Inbound equity Foreign Direct Investments (FDI) grew by 40 percent to $ 51.4 billion in April-December 2020-21, official data showed on Thursday, which sets the stage for the current fiscal recording one of the biggest jumps in foreign equity inflow since the Narendra Modi government came to power.

FDI into India had grown 30 percent in 2015-16, but it has had a mixed record in recent years. It rose 12.6 percent in 2019-20 after contracting 1.1 percent in the previous fiscal.

The latest rise is mainly because US companies continued to channel funds into India. Policymakers attribute this to India's policy to aggressively seize global supply chains that sought to leave China in the wake of the coronavirus pandemic.

In the initial days of the pandemic, as Beijing’s faced outrage for failing to contain the virus, New Delhi stepped up efforts to encourage China-based manufacturers to shift to India and gain from lower labour cost and a slew of incentives from an investor-friendly government.

"Under the direction of the Prime Minister’s Office, the Commerce and Industry Ministry and facilitation agencies such as Invest India oversaw a massive exercise to reach out to China-based Western businesses. The Indian embassy in Beijing also held hundreds of investor calls and meetings where multiple state governments also pitched themselves," a senior official said.

The efforts may have worked as FDI from the US reached record figures. As a result, while the US was the fifth-largest source of FDI for India in terms of historical FDI (since 2000), it has now reached the third-spot, behind Mauritius and Singapore.

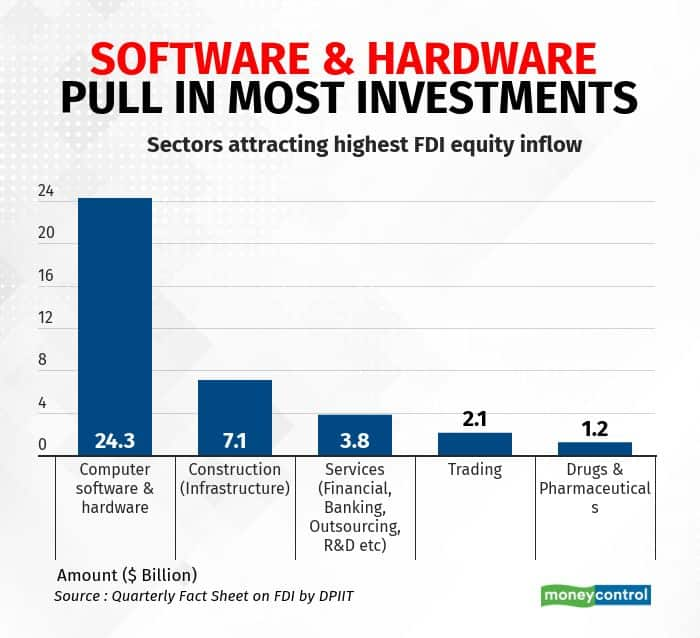

A deep dive into the data released by the Department for Promotion of Industry and Internal Trade (DPIIT) also reveals that inbound investments have remained highly uneven in terms of their sectoral distribution.

In the first 9 months of the financial year, there was a fourfold jump in investments in the computer software & hardware sectors despite the pandemic and the subsequent nationwide lockdown putting an almost two-month-long brake on manufacturing. FDI in the sectors jumped to $ 24.3 billion over the period from just $ 7.6 Bn in FY20.

The government's production-linked incentive scheme for mobile phones, components, IT hardware and electronics is the plausible reason for this. Case in point, the PLI scheme for mobile phones was announced in April 2020, with July 31, 2020, being the final date of application. Despite this being the height of the coronavirus pandemic, the government got submissions from all major global companies. "This has led to Rs 35,000 worth of goods being produced, 22,500 jobs being created and Rs 1300 crore worth of investments entering India," IT Minister Ravi Shankar Prasad said last month.

With an incentive structure of 4-6 percent of the incremental sales over 2019-20, companies such as Samsung announced they were shifting to India. Apple has been the latest to join the list, now targeting to manufacture iPhone-12 models from India. The construction and infrastructure sector also got attention from investors, with FDI already soaring to $ 7 billion from just $ 2 billion last year. The services sector was a distant third.

Continuing outreach by states also helped push up FDI. Industrially dominant states such as Gujarat, Maharashtra and Karnataka have continued to attract the most FDI. The government has continued to push states to seek more opportunities on their own, asking each to create and submit to the NITI Aayog, their policy on seeking FDI.

Continuing outreach by states also helped push up FDI. Industrially dominant states such as Gujarat, Maharashtra and Karnataka have continued to attract the most FDI. The government has continued to push states to seek more opportunities on their own, asking each to create and submit to the NITI Aayog, their policy on seeking FDI.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.