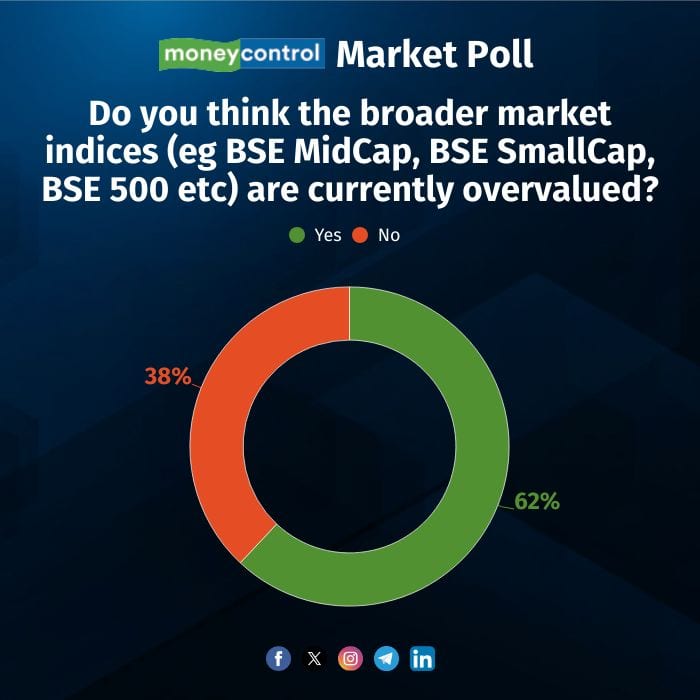

The recent, swift rebound in momentum may have taken the broader market indices into an overvalued zone, a Moneycontrol Market Poll comprising of 30 participants has revealed.

As many as 62 percent participants said they believe the broader indices - BSE Midcap, BSE Smallcap and BSE 500 - are currently looking overvalued. The Nifty Midcap 150, Nifty Smallcap, and Nifty 500 indices are on track to post gains for a fourth consecutive month.

In March, April, and May, the BSE Midcap index had risen by 7.8 percent, 4.8 percent, and 6.15 percent, respectively, and it is already up over 3 percent in June. The Nifty Smallcap index is higher by 9.5 percent, 2.2 percent, and 8.7 percent over the same period, with another 3 percent gain so far in June. Similarly, the Nifty 500 too is up more than 2 percent in June, after posting a rise of 7.3 percent in March, 3.2 percent in April, and 3.4 percent in May.

According to Prashanth Tapse of Mehta Equities, valuations in the broader market have significantly exceeded their longer term averages, and in some cases appear unsustainable, unless supported by strong and consistent earnings growth in coming quarters. Tapse attributed much of the ongoing rally to liquidity and sentiment, rather than underlying earnings growth. He has also cautioned that potential risks, including tariff concerns linked to US President Trump, geopolitical tensions, and uncertain US Federal Reserve policy could trigger a correction, but it may be healthy. Such a correction, or an earnings catch-up, would be necessary to justify current valuations in the short term.

Currently, the one-year forward price-to-earnings (P/E) ratio for the Nifty Midcap stands at 28.7x compared to its 10-year average of 28.12x. The Nifty Smallcap trades at 25.03x, exceeding its long-term average of 21.45x, while the BSE 500 is valued at 22.44x versus its decade-long average of 21.47x.

Sunny Agrawal, Head of Fundamental Research at SBI Securities said, “We expect many mid and small-sized businesses to deliver robust earnings growth over the next two years and they are likely to command relatively premium valuations. Going forward, the street is likely to focus on sectors/companies where there is strong growth momentum despite the ongoing global uncertainties.”

Meanwhile, in the fourth quarter of FY25, Nifty 500 companies reported solid results, with aggregate sales rising 6 percent year-on-year to Rs 36,400 crore, EBITDA up 11 percent to Rs 7,500 crore, and net profit increasing 9 percent to Rs 4,300 crore.

This performance has come at a time of geopolitical headwinds, soft consumption trends, and a high base from the previous year. Key sector contributors included metals, which grew 47 percent year-on-year, public sector banks with a 13 percent gain, healthcare up 46 percent, and telecom, which turned profitable. However, automobiles, oil & gas, and private banks saw declines of 22 percent, 4 percent, and 3 percent, respectively.

Earnings for the Nifty Midcap 150 and Nifty Smallcap 250 rose 29 percent and 8 percent year-on-year in the fourth quarter of FY25, while their full-year profit after tax increased 22 percent and 7 percent, respectively.

Independent market analyst Ajay Bagga said India’s overall market valuation, especially in the mid and smallcap segments, is a concern. Many fund managers had projected 2025 to be a year favouring largecap stocks with broader indices projected to underperform due to stretched valuations.

Without a significant earnings pickup, these elevated valuations may constrain returns, as further P/E expansion appears unlikely. Nonetheless, retail investor flows remain strong in both mid and smallcap segments, fuelling sharp recoveries in previously beaten-down stocks, Bagga added.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.