Note: In the household survey, 200,111 households across 36 states and UTs were visited (spread across 5808 Primary Sampling Units and 186 districts) and 473,569 individuals interviewed.

Globally, 44.8 percent of the alcohol consumed is in the form of spirits followed by beer (34.3 percent) and wine (11.7 percent).

Quick Facts

About 43 percent of alcohol users in India consume more than four drinks on a single occasion, indicating heavy episodic drinking.

One in five men suffers from alcohol dependence, while one in 16 alcohol-using women depend on it.

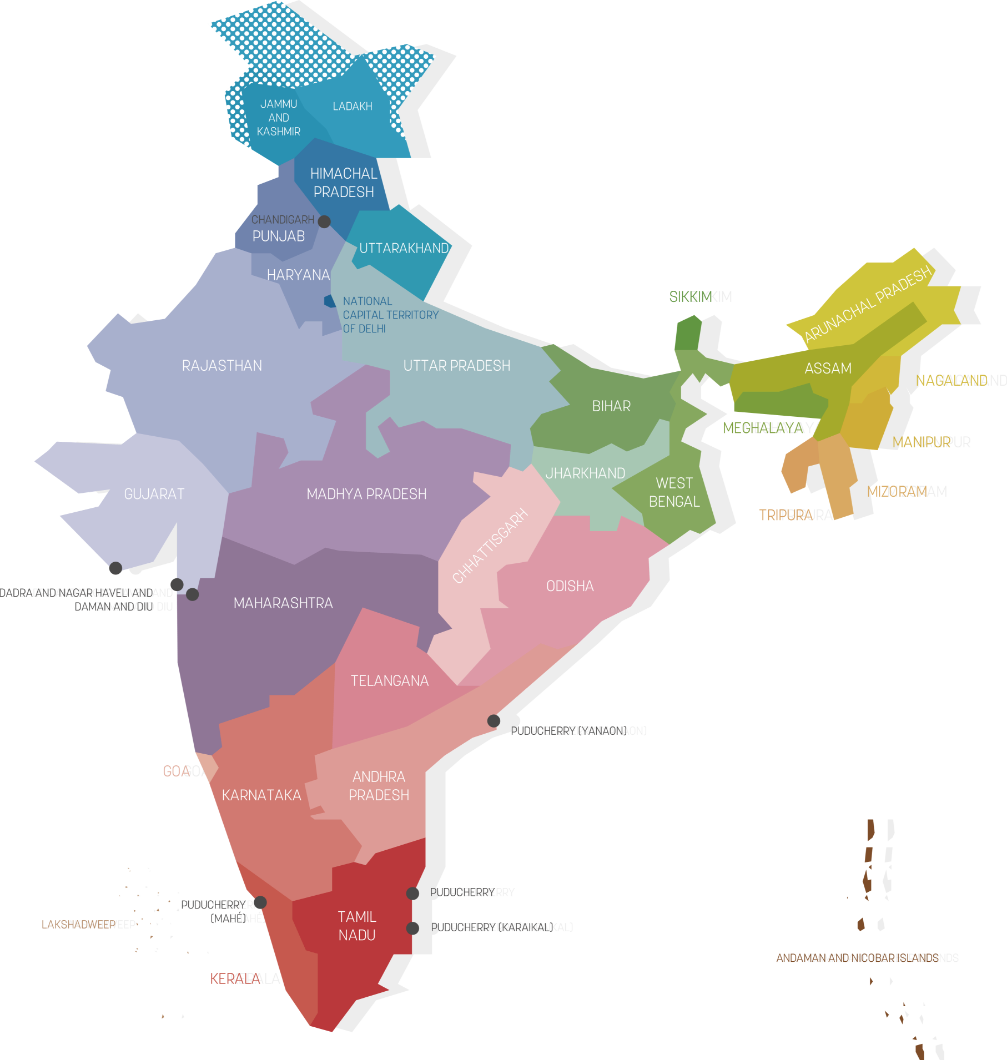

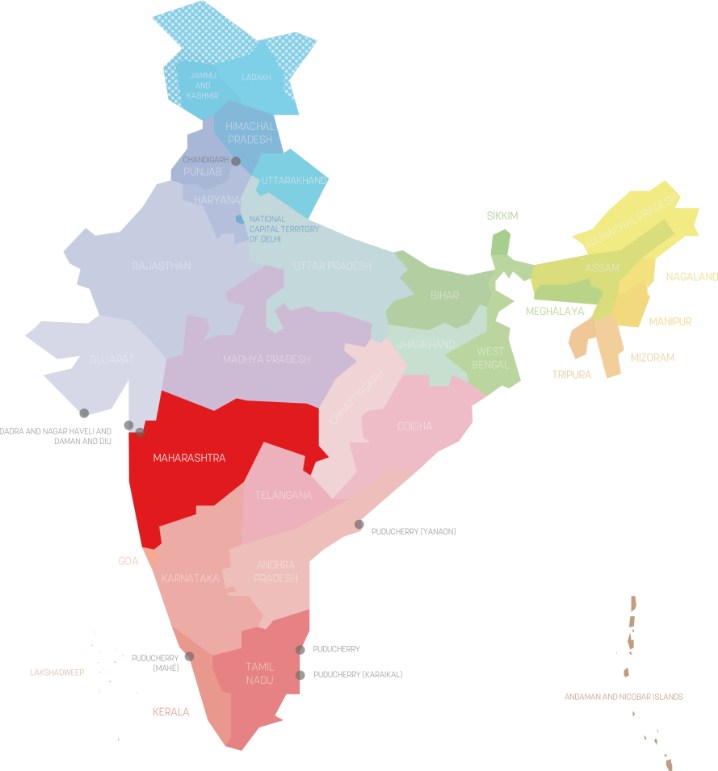

In the Northeast, the preference for homemade rice beer is higher than the rest of the country. The highest proportion of drinking illicitly distilled liquor (kacchi sharab)—about 30 percent)—was reported from Bihar.

Wine penetration in India is low, with an estimated 2-3 million consumers consuming 24 million litres. Wine-drinking remains largely urban, with Mumbai accounting for 32 percent of India’s consumption, Delhi 25 percent, Bangalore 20 percent , Pune 5 percent and Hyderabad 3 percent.