Amol Agrawal

Moneycontrol Contributor

On February 26, the Reserve Bank of India (RBI) informed the market that three banks — Corporation Bank of India, Allahabad Bank and Dhanlaxmi Bank — were taken out of the Prompt Corrective Action (PCA) framework. This was a follow-up to three banks (Bank of India, Bank of Maharashtra and Oriental Bank of Commerce), which were taken out earlier on January 31. This implies that of the 11 public sector banks, six are out of the scanner.

Despite the wide appeal of the PCA framework, it still appears like a black-box. Many analysts are worried that the RBI is letting banks go easily, thereby undermining its own efforts of bringing them under the framework despite stiff opposition. One reason for this is that RBI has not really cared to simplify this black box.

Before looking at the solution, let us quickly understand what PCA is. PCA is like a surgical procedure where the patient is not just operated but is under intensive care after the surgery. Only when the patient is deemed fit do hospitals allow the patient to be discharged and ask her to gradually resume her daily routine.

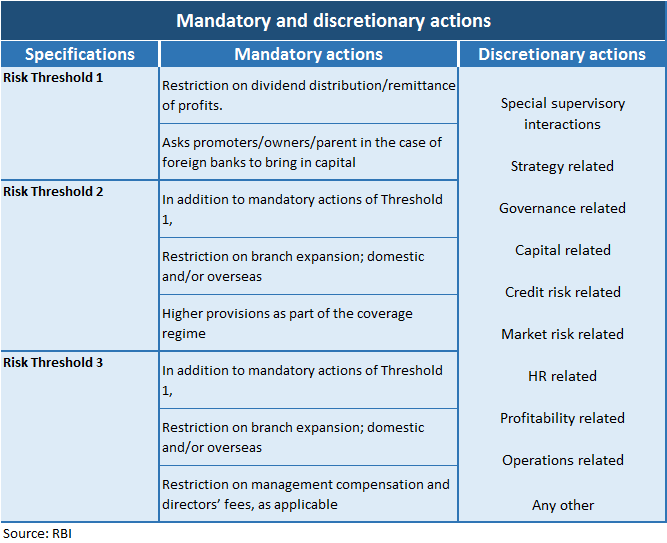

Similarly, under the PCA framework, the RBI takes the ill banks into its custody where illness is defined as banks having low capital, poor asset quality, leading to high NPAs, low profitability etc. To give the right treatment, RBI has established three thresholds to gauge the exact illness of the banks. Based on these thresholds, RBI carries out the treatment. (See the table below)

Interestingly, PCA is not a new development and was instituted in 2002. The idea came from the US where PCA was first used to resolute banks during a financial crisis in the early 1990s. Taking the lessons forward, some other countries have also implemented their own PCA plans. RBI Deputy Governor Viral Acharya in a speech (October 12, 2018) compared the PCA frameworks in India and the US.

However, what is lacking in the PCA framework is that it reads like a black box. It is really difficult to track many financial indicators, which explain the entry and exit of banks in the framework. Just like entering a patient’s cubicle makes one jittery after seeing the buzzing of many health indicators, same is the case with the PCA as well. Sample these RBI press releases of January and February, where six banks exited:

“Taking all the above into consideration, it has been decided that Bank of India and Bank of Maharashtra, which meet the regulatory norms including Capital Conservation Buffer (CCB) and net NPAs of less than 6 percent as per the third quarter results, are taken out of the PCA framework, subject to certain conditions and continuous monitoring. In the case of Oriental Bank of Commerce, though the net NPA was 7.15%, as per the Q3 published results, the government has since infused sufficient capital and the bank has brought its net NPA to less than 6%.

“….two banks have also made the necessary disclosures to the stock exchange that post the infusion of capital, the CRAR, CET1, net NPA and leverage ratios are no longer in breach of the PCA thresholds. The banks also apprised RBI of the structural and systemic improvements put in place to maintain these numbers.”

It is difficult to understand both the terms and the flow of funds.

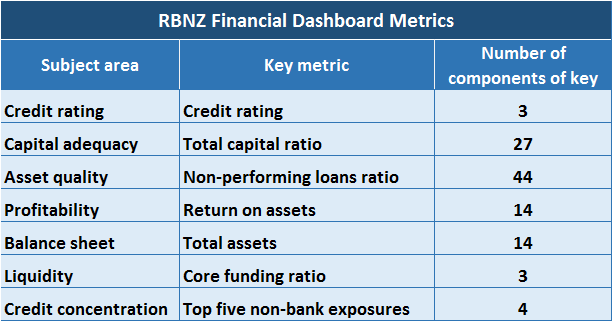

RBI should take a leaf from Reserve Bank of New Zealand (RBNZ) which has developed an online Bank Financial strength dashboard. RBNZ explains the dashboard as: “…an innovative online tool for sharing prudential and financial information on New Zealand incorporated banks. It sits alongside disclosure statements as a source of information for the public and market to better understand and compare banks’ businesses and risks. The dashboard is updated quarterly and is based on information that banks already provide to the Reserve Bank, reducing the cost of the initiative for banks and the Reserve Bank.”

Anyone who sees the dashboard will realise that it really tries to help the public understand the banks’ business and risks. One can play around the graphs in the dashboard to get a sense of financial strength of both individual banks and the banking sector. If one looks at the various metrics, it is not very different from RBI’s own PCA framework.

Source: Reserve Bank of New Zealand

RBI collects a lot of data and needs to figure ways to present it in a better manner. RBNZ’s financial dashboard provides a good way to present this information to build a better public understanding of India’s banking sector.

(Amol Agrawal is faculty at Ahmedabad University. The views expressed here are his own)

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!