The Cabinet Committee on Economic Affairs (CCEA) has approved the sale of the government's 52.63 percent stake in REC to Power Finance Corporation. The stake sale will help the government mobilise around Rs 12,000- 15,000 crore to meet its disinvestment target for FY19. In a similar deal last fiscal, GOI sold its 51 percent stake in HPCL to ONGC and managed to raise Rs 36,915 crore.

The central government might once again overshoot the budgeted fiscal deficit to GDP target of 3.3 percent for FY19. The pressure on government finances is mainly arising from the revenue side, particularly from indirect taxes and non-tax revenue.

On the revenue side, aggregate indirect tax collections grew only 4.3 percent during H1FY19 as against the budgeted growth of 22.2 percent for FY19.

The non-tax revenue includes 1) dividend from RBI and public sector institutions, 2) receipts from the auction of telecom spectrum and 3) disinvestment proceeds. The budgeted estimate of non-tax revenue stands at Rs 2.45 lakh crore. Clearly, there is likely to be a shortfall from the sources mentioned above. The government is trying to meet at least the disinvestment target of Rs 80,000 crore of which it has so far managed to raise Rs 32,737 crore.

Stake sale in REC to PFC clearly indicates the fiscal math is gathering steam and the government is resorting to a last-minute make-shift arrangement to meet targets.

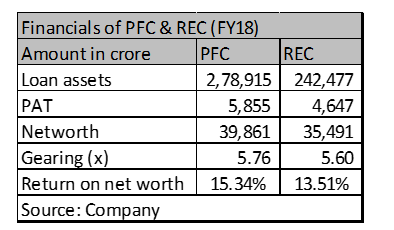

Weakens the financial profile of the buyerGovernment companies buying the government’s stake in other government companies may help in meeting or nearing fiscal targets. However, it ends up weakening the financial profile of the buyer due to depletion of its cash reserves and an increase in debt taken to fund the acquisition. For instance, ONGC funded the acquisition through internal resources and short-term debt. In the case of PFC, the financial metric is not as strong as that of ONGC.

With no tangible benefits in sight for the shareholdersPFC and REC, both being power sector financiers are grappling due to power sector woes. The merger of two entities can create synergies and achieve economies of scale, as REC and PFC are the biggest lenders in power space. However, both the companies will continue to have separate management. In addition, the government is seeking exemption from an open offer on this deal. This means there will be no clear benefit to the minority shareholders of both these NBFCs.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.