August 09, 2022 / 17:10 IST

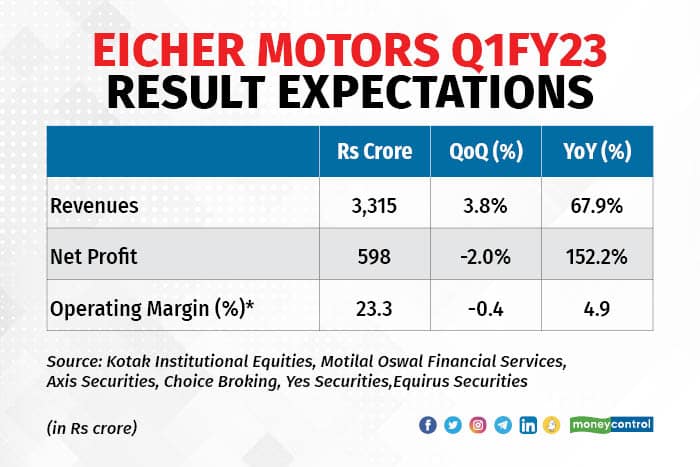

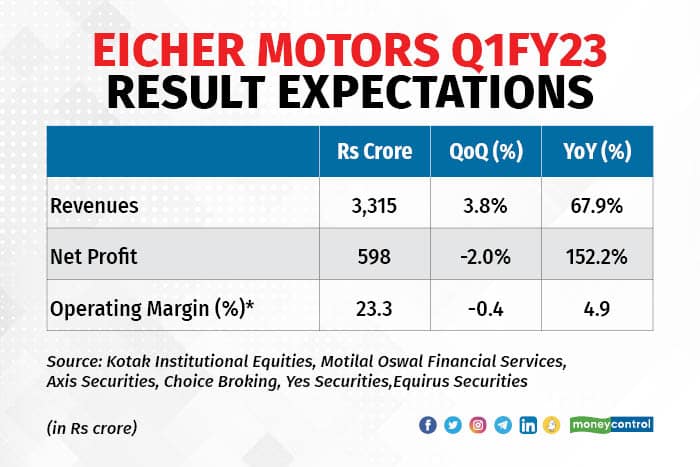

Eicher Motors Ltd on August 10, is likely to report a strong year-on-year improvement in its performance with its consolidated profit after tax (PAT) likely to increase by 152 percent. Compared to the previous quarter, the growth in PAT is forecasted at about 9 percent.

Consolidated revenue for the quarter is expected to jump 68 percent over the corresponding period last year. On a sequential basis, revenue is likely to post a mid-single digit rise.The maker of the iconic Royal Enfield motorcycle, Eicher Motors is expected to report a consolidated PAT of Rs 598 crore on consolidated revenue of Rs 3,315 crore for the quarter, according to an average of estimates of six brokerages polled by Moneycontrol.

Story continues below Advertisement

Disclaimer: The views and investment tips of investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!