GM Breweries, which manufactures and markets alcoholic beverages such as country liquor and Indian made foreign liquor (IMFL), reported a 7 percent year-on-year (YoY) growth in revenue to Rs 414 crore for the quarter ended September.

The company reported earnings before interest, tax, depreciation and amortisation (EBITDA) of Rs 29 crore for the quarter, 16 percent higher on year on account of cost efficiencies. Its net profit also came in 23 percent higher at Rs 19 crore as higher other income (Rs 1.45 crore in Q2 FY19 vs Rs 46 lakh in Q2 FY18) and lower other expenditure offset the moderate increase in depreciation.

Prices of extra neutral alcohol/rectified spirit, the key raw material for GM Breweries that amounts to around 10-11 percent of its total revenue, declined more than 50 percent as sugar production reached record levels last year.

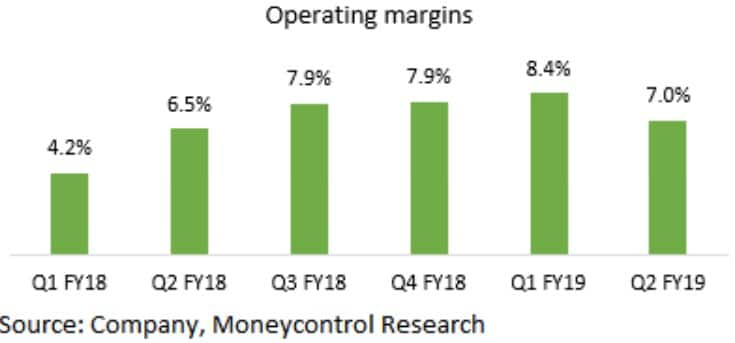

Softer raw material prices, along with an improvement in realisation, helped the company expand its gross margin over the course of FY18. Besides, it also benefitted from stable packaging costs and strict cost control measures.

However, in the quarter under review, despite soft raw material prices, GM Breweries' operating margin declined 140 basis points quarter on quarter as packaging costs surged during Q2. Prices of PET bottles have seen a sharp increase due to a rise in petroleum prices in the international market, as well as adverse currency movements.

During FY18, packaging expenses constituted 8-9 percent of the company's revenue. This was because the contribution of PET bottle sales to total sales was significant during the year. However, GM Breweries is gradually shifting to glass bottles to mitigate packaging-related cost pressures.

With an installed capacity of 13.8 crore litres, GM Breweries is the single largest manufacturer of country liquor in Maharashtra. After a muted volume growth of 0.9 percent for FY17, the company's volumes rose at a moderate 5.7 percent in FY18 as the Supreme Court revoked the highway liquor ban in August.

Driven by higher volumes, the company's capacity utilization inched upwards to around 50 percent in the last fiscal year. Going forward, the company plans to leverage its brand presence in Mumbai and Thane to penetrate deeper into other districts of Maharashtra.

With the change in consumer preferences, liquor consumption is on the rise in India. GM Breweries, with its current capacity, is well positioned to capture the demand in the market.

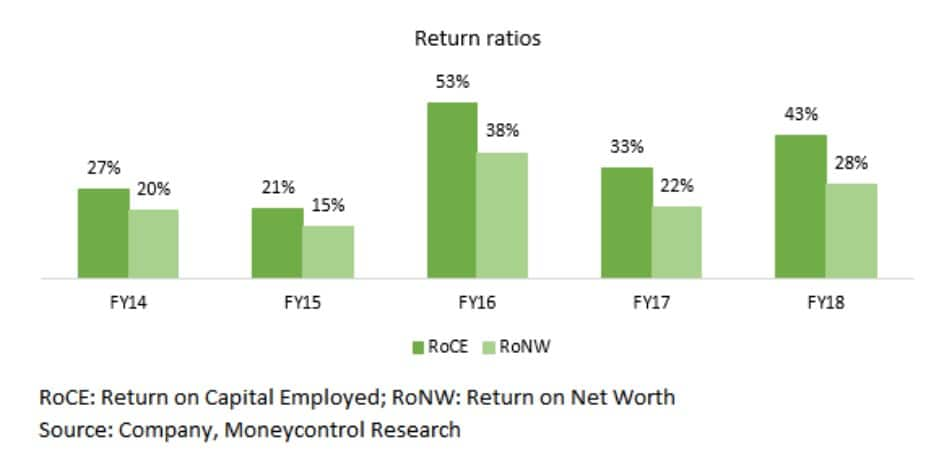

At the current market price of Rs 551 per share, the stock trades at 12-month trailing PE of 10 times, which implies a steep discount to other listed companies in the sector. The company has a debt-free balance sheet and has consistently delivered a return on capital of more than 25 percent.

Given its strong business fundamentals, the stock seems an interesting bet at current levels as GM Breweries has sufficient capacity headroom to grow volumes by more than 20-25 percent for the next 3-4 years. However, the competitive landscape as well as business execution needs to be monitored closely.

For more research articles, visit our Moneycontrol Research page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.