The live blog session has ended. For more news and updates, stay tuned with Moneycontrol.com

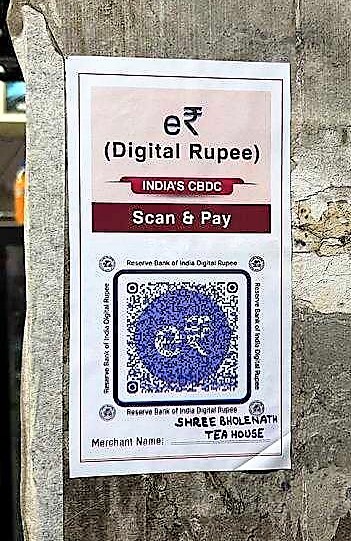

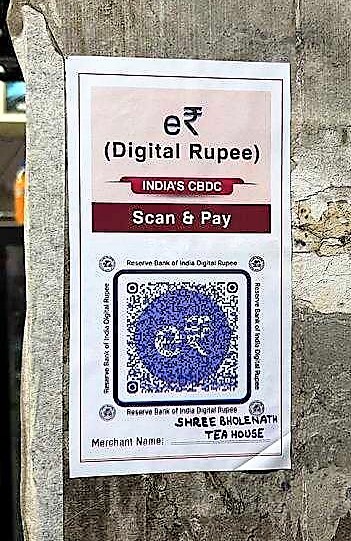

Coverage of RBI Digital Rupee pilot launch

The live blog session has ended. For more news and updates, stay tuned with Moneycontrol.com

RBI deputy governor T Rabi Shankar in a 2021 speech pointed to three reasons for the high interest in CBDC.

- Central banks, faced with dwindling usage of paper currency, seek to popularise a more acceptable electronic form of currency (like Sweden)

- Jurisdictions with significant physical cash usage seeking to make issuance more efficient (like Denmark, Germany, or Japan or even the US)

- Central banks seek to meet the public’s need for digital currencies, manifested in the increasing use of private virtual currencies, thereby avoid the more damaging consequences of such private currencies.

The RBI has decided to first conduct a pilot rollout of the retail digital rupee. The central bank has identified eight banks for the project that will happen in two phases. The first will begin with four banks, State Bank of India, ICICI Bank, Yes Bank and IDFC First Bank. They will offer the retail digital rupee in four cities: Mumbai, New Delhi, Bengaluru and Bhubaneswar. The second phase will see four more banks joining the project—Bank of Baroda, Union Bank of India, HDFC Bank and Kotak Mahindra Bank. Together, they will extend the pilot to nine more cities: Ahmedabad, Gangtok, Guwahati, Hyderabad, Indore, Kochi, Lucknow, Patna and Shimla.

Read More

The RBI on November 29 while announcing the pilot said that the implementation will be done in phases in partnership with a few banks and in some cities to start with and the scope will later be scaled up. The pilot will be implemented among a small group of customers and merchants, starting with the four cities of Mumbai, New Delhi, Bengaluru and Bhubaneswar. It will in the next phase be extended to Ahmedabad, Gangtok, Guwahati, Hyderabad, Indore, Kochi, Lucknow, Patna and Shimla.

The Reserve Bank of India will introduce the much-awaited retail digital rupee on December 1 as a pilot programme in a closed-user group. Then, if you have a loan or plan to take one, if you have a credit card, or if you subscribe to SMS alerts from a bank, there are important changes coming up in December that you need to monitor

Read more about the digital currency here

The 2022 Nobel Prize for economics has been awarded for studying the banking system and crises. In this regard, the award is timely given the ongoing digitalisation of money, banking, and financial services. A few days prior to the award, the Reserve Bank of India (RBI) released a concept note on the central bank digital currencies (CBDC). The note discusses the RBI’s views on issuing a CBDC, and how this can change the banking and payment system.

The introduction of a central bank digital currency (CBDC) will create an efficient and cheaper currency management system, said Ajay Manglunia, managing director and head of investment group at JM Financial, in an interview with Moneycontrol. CBDC settlements will ensure finality and reduce risk in the system, he said.

Government-run Union Bank of India has executed more than 25 percent of the overall government securities trade in the secondary market in the last three days under the wholesale pilot announced by the central bank for the rollout of digital currency, an official aware of the development told Moneycontrol. The official declined to be named.

Under the first pilot project that starts on December 1, four banks have created a wallet in their mobile banking applications where these CBDCs will be available to select customers.

Under the first pilot project that starts on December 1, four banks have created a wallet in their mobile banking applications where these CBDCs will be available to select customers.

"We have seen UPI’s success in small and retail transactions. How will the e₹-R impact upi and the way we pay? , NaveenJindal tweeted

-The central bank has asked lenders not to report low-value transactions made via the digital rupee, seeking to ensure its proposed virtual currency offers a similar degtee of anonymity associated with paper money for business exchanges below a material value threshold.

-Bankers told ET that once the CBDC-R (Central Bank Backed Digital Currency-Retail) is transferred to customer wallets, banks will not track or report these transactions.

-"These transactions don't leave a trace in the core banking system and that's why they are more anonymous than the current digital transactions," said a senior official at a bank involved in the Reserve Bank of India (RBI) pilot project. Hence, the RBI has asked banks "not to report these wallet transactions as part of mandatory regulatory reporting".