Q1 Results Highlights: Eternal shares rally 7% on positive management commentary; UltraTech Cement net profit jumps 49%

Q1 Results 2025: Several companies are releasing their results for the first quarter of the financial year 2026. Zomato-parent Eternal, UltraTech Cement, Havells, IDBI Bank, PNB Housing Finance, UCO Bank, Bansal Wire Industries, CRISIL, Dhanlaxmi Bank, Dodla Dairy, Globe Civil Projects and Oberoi Realty are among the notable names among the 46 firms announcing earnings today.

-330

July 21, 2025· 17:47 IST

Oberoi Realty Q1 Results LIVE: Net profit falls 28% to Rs 421 crore

- Net profit falls 28% to Rs 421 crore

- Revenue from operations falls 30% YoY to Rs 988 crore

- Net profit margin falls to 39%

- EPS reduces to Rs 11.59 per share

-330

July 21, 2025· 17:32 IST

Eternal Q1 Results LIVE: Do not see any innovation in food delivery; says Deepinder Goyal

Deepinder Goyal, group CEO of Eternal, the parent of food delivery company Zomato, said he does not see any innovation in the space which makes him believe that his company’s core business is under any obvious threat at the moment. (Read more)

-330

July 21, 2025· 17:30 IST

Eternal Q1 Results LIVE: Cash balance increases to Rs 18,857 crore in Q1FY26; nearly 3X of rival Swiggy

Zomato parent Eternal on July 21 said its cash balance increased marginally by Rs 33 crore from Rs 18,825 crore in Q4FY25 to Rs 18,857 crore in Q1FY26 even as it spent heavily on setting up dark stores for Blinkit (capex) and others during the period. (Read more)

-330

July 21, 2025· 17:03 IST

Q1 Results LIVE: Bansal Wire net profit rises 30% to Rs 39 crore

- Net profit rises 30% YoY to Rs 39 crore

- Revenue from operations rises 15% YoY to Rs 939 crore

- EPS rises to Rs 2.51 per share

-330

July 21, 2025· 16:28 IST

Eternal Q1 Results LIVE: Management highlights losses due to Bistro expansion

"The increase in quarterly losses is largely on account of investments in the 10—minute food

delivery service Bistro, where the kitchen infrastructure is owned and operated by Blinkit. We have 38 such kitchens live in Delhi-NCR and Bangalore currently. Early data is encouraging as the kitchens are generating incremental demand without cannibalizing the Zomato business. Through Bistro, we are tapping into two demand pockets so far unaddressed by Zomato - a) customers looking for high quality but low cost meals (think customers who buy from home chefs) and b) customers looking for snacky food in 10 mins. While customer side traction is pretty strong, we need to work and find answers to making money in this business. We will therefore continue to make calibrated investments towards building a scalable and

profitable business here, and will keep you posted when we have more to share.

In addition to Bistro, we also plan to invest in scaling up Nugget and our newest initiative Greening India. For now, we are budgeting INR 150 crore of loss funding across these three initiatives in FY26 which should reflect in the Others segment," said Deepinder Goyal.

-330

July 21, 2025· 16:18 IST

Q1 Results LIVE: Havells net profit falls 15% to Rs 348 crore

- Net profit falls 15% YoY to Rs 348 crore

- Revenue from operations falls 6% YoY to Rs 5,455 crore

- Expenses reduce to Rs 5,055 crore

-330

July 21, 2025· 15:54 IST

Eternal Q1 Results LIVE: 'Blinkit's margins to get better hereon'

"The long term profitability of the business is not a concern. Despite the investments in long term infrastructure and high competition, a large portion of our business is already profitable with some cities at 2.5%+ Adjusted EBITDA margin (as a % of NOV). Getting to these margins in some cities so early in this business, is a testament to the feasibility of our long term guidance of 5-6% margin. As far as near-term is concerned, it does feel like % margins have bottomed out and, if the competitive environment stays the same, we should see margins getting better from here as a large number of stores that we opened in the past 12 months will mature. In fact, even the absolute losses should come down from hereon," said Blinkit CEO Albinder Dhindsa.

"But the margin improvement journey may not be linear and there could be some bumps along the way if the competitive intensity goes-up again for whatever reason," he added.

-330

July 21, 2025· 15:52 IST

Eternal Q1 Results LIVE: Blinkit adds 243 new stores in Q1

"We added 243 net new stores this quarter, taking our store count to 1,544 stores by the end of the quarter. We are on track to get to 2,000 stores by Dec 2025. We also added 0.4 million sq ft of warehousing space and now operate over 5.6 million sq ft of warehousing space across the country

(including store area, we now manage ~10.4 million sq ft of area across our entire supply chain). NOV grew 127% YoY driven by a 123% YoY growth in average monthly transacting customers (MTC) from 7.6 million to 16.9 million over the past year. On the profitability front, the margins improved from -2.4% of NOV in Q4FY25 to -1.8% despite continued investments in new store roll-outs and seasonal factors," said Blinkit CEO Albinder Dhindsa.

-330

July 21, 2025· 15:42 IST

Eternal Q1 Results LIVE: 'District generating higher average revenue per order than Zomato, Blinkit,' says CFO

Zomato CFO Akshant Goyal said that the average revenue per order generated by its going out business (District) is more than Rs 160, which is meaningfully higher than our food delivery (Zomato) and quick commerce (Blinkit) businesses. "If we execute well, this business has the potential to scale to $3 billion in annual topline (NOV) with $150m of Adjusted EBITDA sometime over the next five years," he added.

Deepinder Goyal meanwhile said, "Going-out is now a INR 8,000 crore annualized NOV business (Q1FY26 NOV*4) which is about 20% of the size of our food delivery and quick commerce businesses. And, on a like for like basis, growing at 30%+ YoY. In Q1FY26, we had about 2 million average monthly transacting customers transacting ~2 times a month on an average with a net AOV (NAOV) of INR 1,700+."

-330

July 21, 2025· 15:38 IST

Eternal Q1 Results LIVE: 'Inevitable,' says Goyal about new rivals in food delivery space

"New ideas, new entrants and disruption are all inevitable. I think it also makes our business stronger as long as we are able to learn, adapt and out-innovate potential competition. At this point, we do not see any innovation in the space which makes us believe that this business is under any obvious threat," said Deepinder Goyal on any risk from new entrants in food delivery.

This comes amid buzz over Rapido's prospective entry into the food delivery segment.

-330

July 21, 2025· 15:36 IST

Eternal Q1 Results LIVE: Goyal on sequential margin decline in food delivery business

"Every year in Q1, margins get impacted (in both food delivery and quick commerce), because of lower availability of delivery partners due to festivals and adverse weather conditions (onset of summer and rains in different parts of the country). In the past, in the food delivery business, this pressure on margins in Q1s used to be offset by improvement in other areas; but now that margins have matured in this business, such fluctuations driven by seasonal factors are possible. Long term, we believe there is further scope of some margin expansion but the current focus is on ramping up investments to drive further growth in the business, while maintaining margins in the 5% (of NOV) ballpark," said Deepinder Goyal.

-330

July 21, 2025· 15:34 IST

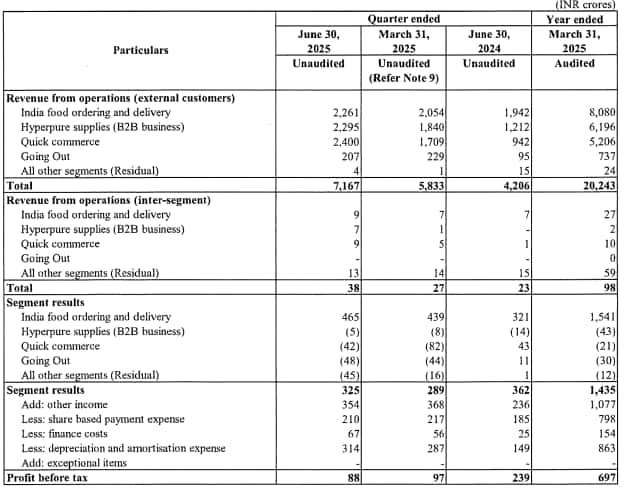

Eternal Q1 Results LIVE: Take a look at how the the company's different segments performed

-330

July 21, 2025· 15:31 IST

Eternal Q1 Results LIVE: Deepinder Goyal speaks about new Zomato CEO

"At Eternal, we operate with a model we call Rotational Leadership, where the CEO role of each business is time-bound, typically for a two-year term. This approach brings structural agility to leadership, ensuring that no role becomes static and that fresh energy enters the system at regular intervals...Within Eternal, different businesses fit into different moulds. Only Zomato is at a point where rotational leadership makes sense to us so far. Looking ahead, at Zomato, we are working on grooming product and technology-first operators to lead our businesses in the future. This is already in motion, not just at the top, but across levels. The result is a leadership pipeline that is wider, deeper, and built for the next few decades, not just the next quarter," said Deepinder Goyal.

"Aditya Mangla has been with us for over four years, is from a product/engineering background, and has held various roles at Zomato, including leading product, supply, and customer support/experience. This is the first time in the 17 year history of Zomato, that someone from product/engineering is leading the business (outside of me, of course). I am super excited to see how Aditya shapes the future of Zomato over the next two years, until it is time to hand over the baton to someone else," he added.

-330

July 21, 2025· 15:27 IST

Eternal Q1 Results LIVE: Shares rally 7% after June quarter earnings

The shares of Zomato-parent Eternal surged over 7 percent after the company announced its results for the first quarter of the financial year 2026. They were trading at around Rs 275 apiece.

-330

July 21, 2025· 15:26 IST

Eternal Q1 Results LIVE: Zomato announces incorporation of Blinkit Foods

Eternal's board has approved the incorporation of its wholly-owned subsidiary Blinkit Foods with a proposed share capital of Rs 10 lakh. "Blinkit Foods is proposed to be incorporated as a wholly owned subsidiary and would inter-alia engage in the business of providing food services (including innovation, preparation, sourcing, sale and delivery of food to customers)," the company said.

-330

July 21, 2025· 15:23 IST

Eternal Q1 Results LIVE: Quick commerce revenue surges 155% to Rs 2,400 crore

Eternal reported quick commerce revenue at Rs 2,400 crore for Q1 FY26, marking a surge of nearly 155% YoY from Rs 942 crore in Q1 FY25. Revenue generated from food delivery segment rose over 16% on-year to Rs 2,261 crore.

-330

July 21, 2025· 15:14 IST

Eternal Q1 Results LIVE: Zomato-parent’s net profit tumbles 90% to Rs 25 crore

- Net profit tumbles 90% YoY to Rs 25 crore

- Revenue rises 70% YoY to Rs 7,167 crore

- Expenses jump 77% YoY to Rs 7,433 crore

-330

July 21, 2025· 14:50 IST

Q1 Results LIVE: Wendt CEO Ninad Gadgil resigns

Along with the Q1 results, Wendt announced that its CEO and Executive Director Ninad Gadgil will be stepping down from his role, effectively from September 15, to pursue career prospects outside the company.

-330

July 21, 2025· 14:47 IST

Q1 Results LIVE: Wendt net profit drops 51% to Rs 4 crore

- Net profit falls 51% YoY to Rs 3.78 crore

- Revenue from operations rises 6% YoY to Rs 52.17 crore

- EPS drops to Rs 18.93 apiece

-330

July 21, 2025· 14:35 IST

IDBI Bank Q1 Results LIVE: Net profit rises 17% to Rs 2,007 crore

- Net profit rises 17% YoY to Rs 2,007 crore

- Net income rose 13% to Rs 8,458 crore

- Net interest income rises 17% to Rs 3,166 crore

- Net NPA margin reduces to 0.21%

-330

July 21, 2025· 14:11 IST

Q1 Results LIVE: Here's what UltraTech Cement says about its India Cements takeover

"India Cements, with a capacity of 14.45 mtpa, has become a subsidiary of UltraTech, effective 25th December, 2024. The Company has successfully turned around the performance of these assets. Comprehensive efforts on multiple fronts have enabled India Cements generate an EBIDTA of Rs. 92 crores, compared to loss of Rs. 9 crores last year. Through debottlenecking, an additional capacity of 0.3 mtpa has been released from the India Cements assets in the lucrative northern region. Furthermore, a capex plan is being made for investments over the next two years for improvement in all areas of operations to bring these assets at par with UltraTech standards," said UltraTech Cement in its press release.

-330

July 21, 2025· 14:03 IST

Q1 Results LIVE: Take a look at UltraTech Cement's Q1 numbers

-330

July 21, 2025· 14:01 IST

Q1 Results LIVE: UltraTech Cement EBITDA rises 44%

- EBITDA rises 44% YoY to Rs 4,591 crore

- Sales realisation improves 2.4% YoY to Rs 5,165 per mt

- Net sales rises 13% to Rs 21,040 crore

-330

July 21, 2025· 13:55 IST

Q1 Results LIVE: UltraTech Cement net profit jumps 49% to Rs 2,226 crore

- Net profit jumps 49% YoY to Rs 2,226 crore

- Revenue from operations rises 13% YoY to Rs 21,275 crore

- EPS rises to Rs 75.67 per share

-330

July 21, 2025· 13:28 IST

Q1 Results LIVE: Globe Civil Projects shares jump 2.5% ahead of June quarter earnings announcement

Globe Civil Projects shares jumped nearly 2.5 percent to trade at Rs 90 apiece. The company is set to announce its first results after market debut.

-330

July 21, 2025· 12:54 IST

Q1 Results LIVE: UCO Bank net profit rises 10% to Rs 607 crore

- Net profit rises 10% to Rs 607 crore

- NII rises 7% to Rs 2,403 crore

- Net NPA ratio reduces to 0.45%

-330

July 21, 2025· 12:21 IST

Q1 Results LIVE: Take a look at UltraTech Cement's June quarter earnings preview

-330

July 21, 2025· 12:07 IST

Q1 Results LIVE: UltraTech Cement's net profit likely to grow 14%

Net profit is likely to grow nearly 13.7 percent YoY to around Rs 2,463 crore. Consensus estimates peg EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortisation) margin at 20.6 percent, up from 16.8 percent in Q1FY25. Most analysts attribute the margin gains to softer input costs and better operational efficiency.

-330

July 21, 2025· 12:06 IST

Q1 Results LIVE: UltraTech Cement likely to see rise in revenue

Cement major UltraTech is likely to post a strong performance in Q1FY26, driven by volume growth, improved pricing, and easing costs, according to brokerages. According to a Moneycontrol poll of eight brokerages, UltraTech's consolidated revenue is estimated to rise 19 percent year-on-year (YoY) to Rs 21,868 crore in Q1FY26.

-330

July 21, 2025· 12:06 IST

Q1 Results LIVE: UltraTech Cement shares jump 1% ahead of June quarter earnings announcement

UltraTech Cement shares jumped nearly 1 percent to trade at Rs 12,619 apiece. The company is set to announce its results for the first quarter of the financial year 2026 today.

-330

July 21, 2025· 11:59 IST

Q1 Results LIVE: Eternal shares jump 3% ahead of June quarter earnings announcement

Zomato and Blinkit-parent Eternal's shares jumped 3 percent in the morning to trade at Rs 265 apiece. The company is set to announce its results for the first quarter of the financial year 2026 today.