The peak in gold prices at $2,067 coincided with the weakness in the dollar against the currency majors but there has been some revival, though not significant, in the exchange rates, in the last one month. The correction in the gold prices to $1,850 an ounce, too, was in alignment with the currency strength. It seems gold has taken support at the $1,850/1,860 levels after its downward movement.

Interest rates have been low and may continue to be so for some more time due to the slow economic growth and recovery due to the pandemic. Lower interest rates reduce the opportunity cost substantially and help gold prices to stay up. The inference that can be drawn from the Federal Reserve notes, as also those of other central banks, is that of a prolonged period of lower rates.

Apart from this, inflation, too, is showing a tendency to edge higher. The Fed is, in fact, targeting an average inflation of 2 percent, which effectively means higher inflation. Inflationary conditions or expectations also support higher gold prices.

If we look at the returns that can be expected from alternative investment avenues, whether debt or equity, there have been some doubts about their sustainability. A number of bond markets have moved into negative yield. Equities have rallied and have been sprinting ahead of the economy. Many have questioned whether the rally can be sustained.

There has been no tangible outcome of vaccine trials and the availability of the same for public use is most likely to be in mid-2021. The biggest problem—the lack of growth and the not so encouraging expectations at a global level—is a major obstruction to be overcome through appropriate policies.

All these factors are of immediate relevance to gold. Gold thrives on these factors. The moment some of these factors turn in a different direction, gold prices may moderate.

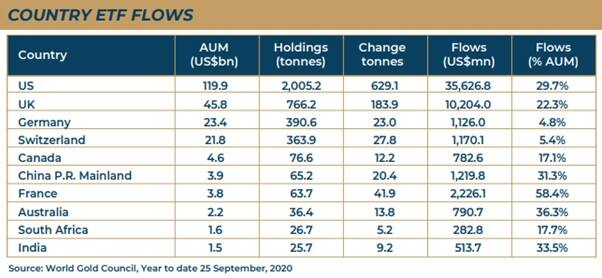

Gold ETFs have registered continuous growth in AUM since the beginning of the year. Gold ETFs added 39 tonnes in August, $2.20 billion in equivalent dollars. The inflows YTD has been 938 tonnes, equivalent to $51.30 billion.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.