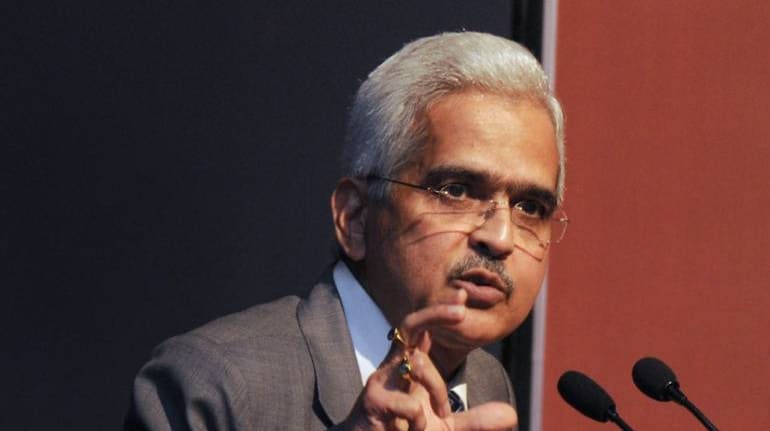

The central bank will keep an eye on unusually high credit growth to any sector and alert banks accordingly, Reserve Bank of India governor Shaktikanta Das said.

There will be a check on the credit growth of banks, non-banking financial companies and small finance banks to minimise risks, Das said in an interview to a television channel.

“There may be some risk involved too if credit growth gets too high suddenly. We will notify the NBFCs, the SFBs or other institutions if there is a sudden credit growth in one sector,” Das said.

Non-food bank credit registered 15.1 percent growth in July compared with 5.1 percent a year ago, the RBI said on August 30. Credit growth to agriculture and allied activities improved to 13.2 percent in July from 11.1 percent a year ago.

Credit growth to industry accelerated to 10.5 percent in July from 0.4 percent, while services sector credit growth improved to 16.5 percent from 3.8 percent a year ago, the RBI said.

Credit growth of scheduled commercial banks accelerated to 14.2 percent in June from 6 percent a year ago and 10.8 percent a quarter ago, the RBI said in a statement on August 25.

The RBI will also ensure that the monetary policy is transmitted to both lending and deposit rates, Das said in the interview. The central bank has increased its benchmark policy rate by 140 basis points since May in a bid to tame inflation.

Although several banks have increased deposit rates after the rate hikes, lending rates have gone up more for most banks.

“The gap is coming down slowly though. We are pulling out excess liquidity. Banks will have the pressure to increase their deposits now. Deposit rates are increasing and will increase furthermore in the future,” said Das.

Alongside, he suggested that banks need to focus more on raising capital.

“Banks need to raise more capital as the international situation may go even worse in the future. We have to be prepared for the worst… Banks will need additional capital for the growth of their loans, too,” added Das

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.