Attempts by Gujarat-based Amul to enter Bengaluru seem to have turned up the heat in the IT hub's milk and dairy market, as many allege it would negatively impact local dairy co-operative Nandini, and lakhs of dairy farmers in Karnataka.

Political controversies aside, it won’t be easy for the milk behemoth to unseat Nandini’s dominant position in the city.

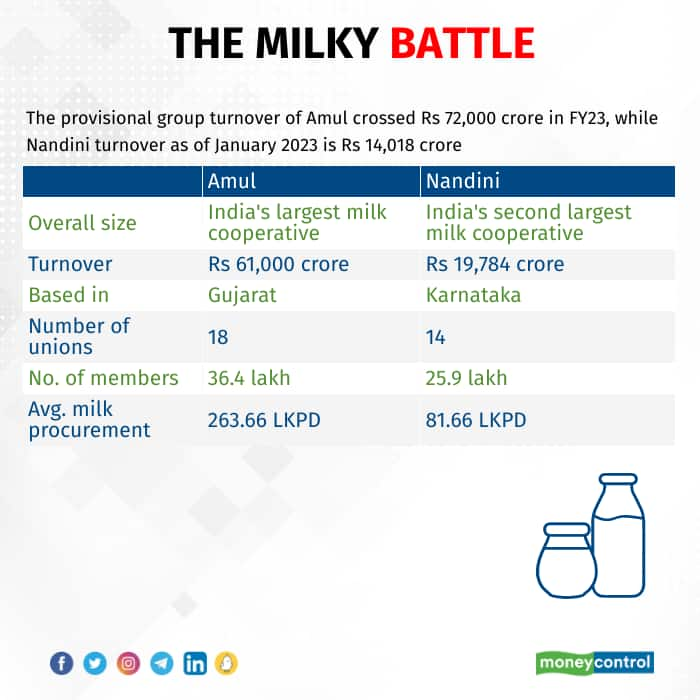

The biggest milk cooperative in India, Gujarat Cooperative Milk Marketing Federation (GCMMF), which owns the Amul brand, is more than three times the size of Karnataka Milk Federation (KMF), which owns the Nandini brand.

KMF is also the second-biggest milk cooperative in the country after GCMMF.

In FY22, GCMMF’s group turnover stood at Rs 61,000 crore, while KMF had a turnover of Rs 19,784 crore.

Amul has 36.4 lakh members under 18 district cooperative milk unions and 18,600 village societies. On average, its milk procurement stood at 236.66 lakh kilogram per day (LKPD) in FY22.

Meanwhile, Nandini has a membership base of 25.9 lakh farmers under 14 district cooperative milk unions, with 17,474 dairy cooperative societies. The cooperative’s annual average milk procurement stood at 81.66 LKPD in FY22.

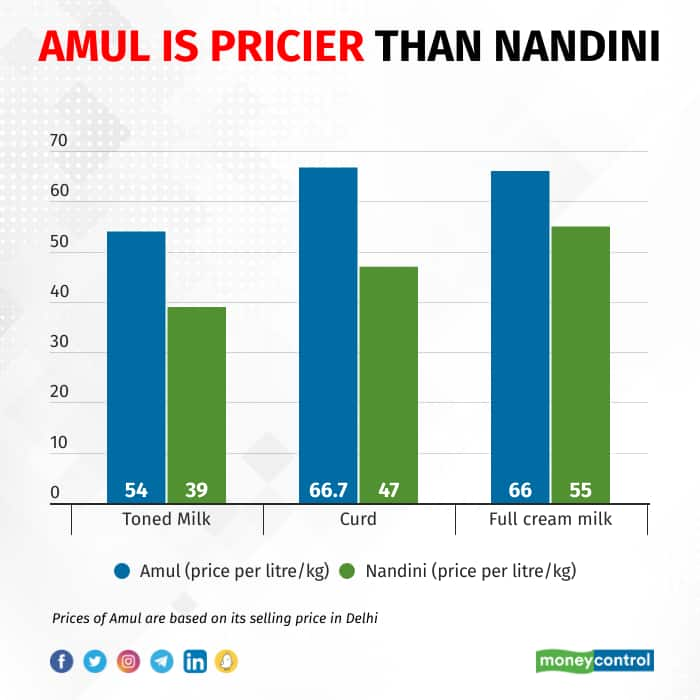

Although Amul is, without doubt, the bigger player, it would be challenging for them to take away Nandini’s dominance in Karnataka’s dairy market due to the low rates at which the latter’s products are sold.

“Even in the past, Amul has struggled while competing against local players with really strong brand equities in new markets they have tried to enter. So, this won’t be an easy ride for them,” said Shamsher Dewan, Senior Vice President and & Group Head (Corporate Ratings), ICRA.

Nandini’s toned milk, sold at just Rs 39 a litre, is the cheapest in South Asia. Meanwhile, Amul sells its toned milk for Rs 54 a litre in Mumbai and Delhi, and plans to sell for the same price in Bengaluru as well according to media reports. This difference can also be seen in other products such as full cream milk and curd, among others, where the two would directly compete.

“States like Karnataka have strong local dairy unions with a good network for directly procuring milk from farmers and might also offer better procurement prices for farmers in their geography. This makes it harder for private players and brands from outside to enter these markets,” said Dewan.

State government incentive to farmersOne of the factors that makes it possible for Nandini to keep its prices low is the incentive given by the Karnataka government to farmers selling milk to unions affiliated to KMF.

The scheme to give incentives to farmers was started in 2008 by the then BJP-ruled government, led by BS Yediyuruppa, by giving Rs 2 per litre as incentive on top of the procurement price by KMF.

This was further increased to Rs 5 per litre by the Congress-ruled government, led by Siddaramiah, in 2015. In 2019, this was further increased to Rs 6 per litre when Yediyuruppa once again became the Chief Minister.

“A mix of strong network for procurement and the subsidy from the state government allows Nandini to keep its prices low,” said Dewan.

Budget documents show that, in total, the state government doled out Rs 1,402.96 crore as subsidies to dairy farmers in FY22. However, revised estimates show that this has marginally declined to Rs 1,207 crore in FY23 and further down to Rs 1,200 crore, according to the budget estimate for the current fiscal.

Amul as a premium productWhile Amul might not be able to unseat Nandini’s dominance in Bengaluru’s dairy market, it could be able to carve out a niche for itself as a premium product.

“The taste of Amul products is accepted over a wider range of markets in the country. Its products, such as butter, is considered as a premium product in the segment. So, people who want Amul will buy it regardless of the price,” said Dhairyashil Patil, President, All India Consumer Products Distributors Federation.

However, according to Patil, the current controversy is unwarranted as Amul will neither impact Nandini’s market dominance nor the farmers of the state. “The milk that farmers produce will continue to be procured, so they won’t face any problems because of Amul's entry,” he said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.