Defence major Bharat Electronics Ltd (BEL) is expected to announced its Q1FY26 earnings on July 28.

According to a Moneycontrol poll of six brokerages, revenue is expected to increase 10 percent year on year (YoY) to Rs 4,244 crore but may see a 53 percent sequential fall.

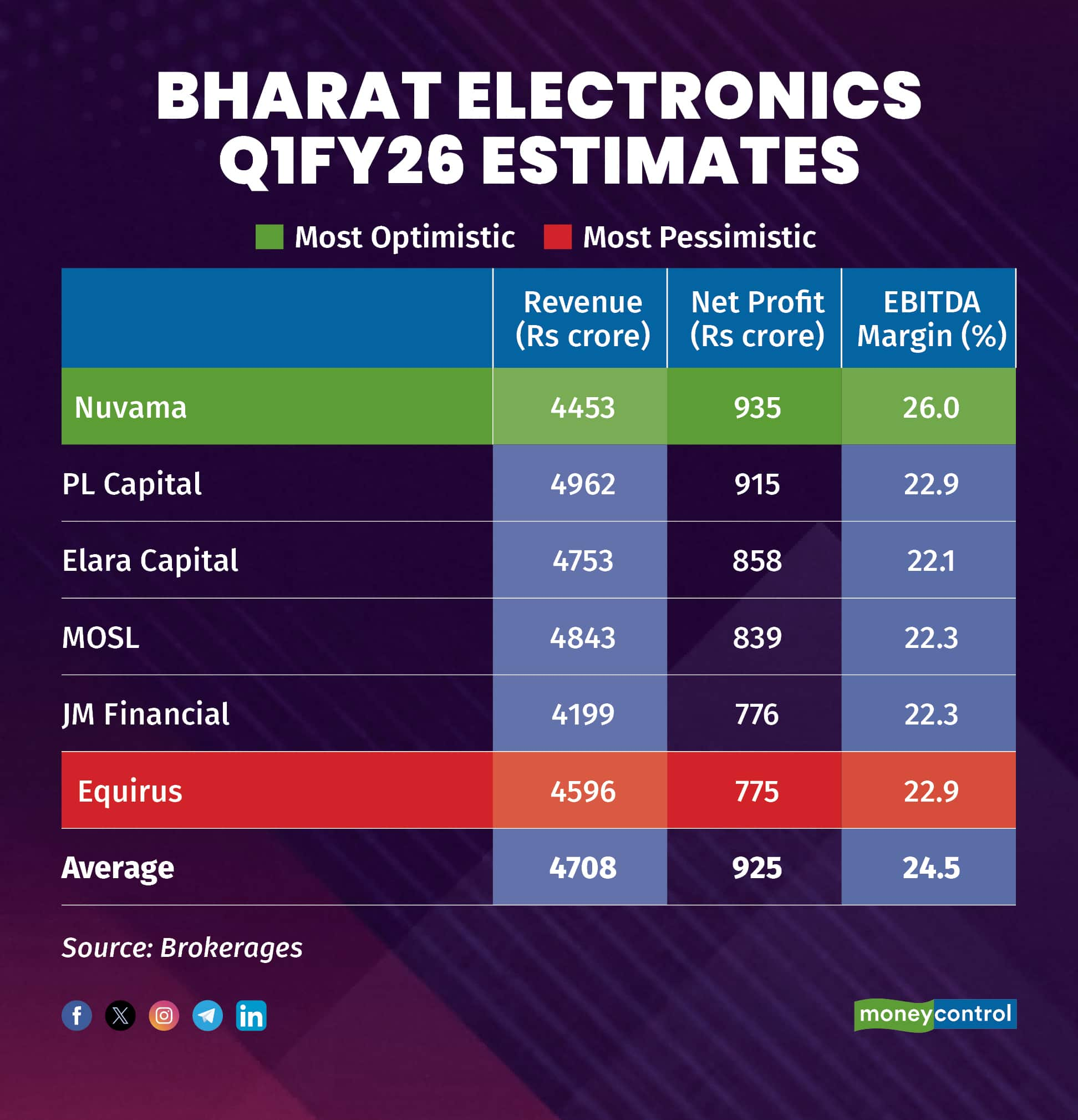

Nuvama Securities, Equirus Securities, HDFC Securities, PL Capital, Motilal Oswal and JP Morgan were the six brokerages.

While these brokerages fear a major decline in numbers sequentially, they see net profit growing 15 percent year on year (YoY) to Rs 925 crore, on the back of a growing order book, the Centre's indigenisation push and growth in non-defence segments.

Earnings before interest, taxes, depreciation and amortization (EBITDA) margin for the quarter is expected to increase to 24.5 percent from 22.3 percent in the corresponding quarter of the previous fiscal.

The most optimistic is Nuvama. It expects net profit to grow 20 percent to Rs 935 crore from Rs 776 crore in the previous fiscal, but down nearly 50 percent from the previous quarter. The most pessimistic is Equirus Securities, which fears a fall in net profit by two percent YoY and around 64 percent quarter on quarter (QoQ).

Most brokerages note that despite a weaker quarter due to lower execution, BEL continues to have a strong order inflow momentum. HDFC Securities points to an opening order book of Rs 71,600 crore, which is expected to drive revenue traction.

Year-to-date (YTD) order inflow has reached Rs 730 crore. PL Capital also notes that BEL announced fresh orders worth Rs 7,350 crore during the quarter, with the management commentary on the pipeline and the potential award of the QRSAM (Quick Reaction Surface-to-Air Missile) order being closely watched. Equirus Securities adds that BEL is well on track to achieve its FY26 order inflow guidance of Rs 27,000 crore.

Healthy revenue growthWhile revenue is expected to fall sequentially in Q1FY26, brokerages estimate that YoY revenue growth is expected to remain robust across the board, led by the sizeable order book. PL Capital estimates approximately 18 percent YoY growth, citing strong delivery momentum. Motilal Oswal also expects a 15 percent revenue increase, largely driven by the execution of the Rs 71,700 crore backlog.

Margins to remain resilientMargins are expected to remain stable or improve slightly, with most brokerages seeing no major downside risks. HDFC Securities expects margins to stay flat on a YoY basis, even as revenue scales up.

Motilal Oswal anticipates margins at 22.3 percent, similar to the previous fiscal. PL Capital is slightly more optimistic, projecting an expansion of around 70 basis points in EBITDA margin, driven by leverage on employee costs, despite modest pressure on gross margins.

BEL reported an operating margin of 28.6 percent in FY2025, compared to its guided range of 23–25 percent, and the management now expects margins of 27 percent in FY2026. JP Morgan attributes this margin resilience to BEL’s strategic focus on indigenisation, in-house R&D, and cost efficiency, all of which support a strong operating performance trajectory.

Diversification and export momentumWhile the Union government's Make-in-India initiative continues to be a key driver for BEL, brokerages also suggest that the company's diversification beyond core defence also has a role to play. Both JP Morgan and Equirus note that the growing contribution from the non-defence and export segments would help smooth out volatility in the defence order cycle.

Civilian revenues now contribute around 13–15 percent to total sales, with BEL participating in sectors like metro rail and airport infrastructure. Export potential is also increasing, supported by proven capabilities in integrated command systems, radars, and electronic warfare platforms. Emergency procurement discussions currently underway could further supplement BEL’s near-term order book, enhancing revenue visibility, believe brokerages.

Analysts will keep a watch on orderbook estimates and execution plans for FY2026 and FY2027, updates on emergency procurement order announcement and working capital.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.