There is a famous saying in the commodity market that the cure for high prices is high prices. When prices rise, producers are willing to produce and sell more to maximise profits. This self-correcting mechanism leads to higher supply and a fall in prices. This phenomenon is not being seen in oil prices currently. While crude oil prices have risen sharply over the past few months, there hasn’t been a parallel uptick in supply lately. Is it just a restrain being observed by producers as a lesson from miseries of the past or is there more to it?

Inadequate investment in upstream oil segment While global demand for crude oil has been growing, response from the supply-side has remained inadequate. The crash in global crude oil prices in 2014 led to a sharp decline in upstream investments, with a 25 percent year-on-year fall in 2015 and 2016, flat growth in 2017 and only a modest rise in 2018, early data from the International Energy Agency suggests.

Despite the recovery in prices, investment growth has remained slow with bottlenecks due to smaller players producing from larger oil fields and limited funding avenues. Sharp volatility in prices and scepticism over future oil demand due to rising use of alternate fuels is also contributing to slow investment growth.

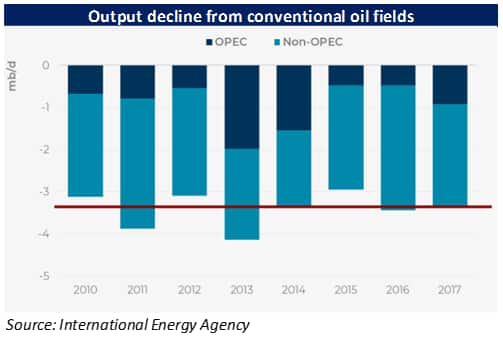

With rapidly growing demand and maturing oil fields, the investment needs are expected to be much higher than before. Each year almost 3 million barrels per day (mbpd) of production is lost to maturing fields, so investment is required to maintain current production levels and meet future demand uptick.

Concerns over spare capacity from Saudi Arabia While Saudi Arabia has assured the market of covering up for lost Iranian barrels in November in the likelihood of US sanctions, there is suspicion over how much the kingdom would stretch. Saudi Arabia currently has close to 1 mbpd of spare capacity and any incremental production above this level would require additional capital expenditure and time.

Supply decline from oil producing nations Crude oil production has been shrinking due to various macro and micro issues plaguing oil producing nations. In the last three years, production from China, Mexico and Venezuela has fallen by more than 1.7 mbpd. While Chinese decline has been addressed, Mexico is planning massive reforms.

The situation in Venezuela remains weak given the worsening political and economic crisis, leading to a sharp decline in crude oil production. With a tight economic and fiscal position, the government has little resources available to invest in maintenance of rigs and oil fields. Exports have dropped by half since 2016 to below 1 mbpd. To support the tumbling output, Venezuela’s state-run oil firm PDVSA has signed a $430 million investment agreement to increase production by 640,000 bpd at 14 oil fields. However, given the country's political and economic instability, it is doubtful if this investment would go through.

Other producing nations like Iraq and Libya have also been entangled in internal conflicts, which has led to tightening oil supply. Political dispute between the central government and Kurds in Iraq has led to an output loss of almost 300,000 bpd since last year. Iraq has since been sitting on this reserve capacity and has lately indicated plans to boost production. While there has been a slight uptick in overall production from Iraq in recent months, we need to observe how much of it could re-enter the system.

Since late August, clashes between rival armed groups have shattered Libya, which impacted production. Output from the country’s major oil fields fell 125,000 bpd following attacks on its supply infrastructure. While the situation is now coming under control, how much of its production would flow back into the market would be something to watch out for.

Outlook In the past whenever crude oil prices saw a sharp spike, the market witnessed a sharp rise in suppliers getting on board the rising crude oil ship. However, this time around there have been several factors which have led to supply remaining suppressed. There has been a lag in investments, given the hit producers had to take when crude oil prices fell below $50 a barrel. Investments have also remained suppressed due to blurry long-term demand in light of rising use of renewable fuels. Various country-specific factors have added fuel to this fire and kept production low. While various nations have indicated their intention to increase production, how much of it would flow back and what would be the timeline is something to watch out for. This would define the contours of crude oil prices in coming months.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.