E-commerce logistics firm Delhivery on November 2 filed its documents with the market regulator, seeking to raise a billion dollars in an Initial Public Offering. The deal will mark a lucrative exit for many of its investors, make some employees rich and serve as a barometer to measure India's startup and tech sector's success.

Delhivery is the latest internet startup to file for a public share amid a historic funding boom, ending years of investor anticipation for internet IPOs. VCs have been investing in Indian internet companies for 15 years now, but are seeing exits at scale frequently and public offerings for the first time.

Listed companies and DRHPs filed this year include Zomato, Mobikwik, Nykaa, Policybazaar, Paytm and Ixigo, with PharmEasy set to file soon. Moneycontrol summarises key takeaways from Delhivery's IPO prospectus.

Delhivery is raising more than originally planned amid a historic bull run

Delhivery is raising more than originally planned amid a historic bull run Delhivery is loss-making, but has narrowed its losses compared to two years ago

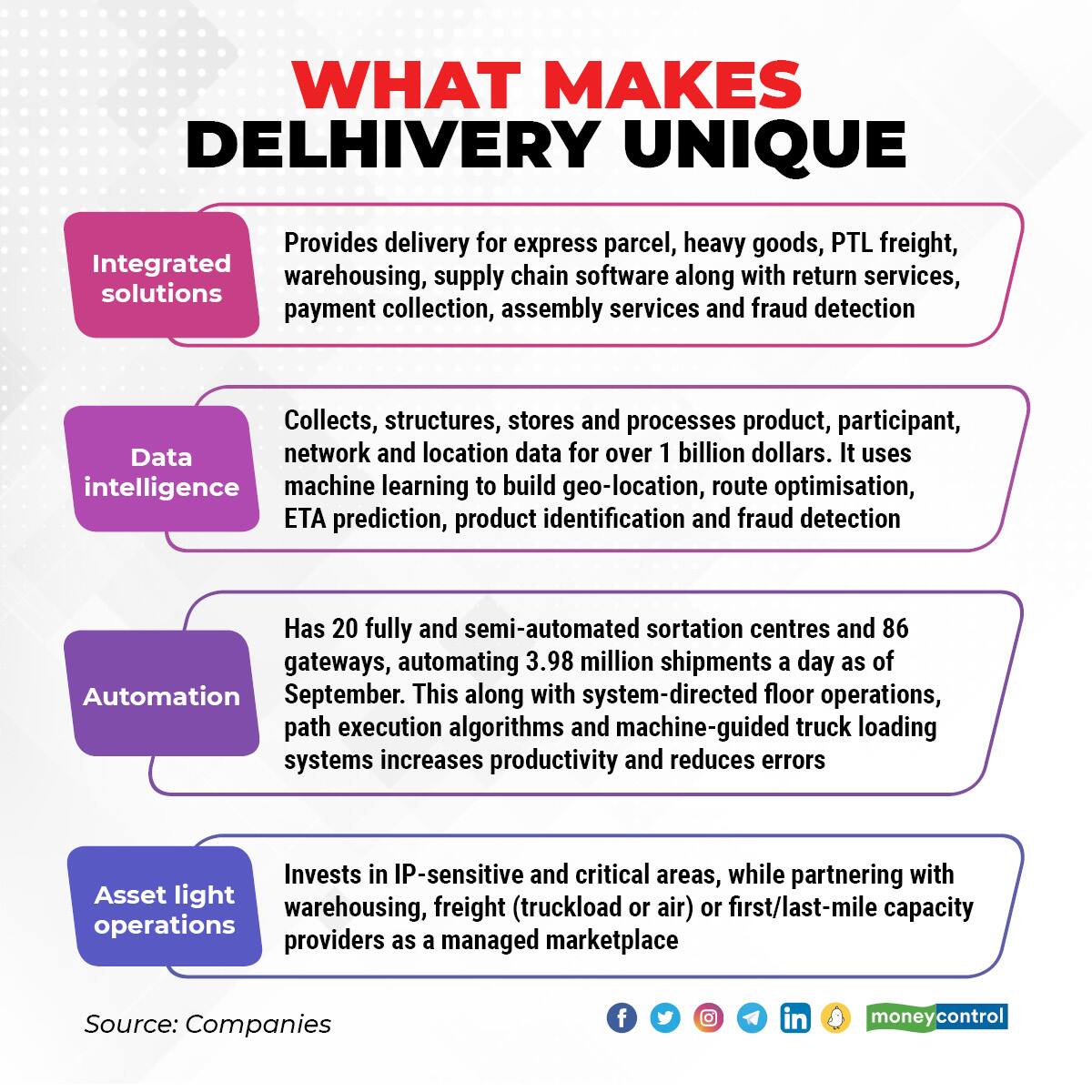

Delhivery is loss-making, but has narrowed its losses compared to two years ago Delhivery says it is a technology company and uses extensive automation, elevating it from being merely a logistics company

Delhivery says it is a technology company and uses extensive automation, elevating it from being merely a logistics company SoftBank, Carlyle and some co-founders will sell a part of their stake

SoftBank, Carlyle and some co-founders will sell a part of their stake Leading up to its IPO, Delhivery appointed industry veterans as independent directors, meant to shore up corporate governance

Leading up to its IPO, Delhivery appointed industry veterans as independent directors, meant to shore up corporate governance

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.