Fundraising through green corporate bonds by companies and banks fell to a two-year low so far in the current financial year due to low investor appetite and little incentive for the issuers, experts said.

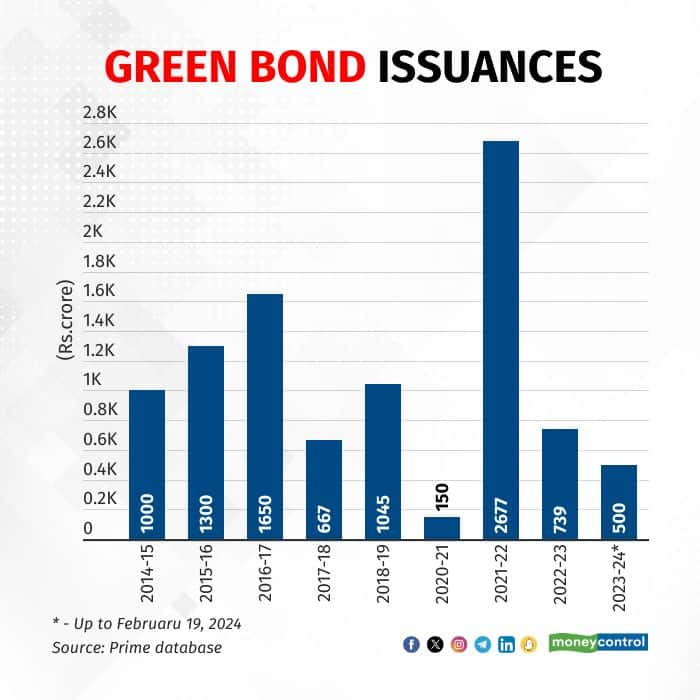

According to the data compiled from Prime Database, green bonds worth Rs 500 crore were issued so far in this financial year, as compared to Rs 739 crore in the previous financial year. In the financial year 2021-22, green bonds worth Rs 2,677 crore were issued.

Green bonds are fixed-income securities that are dedicated only to projects with environmental advantages or climate and environment-related objectives.

“One reason for the decrease is greenium. The greenium has decreased from about 15-20 basis points (Bps) since 2016 to a low single digit currently. Green bonds have additional cost in the form of regulatory compliance and additional disclosures, thereby providing little incentive for the issuances,” said Arun Bansal, executive director, head of treasury at IDBI Bank.

Adding to this, Rajeev Pawar, head of treasury - Ujjivan Small Finance Bank said there are no tax or reserve benefits on green bonds so investor and issuer interest is low.

Also read: Electoral bonds verdict, RBI action on Paytm sign of robust institutions

The numbers

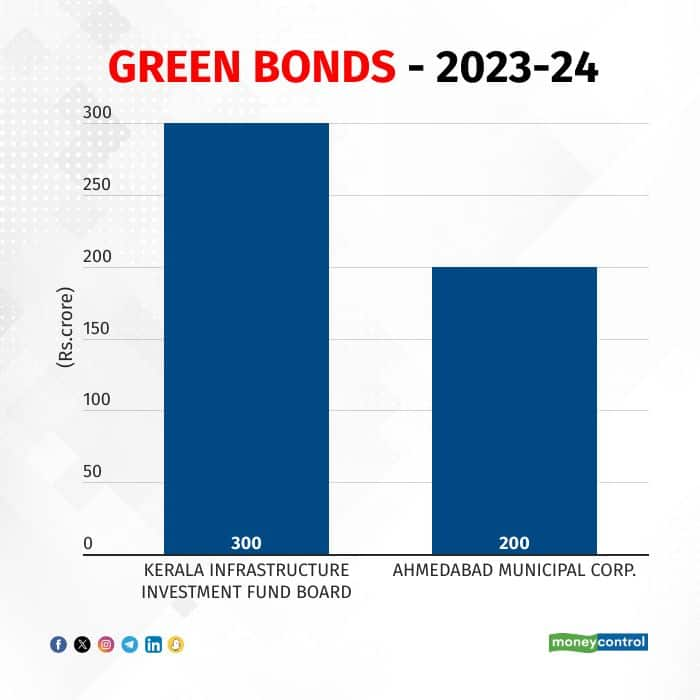

In the current financial year, so far only two issuers — Kerala Infrastructure Investment Fund Board and Ahmedabad Municipal Corporation — raised funds through green bonds, as per Prime Database data.

Kerala Infrastructure Investment Fund Board raised Rs 300 crore on June 30, 2023, and Ahmedabad Municipal Corporation raised Rs 200 crore on February 5, 2024, at a 7.90 percent coupon rate.

On January 15, Moneycontrol reported that Ahmedabad and Vadodara Municipal Corporations planned to raise a combined Rs 300 crore through green municipal bonds in January.

Municipal bonds are similar to corporate bonds, the only difference being that they are issued by civic bodies to finance urban infrastructure.

Investors are promised a specified interest and return of the principal amount on the maturity date. Such bonds are issued by states, cities, utility providers, transit authorities, school districts and hospitals.

Why the low appetite?

In India, there is no obligation to invest in these green bonds and there are also no dedicated companies to invest in them. As a result, the appetite of the Indian investor for such bonds has been low, say experts.

Also, green bonds are new in India and hence, pricing based on the international issue of bonds becomes difficult, dealers say. They point to the tepid response to the recent issue of sovereign green bonds by the government.

Also read: Corporate bonds borrowing cost may fall on shift in demand as govt borrowing completes: Experts

The outlook

Money market experts said ESG momentum is expected to pick up in the coming years and issuances of green bonds can be expected. However, they added that lower greenium or premium may pull back some issues.

“Certainly during the next couple of years ESG theme will gain momentum and higher allocation and issuances can be expected on green bonds,” Bansal added.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.