India has been among the emerging markets where foreign institutional investors lost the least in dollar terms so far in 2018. The benchmark 50-stock Nifty index is up 8.5 percent for the calendar, despite the rupee depreciating 9.23 percent against the US dollar. Strong inflows into domestic mutual funds has been the main reason for this trend.

So while the Nifty rose in absolute terms, a foreign investor would still have seen his portfolio value shrink slightly because of the depreciation in the rupee.

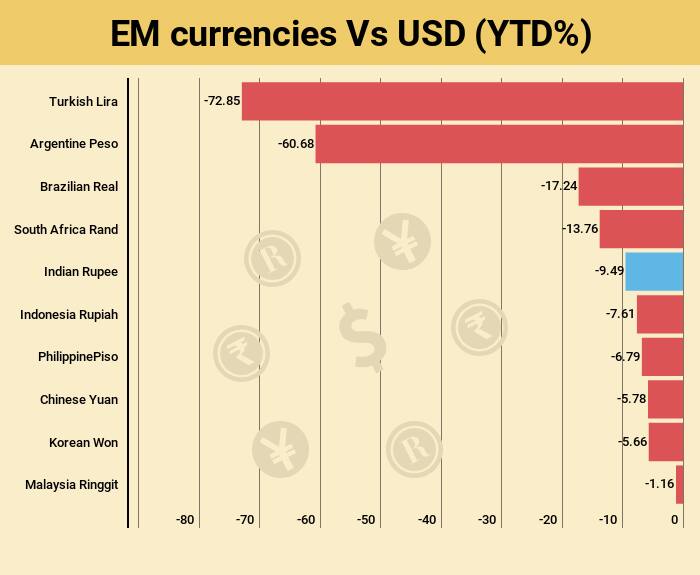

Although this by itself may not convey why the Indian market is better placed than its emerging market peers, a look at the performance of nine other emerging markets indices and the movement in their respective currencies paints a clearer picture.

Calendar 2018 has been bad for emerging markets currencies in general, and more so for some than the others. The Turkish lira has been the worst-affected of the lot, crashing around 80 percent against the dollar.

The other big losers on the list include the Argentine Peso, which has depreciated over 60 percent in the period under review, the Brazilian Real (-17 percent), and the South African Rand (-14 percent).

To put things in perspective, the Turkish index BIST 30 has fallen by around 9.8 percent so far this year. This means a foreign investor would have had to bear the brunt of a negative return of 9.8 percent on his investment along with an 80-percent devaluation of his investment due to the fall the lira’s value.

Similarly, Argentina, South Africa, Brazil, Indonesia, China, South Korea, the Philippines, and Malaysia, have all seen their currencies devaluate against the US dollar this year but have also witnessed either flat or negative returns from their benchmark indices.

One of the biggest reasons for the Indian stock market remaining buoyant despite foreign investors being net sellers for the better part of this year, is the strong inflows from mutual funds. MFs have invested like never before because of a surge in popularity for systematic investment plans (SIPs).

So far this year, FIIs have net bought Indian stocks worth Rs 4,831.36 crore, predominantly due to a lot of buying in the last couple of months. Domestic institutional investors, on the other hand, have been net buyers for most of the year and have net bought stocks worth Rs 66,318.20 crore since January 1.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.