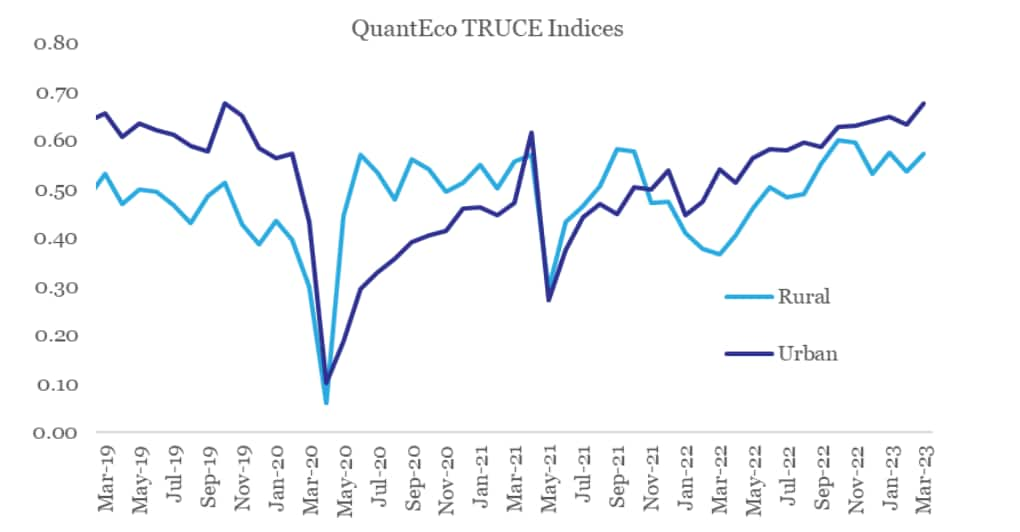

India's urban consumption hit a three-and-a-half-year high in March, according to QuantEco Research's TRUCE index.

"Urban consumption index rose to 0.68, i.e. the highest level since November 2019 led by air passenger traffic and petrol consumption," QuantEco Research said in a note on May 23.

The Tracking Rural Urban Consumption Expenditure, or TRUCE Index, is QuantEco Research's proprietary index that intends to fill the gap in Indian economic data caused by the lack of a measure of retail sales. The monthly TRUCE index measures consumption on a scale of 0 to 1.

Urban consumption to moderate

While urban consumption was at a multi-year high at the end of 2022-23, QuantEco Research expects it to decline in 2023-24 due to the rapid monetary tightening undertaken by the Reserve Bank of India (RBI) over the past 12 months.

"We anticipate urban leveraged consumption of goods to wane in 2023-24, as pass-through of past monetary tightening to consumers gets completed. Services consumption in comparison could retain growth momentum at least through H1 FY24 (April-September 2024) with still ground to cover vis-à-vis pre-COVID levels," QuantEco Research noted.

In an attempt to bring down elevated inflation, the RBI increased the policy repo rate by 250 basis points to 6.5 percent in 2022-23. However, Consumer Price Index (CPI) inflation has remained above the central bank's medium-term target of 4 percent for 43 months in a row, although economists expect it to be close to that figure in May, data for which will be released on June 12.

According to QuantEco Research's analysis, growth in personal loans rises as the repo rate increases. However, this relationship breaks down as the repo rate moves above 6 percent – which has happened in India in recent months. The adverse impact of higher interest rates as well as the fading of pent-up demand for goods is seen leading to a decline in the "exceptional rise in credit to consumer durables seen over the last 18 months".

Rural consumption patterns

While the TRUCE urban consumption index rose to 0.68 in March from 0.63 in February, the rural index increased to 0.58 from 0.54.

Source: QuantEco Research

Source: QuantEco Research

Festival-related demand in the second half of 2022 had helped rural consumption nearly catch up to its urban counterpart. Although it cooled down subsequently, it is now showing signs of consolidating, with growth in tractor and two-wheeler sales faring well in recent months.

"Risks of El Nino on monsoon notwithstanding, rural consumption is expected to fare better here on, owing to Rabi harvest-led improvement in cash flows, government's procurement of wheat, rise in agri wages, easing agri input costs, and elevated fiscal outlay by agri/rural ministries (vs. pre-COVID era)," QuantEco Research noted.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.