For the second time in three months, India's main two high-frequency macro indicators turned up better than expected, boosting hopes of a continued balance in growth and inflation.

Data released on December 12 showed that while headline retail inflation rose to a three-month high of 5.55 percent in November from 4.87 percent in the previous month, it was lower than economists' expectations of 5.8 percent.

Also Read: 'Best of both worlds' – economists give thumbs-up to CPI, IIP data

Industrial growth surged to a 16-month high of 11.7 percent, nearly double the September print of 6.2 percent.

But, muddying the waters for both sets of data is a low base.

For the Consumer Price Index (CPI), the low base – the overall price index fell 0.1 percent month-on-month in November 2022, the period based on which last month's inflation number was calculated – meant the impact on inflation was unfavourable and was partially responsible for the greater price rise.

For the Index of Industrial Production, the low base – thanks to Diwali falling in October in 2022 but in November this year – reflected favourably, adding as much as 3.6 percentage points to the headline IIP growth number for October, said Rahul Bajoria, managing director and head of EM Asia (ex-China) Economics at Barclays. Consequently, "caution should be employed while interpreting the higher-than-expected IIP expansion," said Aditi Nayar, chief economist at ICRA.

Festival season mismatchWhen it comes to the IIP data, the impact of the base effect – wherein the year-ago period, based on which the year-on-year change in production is calculated, helped in pushing up the latest month's growth figure – was rather pronounced thanks to the differences in the festival calendars of 2022 and 2023.

Also Read: Optimism among businesses, but India's consumption story has cracks

Take, for instance, the growth in capital, consumer durable, and consumer non-durable goods. In November, the output in these three segments jumped by 22.6 percent, 15.9 percent, and 8.6 percent, respectively.

In October 2022, their output contracted by 2.9 percent, 18.1 percent, and 13 percent, respectively, making it instructive to compare last month's output with that of October 2021.

In 2021, Diwali was on November 4, around the same time as this year.

The festival season is the time when households shop a lot more than they do at other times of the year and make big-ticket purchases.

When compared to October 2021, production of consumer durables and non-durables in October 2023 was 5 percent lower. As such, the strong base effect has "masked the weakness in the consumer goods segment", Rajani Sinha, chief economist at CareEdge, said.

This is not to say it’s all bad news. Production of capital goods, for example, is up 19 percent compared to October 2021, reflecting the government's focus on capital expenditure. But the future is not going to be as rosy. Economists see industrial growth dropping off sharply in November to low single digits – again, due to a base effect – as the fewer working days on account of festivals also took a toll on production efforts.

Inflation roller-coaster

If the low base was good for IIP, it was the opposite for inflation but not as bad as was thought, as the headline number came a quarter percentage point lower than expected. And it has to rise even further to 6.4 percent in December to meet the Reserve Bank of India's (RBI) forecast of 5.6 percent for the October-December period.

The problem, though, is that December's reading – to be released on January 12, weeks before Finance Minister Nirmala Sitharaman presents the interim budget for 2024-25 and the RBI's next interest rate decision on February 8 – is tracking along those lines.

"The December CPI inflation estimate is tracking at 6.2-6.4 percent as base effect turns adverse," said Gaura Sen Gupta, India economist at IDFC First Bank.

"High-frequency food prices in the first two weeks of December show that vegetable prices have moderated, reflecting improved supply dynamics. However, the moderation is much lesser than the usual winter season decline."

Just how adverse will the base effect be in December?

If one assumes the overall price momentum – month-on-month change in prices – is the same as it was in November and the general index of the CPI rises 0.5 percent sequentially, inflation could rise to 6.6 percent!

Source: QuantEco Research

Source: QuantEco ResearchHowever, this will hide what is happening below the covers.

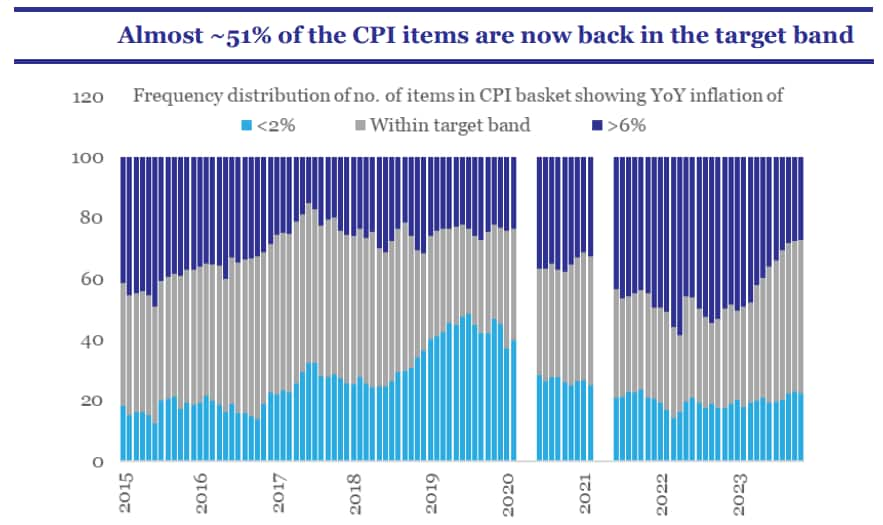

According to QuantEco Research's economists, the median inflation rate for the 299 items in the CPI basket was at a 32-month low of 4 percent in November. Further, 50.5 percent of these items had an inflation rate that stood within the RBI's 2-6 percent tolerance range – the highest such proportion in more than five years. Clearly, one must wait for the base-effect dirt to settle before drawing any conclusions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.