The HDFC Bank stock's prolonged underperformance may soon end as its weightage in the benchmark MSCI index is set to rise following the drop in FII ownership. This could attract inflows of $3-5 billion from passively managed funds that are benchmarked to the MSCI index.

Also, the higher weightage means many foreign funds tracking the MSCI index will not need to trim their overweight positions in the stock in the aftermath of the merger with HDFC.

HDFC Bank's shareholding data for the quarter ended June 2024 shows that foreign ownership has slipped to 54.83 percent, making it eligible for a weight increase in the August 2024 MSCI rebalancing. That is because there is now a 25 percent headroom for new foreign funds wanting to buy the stock. This means HDFC Bank's weightage will be based on its full free float market capitalisation, as opposed to half the free float market capitalisation that was used to calculate the weightage till now.

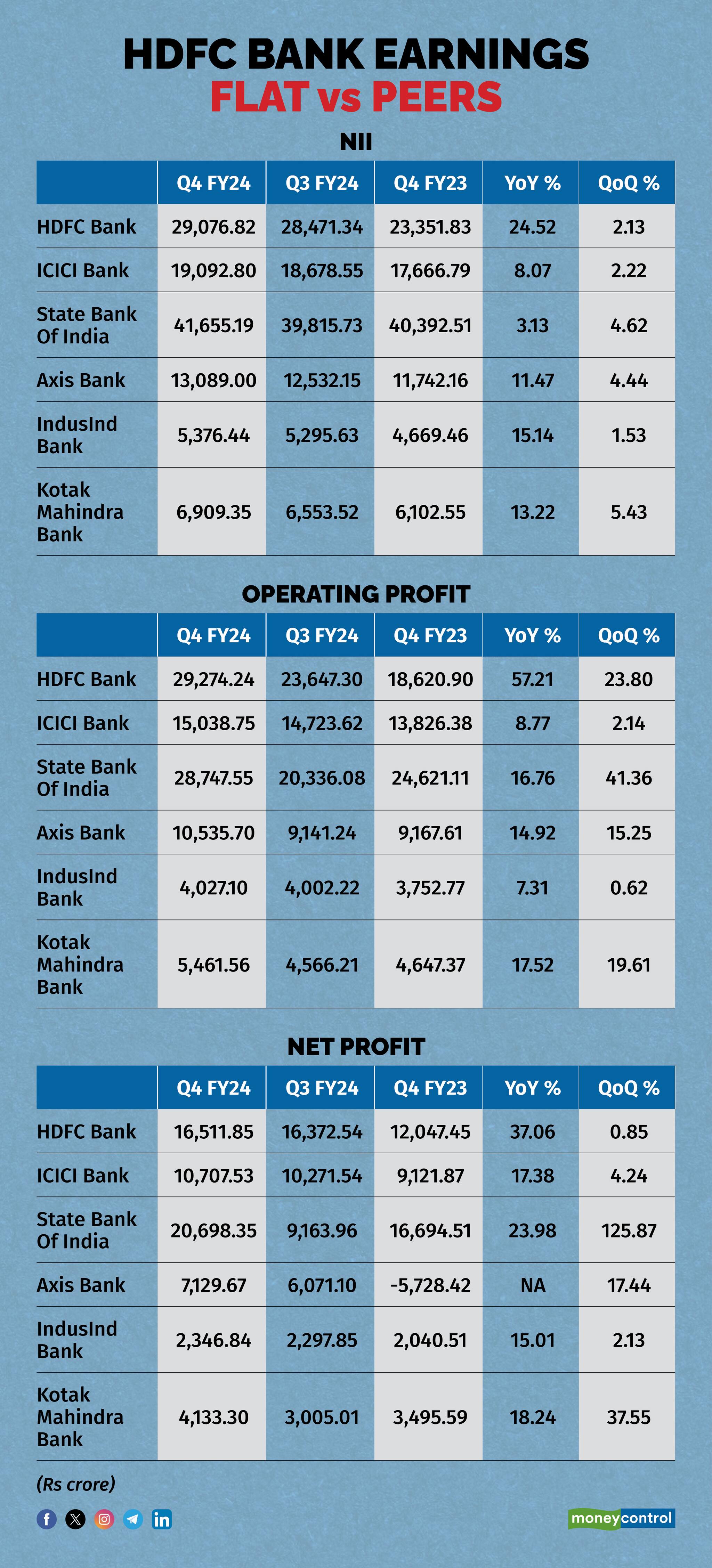

Here is HDFC Bank's earnings performance compared to its peers in the March 2024 quarter:

HDFC Bank's EPS remained nearly flat in FY24, a first in its history of over 20 percent annual growth, thanks to the merger. Excluding Q4FY24 one-offs, profit growth would have been stable.

As banks compete for deposits, no entity has shown better growth in low-cost current and savings accounts (CASA) in FY24. HDFC Bank saw its CASA ratio drop from 44.4 percent in FY23 to 38.2 percent in FY24 due to the merger. Similarly, Axis Bank's CASA ratio fell from 47 percent to 43 percent, and ICICI Bank's from 44.4 percent to 38.2 percent. Total deposits of the lender stood at Rs 23.79 lakh crore during the quarter while total advances of the bank stood at Rs 25.07 lakh crore.

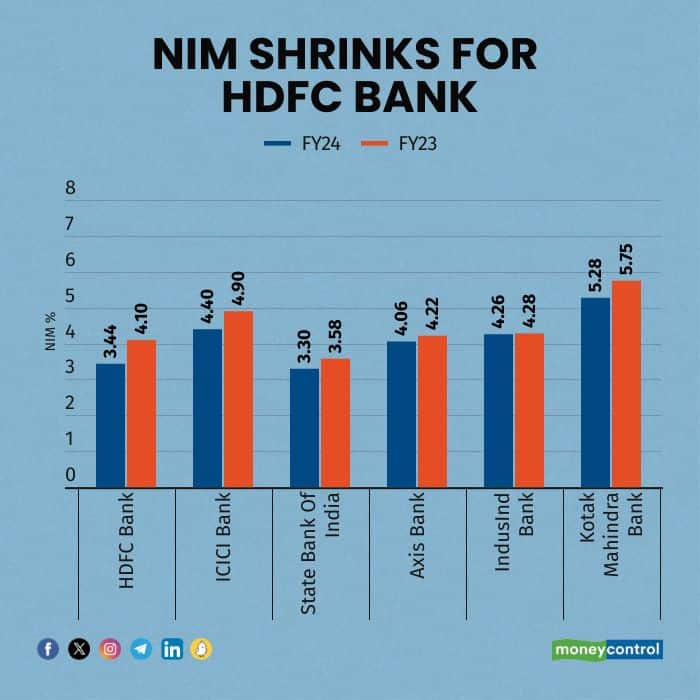

As a result, the net interest margin (NIM)—the difference between what a bank earns on loans and what it spends on liabilities like deposits—has shrunk for most banks. For HDFC Bank, it has dropped from 4.1 percent in FY23 to 3.44 percent in FY24, much lower compared to peers. During this period, SBI’s NIM dipped from 3.58 percent to 3.3 percent , and ICICI Bank’s from 4.9 percent to 4.4 percent.

HDFC Bank's gross non-performing assets (GNPA) remained flat compared to a year ago, and provisions saw a significant increase compared to its peers. The CD ratio improved thanks to strong deposit growth and slower loan growth. Despite stable margins and asset quality, the bank created Rs 10,900 crore in floating provisions, prioritizing balance sheet strength over profit. This prudent approach, contrary to market expectations, explains the bank's 1.8x FY26 core book valuation despite post-merger earnings decline, which may continue next fiscal, analysts said.

In FY24, HDFC Bank's return on earnings stood at 17.2 percent, lower than that of ICICI Bank, SBI, and Axis Bank. Additionally, its price-to-book ratio remained lower compared to ICICI Bank, Axis Bank, and Kotak Mahindra Bank.

In 2024, HDFC Bank underperformed its peers, gaining only 4 percent compared to ICICI Bank's 21 percent, Axis Bank's 15 percent, and State Bank of India's 29 percent. Similarly, in 2023, it also underperformed, achieving only a 4 percent gain.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.