BUSINESS

Wakefit valued at Rs 2,800 crore in SIG-led round, raises Rs 200 crore

Wakefit was valued at Rs 1900 crore last year

BUSINESS

Exclusive: Edtech Teachmint rolls out unique ESOP plan

Teachmint’s new plan will let employees sell their shares whenever they want to after vesting, without waiting for a funding round, secondary share sale or exit event.

BUSINESS

Exclusive: Insurance startup Turtlemint eyes unicorn tag after Policybazaar IPO

Tiger Global Management, among other investors, is said to be in talks to lead the funding round. Moneycontrol sifted through internal documents for Turtlemint's revenue projections, business plans, IPO and more

BUSINESS

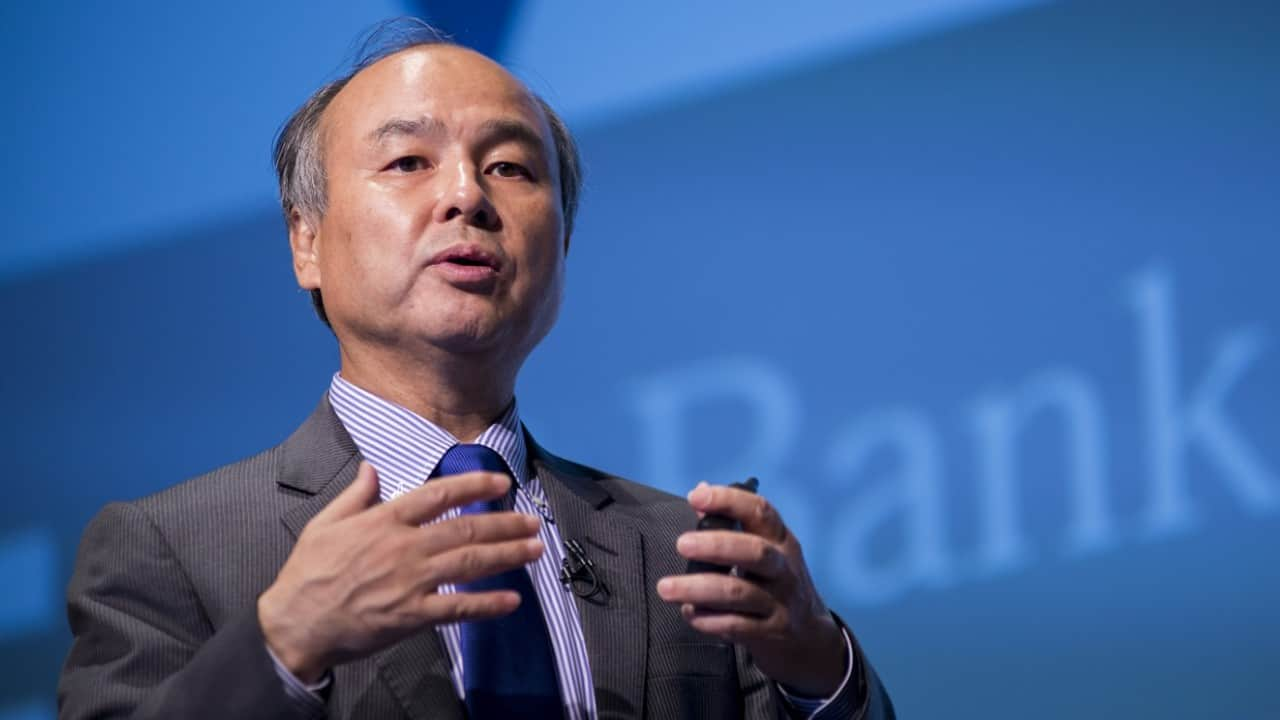

Paytm IPO will be a big event for SoftBank, says Masayoshi Son

SoftBank had first led a $1.4 billion round in Paytm in 2017, valuing it at $7 billion. It led subsequent rounds too, and its current holdings are worth over 2 times what it has invested.

BUSINESS

Current startup valuations not sustainable, need to be careful says Investcorp India partner

The PE firm is cautious about technology valuations and the risks. In an interview, partner and PE head Gaurav Sharma breaks down the dynamics.

BUSINESS

Decoding Delhivery's IPO prospectus in five charts

The e-commerce logistics firm wants to be the pipeline for India's digital economy. Will its pitch catch fire with public market investors? Moneycontrol sums up its IPO filings in charts.

BUSINESS

Analysis: Why has Sequoia not invested in India’s hottest start-up space?

Sequoia India has steered clear of investing in ecommerce rollups, better known as Thrasio models. The decision has surprised many close to Sequoia. Moneycontrol explains why the local unit of the world’s oldest and biggest venture capital firm has been shy of investing in what’s perhaps the hottest start-up space in India.

BUSINESS

Neobank Fi raises $50 million in round led by B Capital, Falcon Edge Capital

Fi offers a zero-balance savings account targeting working professionals, with the goal of simplifying banking and savings for them. While it was invite-only until recently, it has now opened up to all users

BUSINESS

Purplle raises $75 million led by Kedaara Capital to build house of brands

Amid Nykaa's bumper IPO, rival Purplle has raised a large funding round with plans to retain 70-80 percent annual growth rate.

BUSINESS

Explained: Sequoia Capital’s new disruptive structure. What has prompted it?

Sequoia Capital, the world’s oldest venture capital firm, is disrupting its own business model so it can stay relevant in an era of intense competition. Moneycontrol explains the attempt

BUSINESS

16-month-old ed tech firm Teachmint valued at $500 million

Sixteen-month-old Teachmint, founded by Mihir Gupta, Payoj Jain, Divyansh Bordia and Anshuman Kumar has capitalised on the online education boom during the pandemic and has raised $116 million since inception.

BUSINESS

Exclusive: Neobank Fi aims for $200-million valuation in new funding round

Neobanks are still a new concept in India, but early traction is leading to successive funding rounds at higher valuations.

BUSINESS

Sick of Zoom and vigilant of a third wave, VCs get back to in-person meetings, travel

For many investors, it’s a relief to return to normalcy – they have missed even the mundane and troubling aspects of business travel – delayed flights, traffic on the roads, and fatigue.

BUSINESS

CarDekho turns unicorn, valued at $1.2 billion in pre-IPO round

The car sales platform has raised $250 million in equity and debt funding from LeapFrog Investments, Mirae Asset, Franklin Templeton, Canyon Partners and Harbor Spring Capital, in a round that made it India’s 33rd unicorn in 2021.

BUSINESS

Only in fund management, a bad product doesn't get penalised: Nikhil Vora

Sixth Sense is closing in on a record Rs 2,500-crore third fund, nearly three times what its chief executive Vora had planned to raise

BUSINESS

Book review: The Contrarian - Peter Thiel’s biography is a messy tale of a messy man

Bloomberg Businessweek journalist Max Chafkin attempts to uncover the mysterious man behind Silicon Valley's biggest companies and investment firms- PayPal, Palantir, Founders Fund, et al. Who is Peter Thiel really?

BUSINESS

Indian startup funding crosses $25 billion amid unicorn boom

The record-breaking funding continues for startups

BUSINESS

CoinSwitch Kuber turns unicorn, raises $260 million from Coinbase Ventures, a16z

Now India's second cryptocurrency unicorn, CoinSwitch Kuber plans to use the funds to hire talent across engineering, product and data functions besides launching more asset classes to spread awareness about cryptocurrency

BUSINESS

Exclusive: Mensa Brands could be India’s fastest unicorn

Amid an epic funding boom, former Myntra CEO Ananth Narayanan's Mensa Brands could be India's fastest unicorn- zero to a billion dollars in barely six months

BUSINESS

Exclusive: Top founders Amrish Rau, Jitendra Gupta to raise fintech VC fund

Two of India's best known founders, Amrish Rau and Jitendra Gupta, are becoming venture investors, a growing trend even amid a record funding boom.

BUSINESS

Alteria Capital closes Rs 1,800 crore second venture debt fund

This will make it India's largest venture debt fund

BUSINESS

Meesho raises $570 million from Fidelity, B Capital, others at $4.9 billion valuation

Meesho's valuation of $4.9 billion makes it one of India's highest valued startups, succeeded by barely half a dozen other internet startups

BUSINESS

Vedantu raises $100m at $1b valuation, becomes India's 5th edtech unicorn

Vedantu's fundraise helps it grow fast even as rivals Byju's and Unacademy buyout the rest of the online education market with a string of acquisitions.

BUSINESS

Exclusive | SoftBank in talks to back GlobalBees at $500m valuation

The Japanese tech investor is leading a $100 million round in GlobalBees. The latter had raised $150 million in ‘seed’ equity and debt funding in July from SoftBank, PremjiInvest, Chiratae Ventures, ChrysCapital and Lightspeed India