A recent note by Elara Capital has compared the current euphoria in thematic and sectoral funds to periods ahead of the dot com crash and the global financial crisis of 2008-09, stating that the rapid rise in the assets under management (AUM) within this category reflects an overabundance of greed in the system.

In recent months, concerns surrounding thematic and sectoral funds have intensified, Elara’s Domestic Liquidity Tracker has noted.

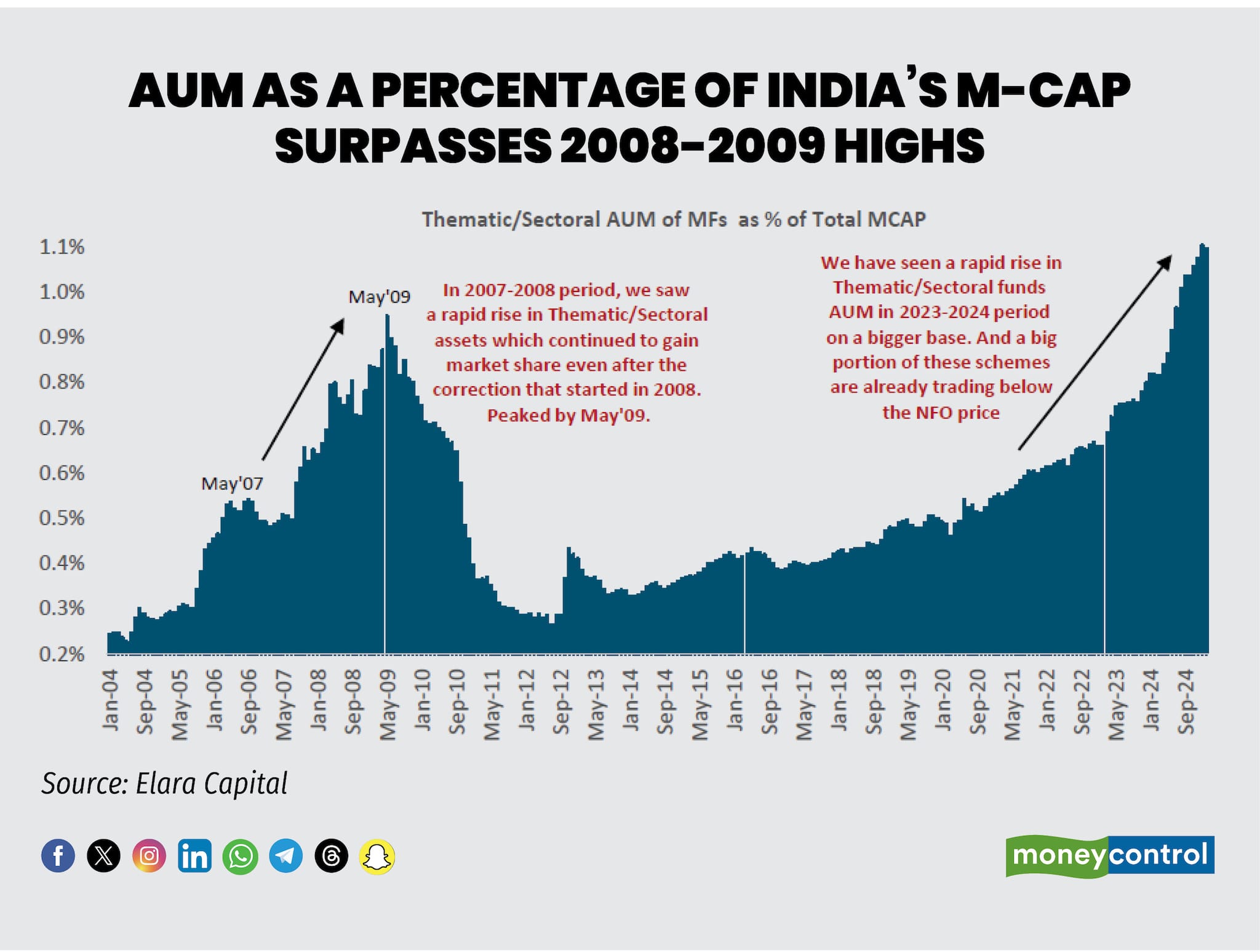

The report said that the concentrated buying of select stocks by these funds has led to inflated valuations across sectors, creating both direct and indirect distortions in overall market pricing. The current AUM of these funds as a percentage of India’s total market capitalization has exceeded the highs seen during the 2008-09 financial crisis.

Historical data has shown that a majority of these inflows occurred within 6-9 months leading up to the Global Financial Crisis (GFC) collapse, a pattern that the report said seemingly may be repeating itself.

The report said that at present, nearly 19 percent of the thematic and sectoral schemes are down by over 10 percent. While this is similar to what has been seen historically in 2016 and 2020 as well, the report added that the difference between then and now is the investor sentiment, which is now 'exuberant'.

"The last major spike in thematic fund losses occurred in March 2008, after which markets attempted a brief stabilisation. However, the subsequent correction from May 2008 led to severe declines in these stocks, causing widespread market turmoil. Presently, the market appears to be in a comparable recovery phase which is similar to March-May 2008, raising fears of another potential downturn," the report said.

In a previous similar cycle, closure of schemes in this category was only visible from May 2011, the report said.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.