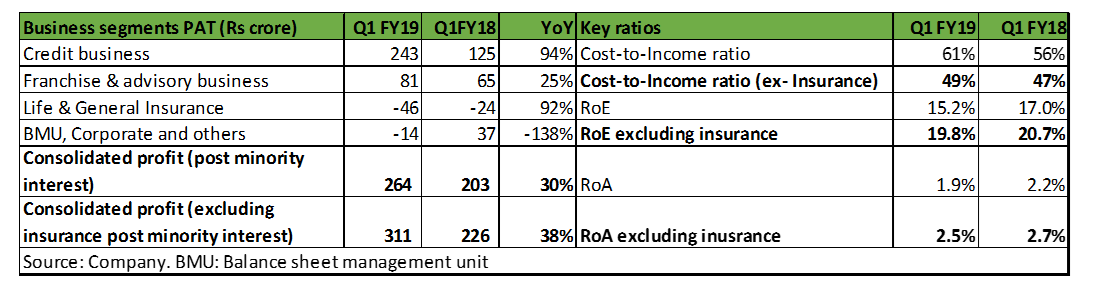

Edelweiss Financial Services: Quarter at a glance

The company reported strong Q1 FY19 earnings. Net profit surged 30% year-on-year (YoY) on the back of strong credit growth and increased scale of the wealth management business, partially offset by weak performance in the capital market business. Excluding the loss making insurance business, net profit growth was slightly better at 38% YoY.

The company’s life and general insurance has been incurring losses and remains a drag on the group’s overall profitability. The management expects Edelweiss’ share in accounting loss from the insurance businesses to be around Rs 200–225 crore per annum and expect breakeven only after 2021.

Profit growth in the franchise business, which houses capital market-related businesses along with wealth and asset management, was muted at 25% YoY. This was due to slowdown in the broking and investment banking arm, which remains susceptible to inherent volatility in capital markets.

Balance sheet management unit (BMU) is group’s active treasury function that supports its liquidity position and enhances asset-liability management (ALM) profile. Loss in this portfolio was attributed to markdown of G-Secs. However, the management sounded confident of generating return on assets (RoA) of around a percent in BMU.

Edelweiss intends to improve its operational efficiencies by lowering the overall C/I ratio by 100-200 bps every year. However, the same (excluding insurance) inched up to 49 percent in Q1. Consequently, profitability was slightly lower as return on equity (excluding insurance) declined 19.8% compared to 20.7% last year.

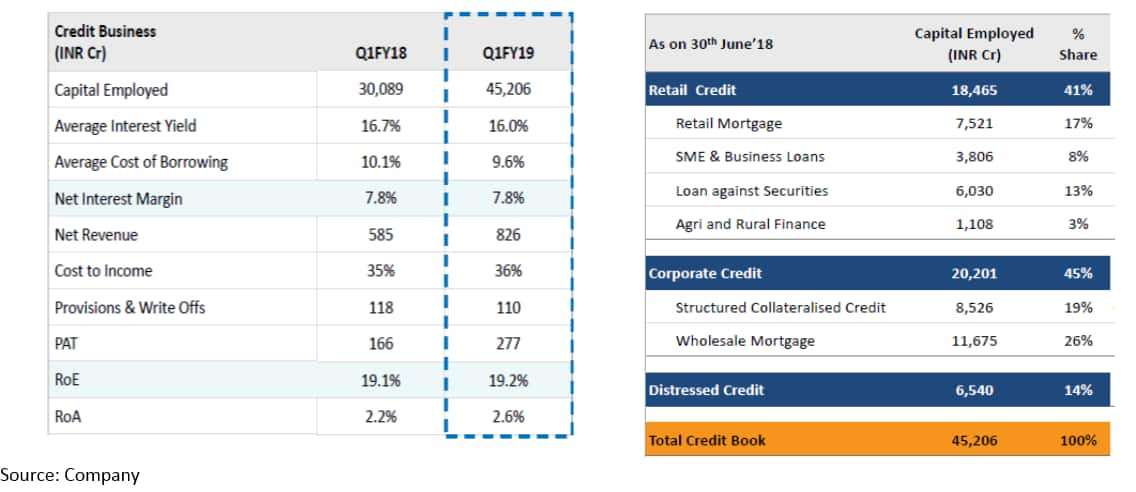

Strong loan book growth driven by retail assets

Edelweiss’ credit business is a key revenue and profit driver and contributed 78% of consolidated Q1 profit (pre-minority interest and excluding insurance). The group’s loan book grew 50% YoY to Rs. 45,206 crore, consisting of the corporate (59% of the loan book) and retail segments (41%) as at June-end.

Retail loan book increased 80% YoY. Increasing prominence of the retail financing business is evidenced by the increase in share of the retail book to 41% of the overall portfolio as on June 30 from 28% as on March 31, 2015. The company expects the share to increase to around 50% by March 31, 2020. The corporate segment primarily includes structured collateralised credit (19% of the overall loan book) extended to promoters and corporates, real estate financing (26%) and distressed asset credit (14%).

Asset quality continues to be comfortable on this book. However, due to transition to IndAS, the NBFC recognised Stage III assets (standard but can be potential stress) and made 58% provision on the same. As per the management, provisions are higher as it expects loss given default (LGD), if any, to be contained at 20-25%.

Within credit, distressed asset segment can be a potential game changer

Edelweiss has employed capital of Rs 6,540 crore in the distressed credit business and operates the largest asset reconstruction company (ARC) in India, with a book size of Rs 43,700 crore. There is a delay of around 3-4 months than what was earlier anticipated in the resolution of delinquent assets under the Insolvency & Bankruptcy Code (IBC).

The management didn’t seem to be overly worried about the delay as its profitability is more sensitive to amount realised than timing of the resolution. As per the management, this business earns an internal rate of return (IRR) in the 16-17 percent range if the resolution value is the same as its asset acquisition value.

There is potential to earn higher carry income (more than 17%) in case the realisation is higher than the price at which asset was acquired. Hence, progress of cases under IBC remains a key monitorable. Any delay or inability in the resolution of delinquent assets could adversely impact the company’s profitability and liquidity profile.

Additionally, Edelweiss’s performance in the distressed asset segment hinges on availability of capital. Canada’s second largest pension fund, Caisse de dépôt et placement du Québec’s (CDPQ) 20% stake in the ARC business gives us comfort on the capital adequacy front.

Healthy performance of wealth and asset management businesses

Performance of the wealth business continued to remain impressive. Assets under advice (AuA) swelled to Rs 96,300 crore, an increase of 46% YoY. About 25% of these assets are under advisory model while bulk of them remain distribution assets. Overall yield on these assets is around 70-75 bps. Net new money flow during the quarter was Rs 3,257 crore.

The asset management business comprising mutual funds and alternative assets saw a YoY growth of 57% and 70%, respectively. Cumulative AUM under mutual funds and alternatives stood at Rs 32,500 crore.

Outlook and recommendationsEdelweiss, with diversified business segments, have unique growth drivers and is a key beneficiary of increased penetration of financials services. While there are multiple growth drivers, it is the fee-based wealth management as well as distressed asset business that excites us the most. Both these businesses can provide a RoE fillip in the future.

Though the performance of the NBFC has been resilient so far, investors should be cognisant of the inherent risks as well. The credit business, including distressed assets, is relatively unseasoned and needs to be tested through business cycles.

Edelweiss’s profitability has improved over the past few years, but it still remains sub-optimal because a significant portion of the group's capital is employed in businesses that are either low-yielding or loss-making currently. Expected improvement in the profitability of the insurance business and reduction in the share of funds allocated to BMU will benefit the group's profitability over the long term.

In the medium term, we see profitability improving for the NBFC on the back of strong growth in the lending book, buoyant capital markets and steady wealth and asset management businesses.

On the valuation front, the stock seems fairly priced with lending book at 2.5 times FY20e book value and franchise business at 20 times one year forward earnings (P/E). Given the sectoral opportunities and multiple growth levers, investors with a long term horizon wanting to participate in a high growth and diversified financial services company should but into the stock.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!