The benchmark indices extended their downtrend for the third consecutive session, falling by nearly six-tenths of a percent on December 2, with market breadth dominated by bears. A total of 1,939 shares were down, compared to 892 rising shares on the NSE. The bears may gain strength if the market convincingly breaks the 20-day EMA and the midline of the Bollinger Bands. Below are some short-term trading ideas to consider:

Amol Athawale, VP Technical Research at Kotak SecuritiesApollo Tyres | CMP: Rs 519.25

Apollo Tyres has shown a robust rally from lower levels in the past weeks. Additionally, it is continuously trading in an ascending triangle chart formation on the weekly scale. Therefore, the overall formation indicates a likely breakout for a new leg of upward movement from the current levels.

For positional traders, Rs 500 would be the decisive level. Trading above this level will likely maintain the uptrend formation, which could continue up to Rs 555. However, if the stock closes below Rs 500, traders may prefer to exit long positions.

Strategy: Buy

Target: Rs 555

Stop-Loss: Rs 500

Bandhan Bank | CMP: Rs 149.78

After its declining trend, Bandhan Bank is in the accumulation zone, where it is trading in a range-bound mode on the daily scale. However, the recent formation of a gravestone doji candlestick pattern is indicating a potential reversal.

The stock is expected to break out of the range and witness bullish momentum from the current levels, with a favourable risk-to-reward perspective. For the next few trading sessions, Rs 144 could be the trend-deciding level for the bulls. If it sustains above this level, further uptrend towards Rs 160 can be expected.

Strategy: Buy

Target: Rs 160

Stop-Loss: Rs 144

Britannia Industries | CMP: Rs 5,875.5

Post its declining trend from higher levels, Britannia is in consolidation mode, trading in a rectangle formation. However, the recent bullish engulfing candlestick formation near the demand zone is indicating good strength.

The upward movement in the stock suggests a fresh leg of the bullish trend in the near term. As long as the stock is trading above Rs 5,680, the bullish momentum is likely to continue. Above this level, the stock could move up to Rs 6,300.

Strategy: Buy

Target: Rs 6,300

Stop-Loss: Rs 5,680

Vinay Rajani, Senior Technical & Derivative Analyst at HDFC SecuritiesBirlasoft | CMP: Rs 404.95

Birlasoft is in a healthy intermediate uptrend after touching a low of Rs 336 in October 2025. This week, the stock broke out of a 5-week range on the back of above-average volumes. The stock also trades above the 20-day and 50-day SMAs, and momentum indicators like the 14-day RSI are rising and not overbought. This suggests that the uptrend is likely to continue.

Strategy: Buy

Target: Rs 450

Stop-Loss: Rs 375

Glenmark Pharma | CMP: Rs 1,978.6

Glenmark Pharma has rallied in the last few weeks and is currently trading above a 6-week range. This indicates that the stock is poised to continue the next leg of its uptrend. On the daily chart, the stock is also holding above the 20-day and 50-day SMAs. With momentum indicators like the 14-day RSI rising and not overbought, this is a positive sign for the continuation of the uptrend.

Strategy: Buy

Target: Rs 2,200

Stop-Loss: Rs 1,820

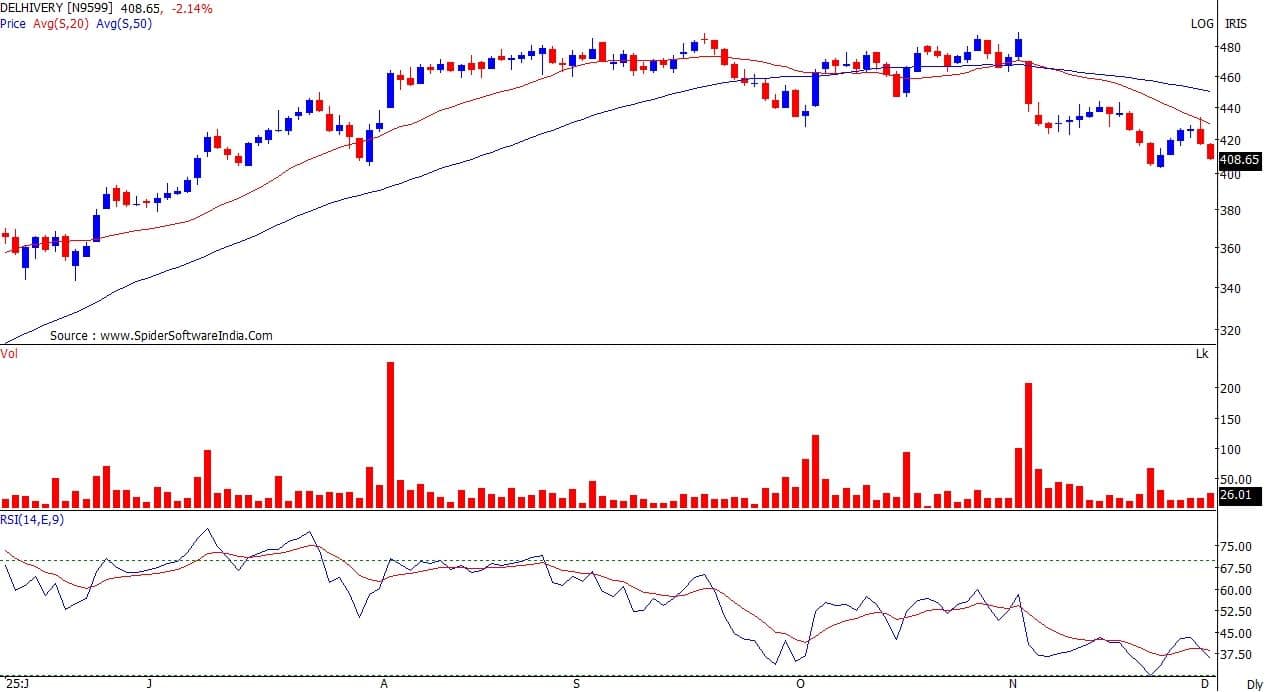

Delhivery | CMP: Rs 409.1

Delhivery has reversed its recent uptrend and is now making lower tops and lower bottoms for the past several weeks. The stock recently reacted from the 20-day SMA on the back of healthy volumes, indicating that selling was intense.

Momentum indicators like the 14-day RSI are also falling and not oversold, which implies potential for further downside.

Strategy: Sell

Target: Rs 380

Stop-Loss: Rs 435

Arun Kumar Mantri, Founder of Mantri FinMartBajaj Finance | CMP: Rs 1,025.5

Bajaj Finance is trading within the cluster of its 21/50/100/200 EMAs, indicating strong trend continuation in the coming days with a positive bias. The price is holding near the middle band of the Bollinger Bands (20,2), confirming that bullish price expansion is likely to occur towards the upper band.

Trading volume above average levels supports the momentum, while the RSI near 50 reflects healthy strength in the move. Overall, the structure remains positive for short-term upside traction, with key support placed near the Rs 1,000 zone.

Strategy: Buy

Target: Rs 1,077

Stop-Loss: Rs 996

Sona BLW Precision Forgings | CMP: Rs 506.4

Sona BLW Precision is trading above key trend-defining EMAs, maintaining an overall bullish bias in line with momentum in the broader auto sector in recent month. The price remains close to the upper Bollinger Band, reflecting strength but slightly extended levels.

The RSI and MACD are showing inherent strength on the daily charts, signaling buy signals on all parameters. The structure supports short-term traders to go long on the counter with a target of Rs 570+ in the near term.

Strategy: Buy

Target: Rs 577

Stop-Loss: Rs 495

Tata Communications | CMP: Rs 1,848.3

Tata Communications has been in bullish momentum for the past few days and is forming a Flag & Pole pattern on the daily charts, currently at the lower zone of the pattern. The recent price action indicates that the bullish move is likely to resume after the recent retracement.

The Parabolic SAR is trading below the price action on the weekly charts, reflecting that the uptrend in the stock will likely remain intact in the medium term. The MACD is trading around the signal line with broadening bands on the daily charts, which suggests positive momentum in the counter.

Strategy: Buy

Target: Rs 1,943

Stop-Loss: Rs 1,802

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.