India's iron ore production is expected to grow at 5 percent annually during 2016-2020 and hit 198.8 million tonnes by 2020, BMI Research today said.

Globally, the research firm said the iron ore market will stay in surplus over its forecast period to 2020. Expanding output in Brazil and Australia and lower steel demand in China will remain the drivers of global oversupply.

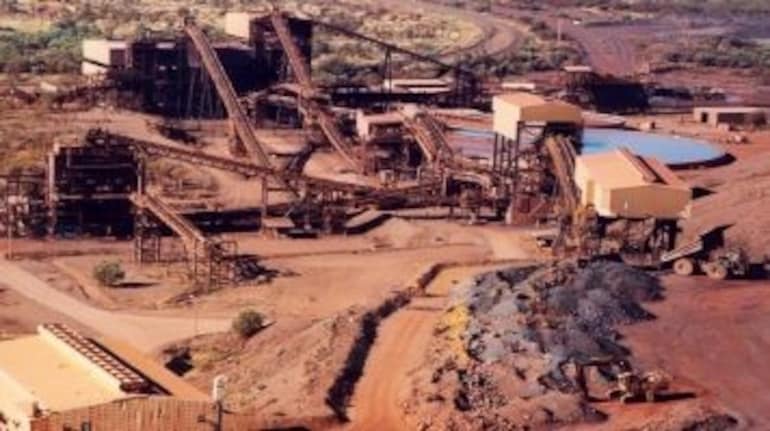

India's mining sector will experience solid growth, primarily boosted by the country's positive reforms and vast mineral reserves, BMI Research said in a statement.

Despite this, the sector will continue to face challenges due to the country's inadequate operating environment, mining royalties and low metals prices, which will prevent India from reaching its full growth potential, it added.

"We forecast India's iron ore output to grow from 159.9 MT in 2016 to 198.8 MT in 2020. This represents average annual growth of 5 percent during 2016-2020...," it said.

Global iron ore production will grow minimally from 3,036 MT in 2016 to 3,165 MT by 2020. This represents average annual growth of 0.3 percent during 2016-2020.

On the one hand, supply growth will be primarily driven by Australia and Brazil due to expanding output by major miners such as Rio Tinto, BHP Billiton, Vale and Fortescue Metals.

"On the other hand, miners in China, which operate at the higher end of the iron ore cost curve, will be forced to cut output due to continued iron ore price weakness," it said.

China's iron ore sector will become increasingly consolidated as low iron ore prices will price out high-cost domestic miners. As such, China will lose iron ore market share to both Australia and Brazil due to the sector's high production costs.

Quoting from Bloomberg Intelligence, BMI Research said that around 70 percent of Chinese iron ore output is uneconomical when prices fall below USD 96 a tonne.

In particular, miners operating in provinces including Hebei, Fujian, Guangdong and Xinjiang will take the strain of lower prices due to their sitting at the highest end of the iron ore cost curve, it added.

"We forecast the country's output to decline from 1,188 MT in 2016 to 1,095 MT by 2020. This would represent average annual contraction of 3.6 percent, while the country's share of global output will fall from 39.1 percent in 2016 to 34.6 percent by 2020," it added.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.