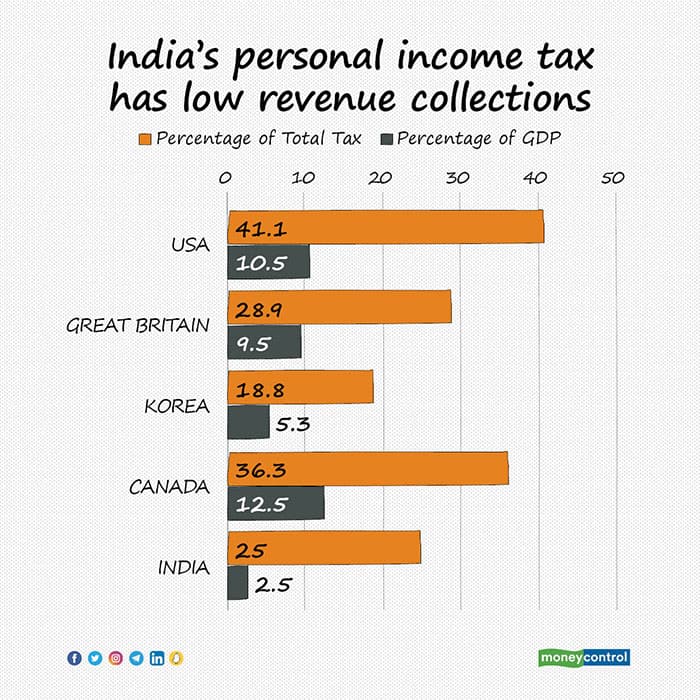

Taxes, taxes, taxes. It’s all everyone can talk about before the Budget. There’s always an expectation of taxes going down. But, India is already fighting multiple battles on this front–from low number of tax payers to low tax compliance–which keeps India’s tax-to-GDP ratio lower than its peers.

India’s tax-to-GDP is at 12%, compared to 25% of the UK and roughly about 20% of China.

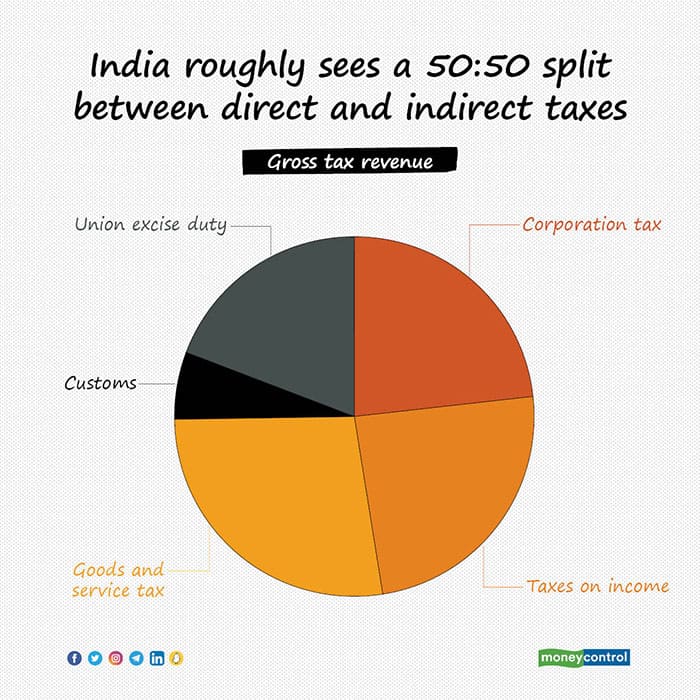

The central government’s gross tax revenue comes from two sources. First is direct taxes, which are collected from institutions/persons, and which include corporate tax (taxes on income of corporations) and income tax (taxes on income other than that of corporations such as personal income tax). Second is indirect tax, which is imposed on transactions, such as Goods and Services Tax, Excise Duties and Customs.

India’s ‘taxing’ problem

The bigger question in India has always been about tax compliance.

To understand this, we need to crunch some numbers. Here goes.

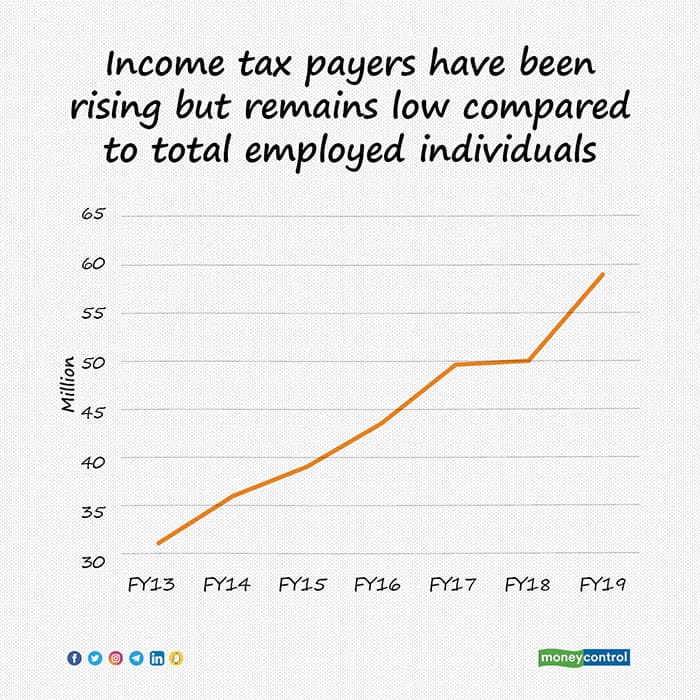

As per the CMIE survey, there are 408 million employed individuals in India as of FY20, of which 153 million are employed in agriculture, income from which is not taxed in the country. This leaves us with 255 million employed in occupations outside of agriculture.

Now, how many ITRs do you think are filed in India? 255 million, you’d think. But, no. It’s less than a fourth of that–in FY19, total ITRs stood at 58 million. Essentially, only 22% of those employed outside agriculture are registered for income tax.

What’s more? Approximately 10 million of these 58 million ITRs are by those who earn below 2.5 lakhs per annum and therefore have zero tax liability! This leaves us with 48 million paying approximately Rs 5 trillion in income tax.

As per the government statements, only 15 million people contribute significantly to the taxes. Also, only about 500,000 individuals filed for the much-talked-about long-term capital gains taxes.

Salaried class cuts a big cheque

Here’s a surprise or a shock, depending on how you earn your income.

Which income do you think contributes the most to tax collections?

Let’s take FY19 figures. That year, Rs 51 trillion of income was taxed in India. In this taxable income, Rs 20 trillion or a good 40% was salary! The remaining 60% of taxable personal income comprised smaller percentages of earnings from business, property, capital gains and so on.

Even in the 58 million returns that are filed, 55 million are from individuals. That is, other income-earning taxable entities such as Hindu Undivided Families (HUFs), firms, companies, association of persons and so on are a small part of the whole story.

So, the salaried individual has been the biggest contributor to income-tax collections.

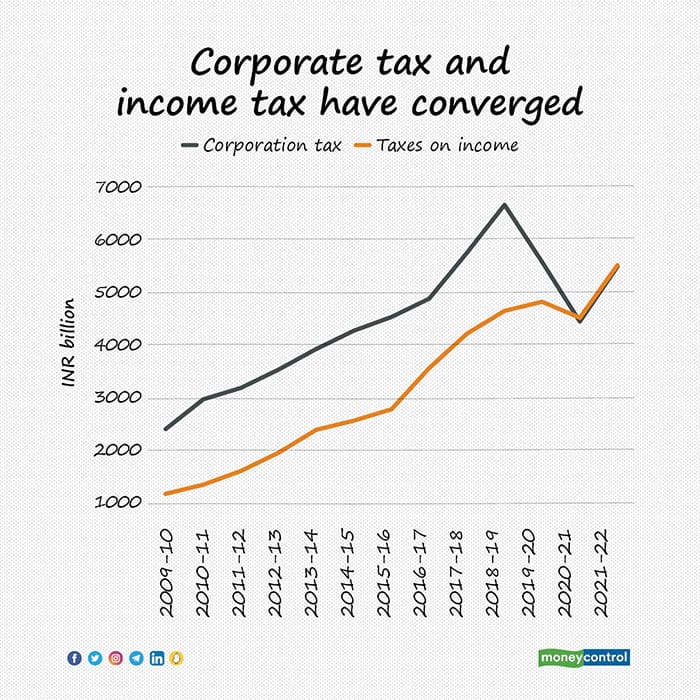

What about the other component of direct taxes–the corporate taxes?

In September 2019, the government slashed the corporate-tax rate. This led to a reduction in collections–in FY19, corporate-tax collections stood at Rs 6.6 trillion, but it fell in FY20 to Rs 5.5 trillion. Covid-19 shrank the numbers further, as the pandemic ate into corporate profitability and reduced the tax liability. In FY22, corporate tax collections were budgeted at Rs 5.4 trillion–roughly the same as income taxes!

Usually, a cut in corporate taxes boosts corporate profits and, in the long term, tax collections bounce back to normalcy. However, India’s corporate-tax-rate cut was followed by the pandemic and an absolute slump in economic activity.

Perhaps things will start looking up soon. Given that corporate profits are set to revive, buoyancy in corporate tax revenues is a fair expectation. NIFTY EPS (a fair proxy for corporate profitability) has consensus expectation of 810 for FY23, which is 19% above FY22 level.

Direct tax serves many purposes, apart from the obvious one–of raising money for the exchequer. One, it helps in fine tuning income and social inequality. Two, taxes help calibrate inflation by affecting available disposable income and hence consumption.

Has GST helped?

Indirect taxes are levied at a uniform rate, irrespective of who is earning what. For example, the tax a billionaire pays for a packet of biscuit and the tax her chauffeur pays for the same packet is the same.

In 2017, India rolled out a new tax regime for indirect taxation–the Goods and Services Tax (GST). GST replaced a host of indirect taxes imposed by central and state governments. The underlying theme ‘One Country One Tax’, or to bring all the Indian indirect taxes under one umbrella.

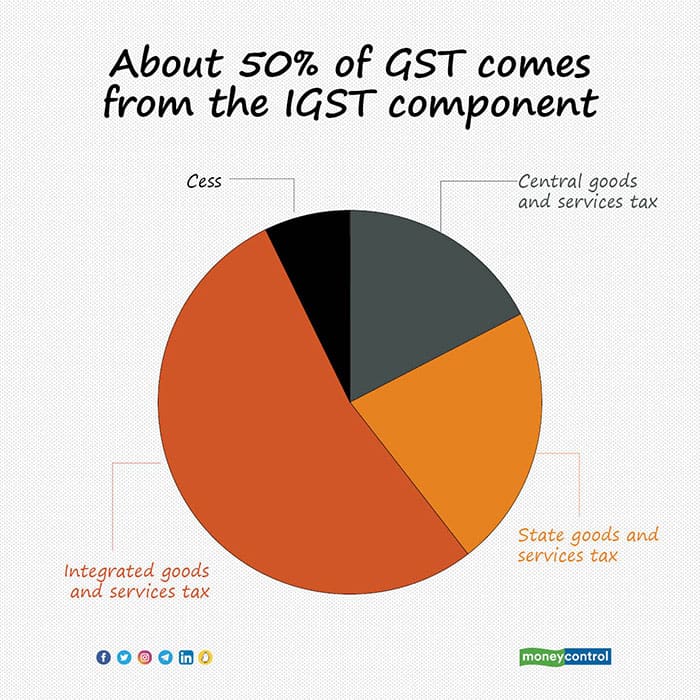

Under this tax regime, the total GST collections are divided between states and centre and it is fair to assume it is roughly a 50:50 split. Therefore, of the Rs 1 trillion-plus monthly collection that we hear about in the news every so often, half is reflected in the centre’s P/L. Centre’s budgeted receipts from GST for FY22 stands at Rs 6.3 trillion.

When transactions (or a sale) happens within a state, the GST collected is split between the state and centre as we discussed above. But what when the transaction is between states, that is a product made in one state is sold in another?

Then the Integrated Goods and Services Tax or IGST is charged, under the GST regime. It is also charged for imports and exports. Under IGST, the tax collection is done by the centre, and then split between the concerned states and the centre.

GST compliance and penetration has steadily improved over the years. This has resulted in tax collections–from Rs 4.4 tn in FY18 to Rs 5.9 tn in FY20, and an estimate of Rs 6.3 tn in FY22. E-ways bills (or electronic way bills, which are needed to transport goods valued above Rs 50,000) serve as a lead indicator for monthly GST collections.

Indirect taxes also include excise (levied on consumption of oil and alcohol, which are goods outside the purview of GST), customs (levied on import of goods) and many other miscellaneous categories such as wealth tax and inheritance tax. Collectively, indirect taxes are expected to make the government richer by Rs 11 trillion in FY22.

Indirect taxes meet three broad objectives. One, social welfare–undesirable products such as alcohol and tobacco are taxed higher to discourage consumption. Two, they determine the trade policy of the country. Taxes on imports and exports determine the final price to the consumer, therefore can make it more attractive or less so to the consumer. Three, regional development can be shaped by setting different tax policies that favour certain kinds of developmental spending. For example, to increase manufacturing output, a tax holiday (a lower tax rate of 18% against the ongoing tax rate of 25%) was extended to new units for two years.

Collectively, direct and indirect taxes are the biggest sources of revenue for GoI, which are what support most of the fiscal expenditure. As of FY22, gross tax collections are expected to be Rs 22 trillion against the total expenditure of Rs 34 trillion, implying that 65% of government’s expenditure is financed through tax revenue.

Taxation isn’t easy

While tax revenues are crucial for governments across the world, it isn’t easy to get taxation policies right.

Governments need the tax revenue but they can’t keep increasing the taxes because that would kill the incentive to

work. At the same time, higher taxes are needed to reduce the fiscal deficit. This leaves countries and policy makers constantly wondering if they are taxing too much or if they are giving away too many sops, which would be especially hard on a resource-constrained, developing country like India.

On top of that, the world now has to deal with a resource-guzzling pandemic. Tax planning in post-Covid world will be a policymaker’s biggest nightmare.

Several international organisations such as IMF and OECD have highlighted the following issues around which future tax policies have to be framed–rising digitisation, widening inequality, ageing population, slowing economic growth and need for sustainability.

Clearly, economies will have to reimagine the tax picture in the post-pandemic world.

The Budget could perhaps provide an exemption on WFH expenses for the salaried or increase their standard-deduction limit.

While lower taxes help in increasing savings and fueling consumption, the exchequer itself is short of resources.

Initiative needs to be taken to tap revenue from new-age businesses that have benefited from the pandemic and to increase compliance. Compliance and increase of tax base alone can go a long way for India!

So before you say a prayer for lower taxes in the coming Budget, remember a lower-tax regime is a double-edged sword. Everyone wants it but few will be prepared for the shambling economy afterwards.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!