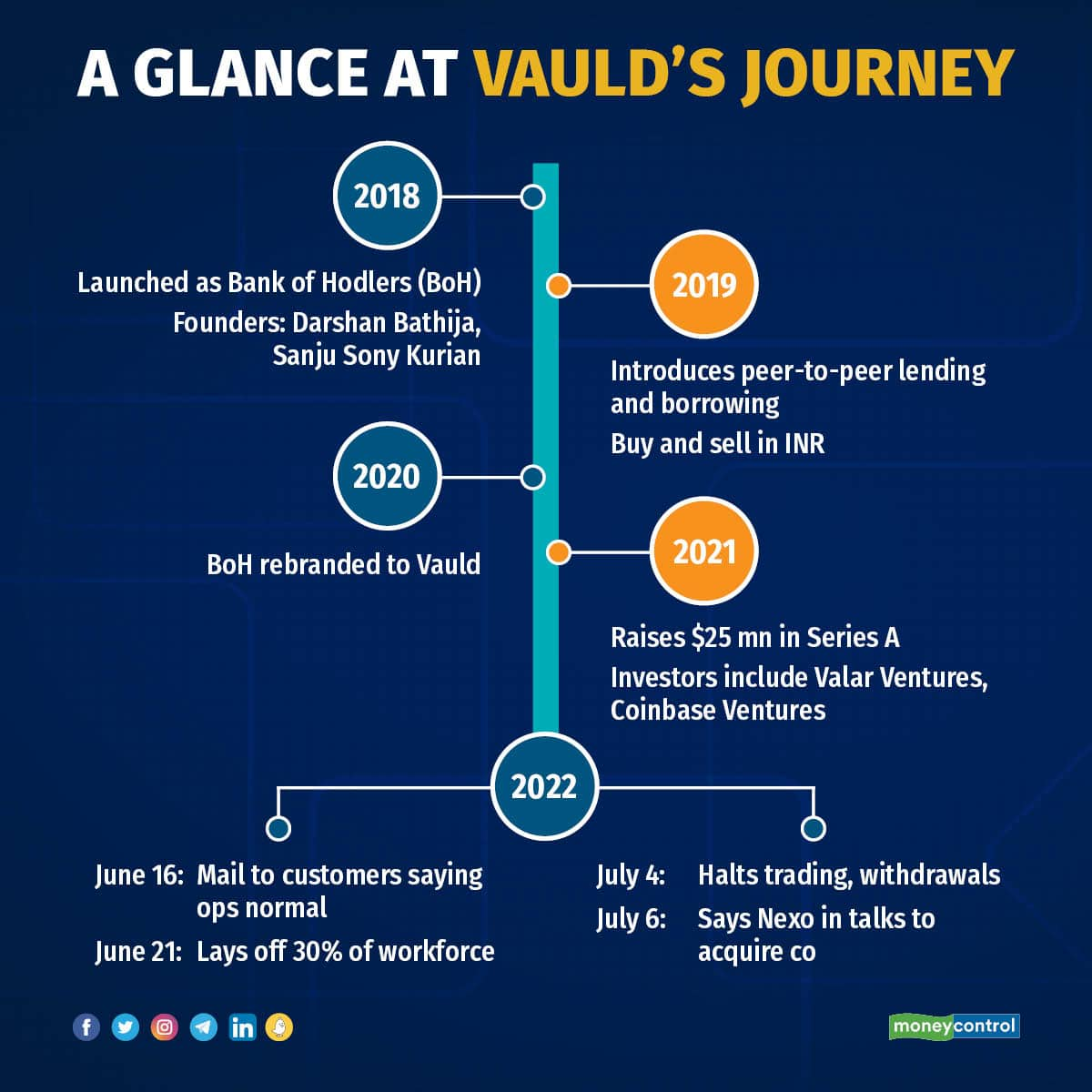

On June 16, crypto firm Vauld (formerly Bank of Hodlers) emailed its investors, saying it continues to operate as usual despite the crypto market crash.

Less than three weeks later, on July 4, the Singapore-based platform sent shock waves among investors with an announcement that it was suspending trading and withdrawals with immediate effect, citing financial difficulties.The announcement triggered panic across the crypto community, which flooded social media and messaging apps with questions.

Vauld said it was looking for new investors and that the move had been triggered by a combination of circumstances such as volatile market conditions and financial difficulties of key business partners that inevitably affected the platform.

“I have my crypto deposits with Vauld, now you have emailed and stopped all withdrawals. All my hard- earned money with Vauld and I lost everything now. I have so many loans on my head, I want my crypto back I will suicide and Vauld and your team will be responsible for my life,” wrote an investor on Vauld's Telegram group.

This was one among the hundreds of such messages being shared in these groups. For many, investing in a single Bitcoin on Vauld during the good times would have meant an investment upwards of Rs 40 lakh.It wasn’t of course the first time it happened. Last month, cryptocurrency lending platform Celsius stopped withdrawals, citing "extreme market conditions." Cryptocurrency broker Voyager Digital suspended all trading, deposits withdrawals and loyalty rewards.

Within a day of announcing the freeze on trading and withdrawals, Vauld said that it had signed an indicative agreement to be acquired by London-based crypto lender Nexo, bringing some relief to its investors.

"They said on June 16 that we are doing fine. On July 4 they changed the narrative and said that they are forced to look for investors and restructure. Why did they change their official stance in a span of 14 days? Did they need that time to get a buyer? That is the question that founders need to answer as it was misleading for customers," said one observer who tracks the crypto space closely. The person requested anonymity.

"Through this transaction, Nexo will get an entry into India and have a base here. The acquisition is positive for customers because the chances of them recovering their investments is higher now," he added.

But the episode has raised a lot of questions covering areas ranging from consumer protection to influencers plugging crypto platforms.

Moneycontrol reached out to Vauld with detailed queries on the recent developments, but the company is yet to respond.

Vauld’s model

Vauld was founded in 2018 by Darshan Bhatija and to date, the firm has raised $27.5 million from marquee investors like Coinbase Ventures, PayPal co-founder, and billionaire investor Peter Thiel's Valar Ventures, CMT Digital, Gumi Cryptos, Robert Leshner and Cadenza Capital.

The firm is registered in Singapore with its primary markets being India and South East Asia.

Through Vauld's platform, one could earn interest through SIPs or borrow money based on their crypto assets without having to liquidate them. On the website, Vauld says it offers a whopping 12.68 percent in annual yields on staking several stablecoins like USDC and BUSD and 6.7 percent on Bitcoin and Ethereum tokens. Vauld earned money by lending these crypto assets to other projects similar to how banks provide money to borrowers.Staking refers to earning gains from digital assets without having to sell them, similar to how one earns interest on savings parked in deposits.

Additionally, through its exchange it also allowed users to make transactions in cryptocurrencies or sell for Fiat currencies, government-issued money that is not backed by any commodity like gold or silver. The exchange had over 250 coins listed on the platform.

What went wrong?

“Their primary revenue model was based on lending the crypto assets to other projects where they would earn higher interest. The exchange did not have a lot of volume,” said Aditya Singh, co-founder of Crypto India, a Youtube channel with over 2,77,000 subscribers.But over the last few months, amid the bearish crypto market, a number of tokens and projects have taken a hit including the bigger ones like Celsius, Terra Luna and Three Arrows Capital. Despite these events, in the email cited above, Bhatija assured investors, saying: “We do not have any exposure to Celsius or Three Arrows Capital, and we remain liquid despite market conditions.”

His statement led to a loss of trust among the investors, says Singh.

Vauld on July 4 said customers had withdrawn $197.7 million since June 12.

“This was a cascading effect. There are many speculations right now but there is no hard proof yet as to where they invested,” added Singh.

For the unversed, crypto firms do not disclose as to which protocols or projects they are investing in as such information is considered a trade secret. In the present circumstances, this has drawn a lot of flak.

The firm reportedly had hundreds of thousands of users with over 20% of them being Indians.

"Vauld wooed Indian investors although it is registered in Singapore. But in India their model was a violation of the laws as entities not registered with the RBI (Reserve Bank of India) are not allowed to lend. Exchanges are in a grey area too, but lending is a complete no as rules around that already exist," said the person cited above.

Consumer protection

Experts tracking the crypto space say Vauld’s marquee investors lent the company a significant reputation.

“It gives the user a lot of validation about a company,” says Singh.

But, given a situation like this, it leaves no option for the investors except to wait and watch. For instance, in Vauld’s case, it has applied to the Singapore courts for a moratorium that will prevent any legal proceedings against the company and its associates.

Namita Viswanath, a partner at IndusLaw, said: “Most of these exchanges enter into some sort of a custodian arrangement with a third party to secure the digital assets or tokens of the customers and also have some kind of wallet mechanism which is linked to an escrow account to safeguard the savings. Global exchanges typically follow this so Indian exchanges have also followed it.”

“But because the entire sector is today unregulated, all of these protections are coming contractually. So there is no regulatory protection for the customer,” she added.

On the moratorium sought by Vauld, Vishwanath said that in case the firm fails to refund payments, it will depend on how its application pans out under Singapore law.

“So far as investors are concerned, they will have to at this point, rely primarily on what sort of obligations are on Vauld and what protection they have in their contracts. And depending on the moratorium process, it will decide whether and how much they can actually recover from this but it's not a statutorily protected right at this point.”

Did influencers mislead investors?

After Vauld suspended withdrawals, social media influencers came under scrutiny. Influencers like Ankur Warikoo and Akshat Shrivastava had promoted crypto investments. Young investors rely mainly on the Internet to consume content on cryptos.Shrivastava apologised in a LinkedIn post for promoting Vauld and clarified that he has his own investments on the platform. Moneycontrol also reached out to him with queries, but no response was received at the time of publishing.

"Some of these influencers actually criticised fixed deposits and asked users to use Vauld to accrue better interest rates. Vauld was spending a lot on hiring; not sure how much they were paying for such influencer partnerships," said a person tracking the space.

Singh said that a lot of YouTube influencers who do not have an in-depth understanding of cryptos often mislead their followers, who start trading on their advice.

In an e-mail response to Moneycontrol, Warikoo clarified, "I have always maintained that one’s investment in crypto should never be more than 5-10 percent of their total investment. Within crypto, I have only stuck to 3 tokens - Bitcoin, Ethereum and Solana."

Warikoo had also said in a YouTube post to his followers on July 4 clarifying that he too had invested Rs 30 lakh on Vauld and that the value of that has reduced to Rs 10 lakh.

"I never withdrew any of my deposits from Vauld - continuing to believe in the product, its investors and its liquidity...I am really truly sorry that it has come to this. Such circumstances have real consequences for all of us," the post read.

Experts said that while the Advertising Standards Council of India (ASCI) has put in place some guidelines for influencers, it is still a nascent market in India and similar content is also being produced on other subjects like stocks and so on. The market can only be disciplined when it matures, they said.

Kashif Raza, the co-founder of crypto education startup Bitinning, said: “Investors should keep in mind not to put all their eggs in one basket. They should diversify investments across asset classes. Crypto is a new and evolving field -- all parts are connected and there will always be domino effects. Investors should not have more than 5-10 percent exposure to crypto lending, DeFi etc.” DeFi is short for decentralized finance.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.