Anubhav SahuMoneycontrol research

Graphite electrode manufacturers witnessed another quarter of pricing-led growth, with HEG far exceeding expectations in terms of sale realisations and margin expansion. Sequential improvement in the sector’s earnings is a reflection of supply-side reforms in China and the higher usage of electric arc furnaces (EAF) for steel manufacturing.

However, as the contract-renewal cycle stabilises, for both graphite electrodes as a product and needle coke as a raw material, the uptrend in earnings also appears to be plateauing in the near term.

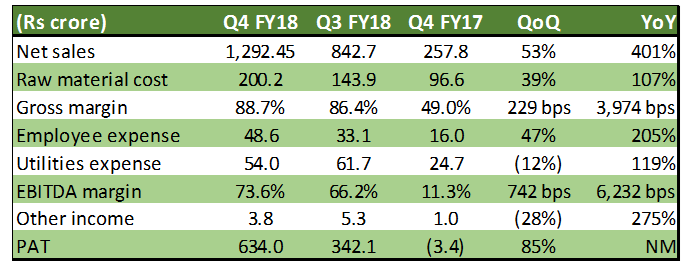

HEG’s quarterly update

Source: HEG

HEG’s quarterly results come as a surprise as the contract renewal cycle accelerates. Sales have increased 50 percent sequentially, benefitting from the change in the way products are priced, and the progress in contract renewals for graphite electrodes.

With a capacity utilization of 84 percent, the company is operating with a steady momentum, partially impacted by a shortage of needle coke.

The company’s realisation of around $12,000 per ton is 55 percent higher, sequentially. The change in cost of raw material has been relatively milder, leading to a 229-bps expansion in gross operating profit margin. However, margins will likely stabilise at this point, as contract renewals for needle coke catch up.

A fall in expense for power consumed and better operating leverage helped EBITDA margin expand to 73.6 percent.

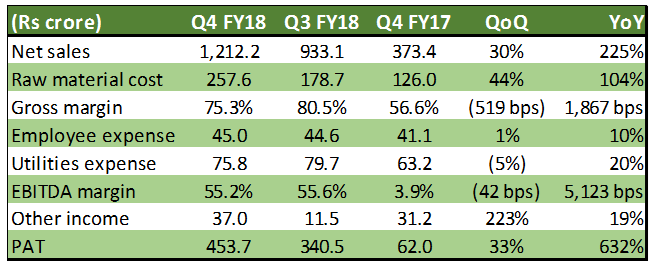

Table: Graphite India Q4

Source: Graphite India

Takeaways from Graftech result

A review of US-based industry leader GrafTech International’s results suggests that spot prices of graphite electrodes are between $17,000 and $23,000 per ton.

GrafTech’s capacity utilisation was 98 percent, after excluding the temporary shutdown of one of its plants. The company reported a sales realisation of $10,124 per ton for graphite electrodes, as long-term contracts brought in 60 percent of total sales.

The company’s realisation in the remaining quarters of 2018, however, is expected to be around $9,500 per ton, as it is a blended average of long-term (3-5 year) contracts, as well as some inked in 2017, when prices were subdued.

In the case of HEG as well, the management expects a realisation of around $11,000 per ton to be sustainable in the near term. As contract renewals for graphite electrodes pick up pace, the company expects almost all its sales in the first quarter of FY19 to come from its most recent price regime. However, HEG also manufactures high power grade electrodes (15-20 percent of total sales), a segment in which it competes with new supply from the Chinese market.

Falling Chinese exports supportive for prices of graphite electrodes

Given that China has cut down on steel manufacturing and has shut down inefficient induction furnaces and blast furnaces, Chinese steel exports have continued to decline this year too.

For January-April, steel export volumes, at 21.6 million tons, have declined by 20 percent year-on-year. This led to higher steel production in other regions where EAFs are preferred.

At the same time, electric arc furnaces are replacing induction furnaces and blast furnaces in China. According to HEG’s management, steel production in China through EAFs is expected to triple from its 2016 level to 160 million tons in 2020. Of the total, nearly 51 million tons of EAF production is expected to start this year itself.

Interestingly, this increase of around 110 million tons in steel production through EAFs in China, between 2016 and 2020, would be equivalent to around a third of the total amount of steel produced in the world using EAFs in 2016.

Not surprisingly, this shift towards EAFs is what is seen turning the tide in favour of graphite electrode manufacturers, because these furnaces’ contribution to China’s total steel production is expected to move up from around 5 percent in 2016 to 15-20 percent in 2020.

Also, there is no new greenfield project in sight for the graphite electrode industry, which is, again, supportive for existing manufacturers. Why so?

Source: HEG

Needle coke supply remains a key overhang

At the moment, limited supply of needle coke is capping the capacity utilisation of units manufacturing graphite electrodes. While HEG is optimistic about achieving higher capacity utilisation of 85-90 percent in the current quarter on the back of debottlenecking, opting for a greenfield project at this juncture is not an option for most global players.

So far, only Graftech has announced a plan to debottleneck 35,000 tons of capacity in the current year. While the company is largely vertically-integrated, any addition of capacity would require third-party sourcing of needle coke, around which uncertainty still remains.

Among recent developments on supply of needle coke is Conoco Phillips’ plan to expand capacity to around 50,000 tons. While this would help stabilise raw material prices, needle coke’s usage for production of lithium ion batteries, which accounts for 15 percent its total usage, would remain a critical factor to look at.

Chart: Global needle coke capacity (‘000 MT)

Source: Company

Constraints on supply of needle coke cap volume growth for the graphite electrodes segment. Realisations could peak in the ongoing fiscal year. By the time the impact of new needle coke contracts seeps into companies’ income statements with a lag, we may already be past the peak of the margin cycle.

Having said that, high barriers to entry, supply side reforms in China, higher usage of EAFs for steel manufacturing and the time lag of around 4 years in getting greenfield capacity, keeps the visibility of free cash flow intact for graphite manufacturers in the medium term.

This also provides HEG a margin of safety at its current valuation of around five times its 2019 estimated earnings. However, given the cyclicality of the company’s business and the expected stabilisation of earnings in FY19, it is advisable to buy the stock only on dips, and that too, only for investors with high risk appetite.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!