Indian startups have raised over $25 billion in a little over three-fourths of 2021, the last $5 billion in just over two months, as internet companies have gained from free-flowing capital at aggressive valuations led by blitzkrieg growth and a slew of stock market listings.

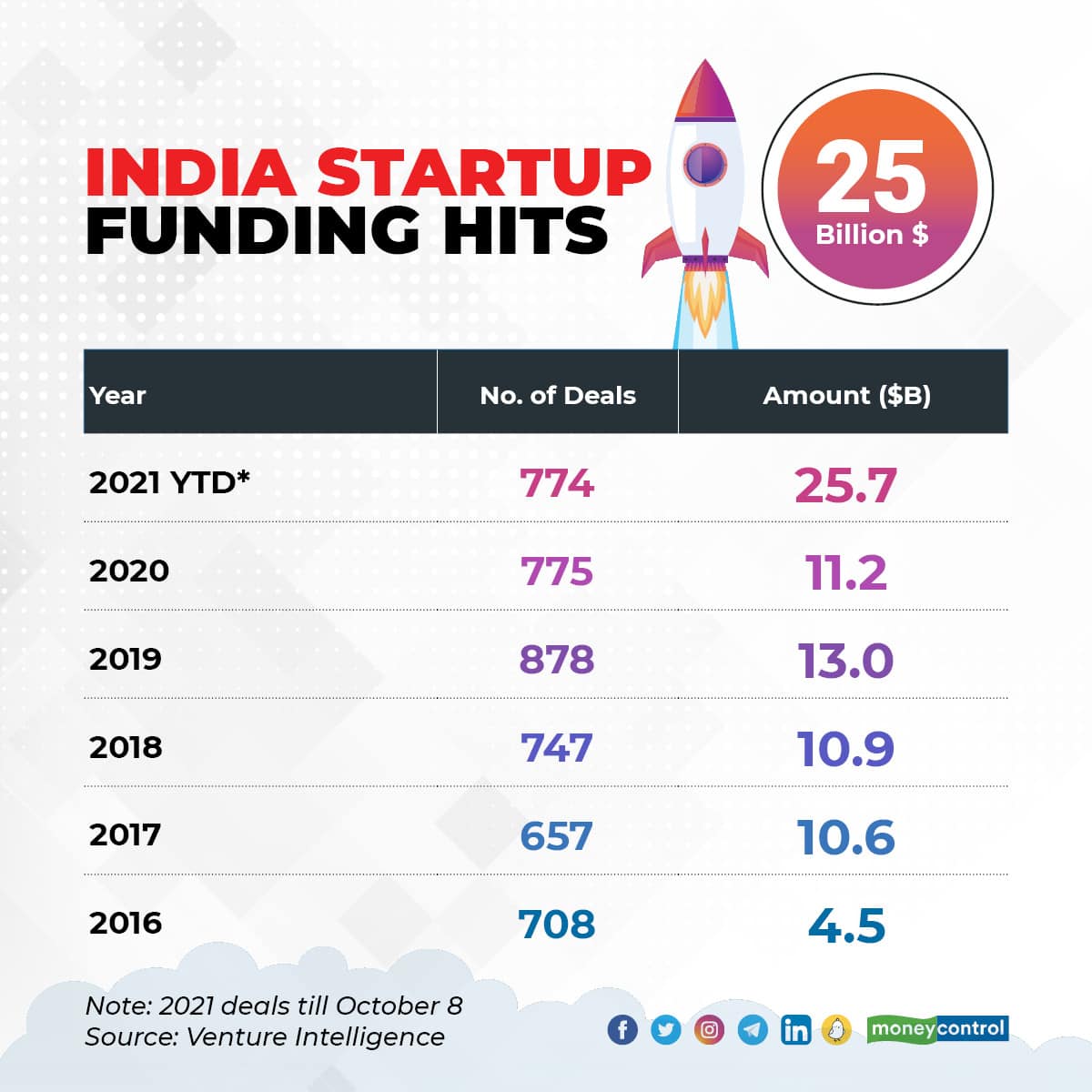

Startups have raised $25.7 billion across 774 deals- the amount nearly double 2019’s $13 billion- a record at that point, as per data from Venture Intelligence.

2021 has seen 31 unicorns created in India so far- private startups valued at over a billion dollars. Unicorns, so named for their rarity in the startup world years ago, now seem to have become commonplace. The 31 unicorns this year are more than the total number of unicorns India produced in all years prior- 26.

This week alone has seen three such startups- meat delivery firm Licious, cloud kitchen Rebel Foods and cryptocurrency exchange CoinSwitch Kuber- cross the billion dollar valuation mark.

While it earlier also took companies years to become a unicorn- the unprecedented funding boom is giving them the crown a lot faster- Moneycontrol earlier first reported that six-month-old Mensa Brands in talks to raise funds at a unicorn valuation.

Notably though, the number of funding rounds this year so far- 774 is well below 2019’s peak of 878 deals, indicating that a lot of money is going to relatively fewer companies. This is seen in many cases, where fast-growing companies have raised large funding rounds at double and triple their previous valuations in a few months- Unacademy, OfBusiness, Infra.market and Meesho to name a few.

Sequoia India, Tiger Global Management and Accel India have been the most active investors, inking 78, 39 and 38 investments each. By value, Tiger, Falcon Edge Capital and SoftBank are estimated to have put billions of dollars individually this year.

Investors are also pouring money into Indian internet companies because while they have been investing for over a decade, they are finally seeing returns, or exits. After Zomato and Freshworks’ bumper listing, over half a dozen companies including Paytm, Oyo, Mobikwik, Delhivery, Nykaa and Policybazaar are looking to list in the coming months.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.