BUSINESS

India needs to find its Moore’s law of growth by investing in AI innovation

Failing to act now by not ramping up innovation and R&D investments by 100x could stand to make us irrelevant. India must significantly ramp up AI R&D investment to assert global leadership in innovation and economic growth, drawing inspiration from Moore’s Law for future progress.

BUSINESS

US-China rivalry intensifies in quantum technology race and security

The adversarial competition between the United States and China in quantum technology is an underappreciated and often overlooked facet of their ongoing rivalry.

BUSINESS

A neutral start to RBI MPC’s easing cycle

RBI said it will look to use the flexibility embedded in the flexible inflation- targeting (FIT) framework. This suggests that the RBI could start to gradually move away from its fixed 4 percent CPI inflation target and instead embrace a range, especially when faced with CPI shocks, such as those from volatile vegetable prices

INDIA

Win-win for BJP; curtains for Kejriwal

A hard fought victory in Delhi and a resounding one in UP’s Milkipur bypoll have wholly overturned the political mood of June 2024. Three successive state assembly victories have increased BJP’s relative strength in Indian politics and diminished the bargaining capacity of its NDA allies

BUSINESS

RBI moves in the right direction but global uncertainty can change plans

Global disinflation is stalling due to service inflation. Expectations on the size and pace of rate cuts in the US have receded and the US dollar has strengthened. Any unanticipated increase in energy prices could also impact future stance

BUSINESS

RBI puts economic growth on the front burner

This has been achieved by letting the rupee become more market determined and mitigating the tightness in liquidity conditions with injection of liquidity through various tools. In the April MPC, subject to global factors, the base case should be for another 25bp rate cut, bringing the Repo rate to 6 percent

BUSINESS

The Reading List: February 7, 2025

A selection of articles and social media gems from the world of economy, business and finance, curated by our research and opinion teams.

BUSINESS

Regulating online games with skill, chance and FDI considerations

A statistical framework that differentiates between games of skill and chance is a silver bullet for online games regulators

BUSINESS

Chart of the Day: Interest rates and the two sides of liquidity

Deposit rates have risen consistently, but tight liquidity hasn’t forced banks to hike loan rates

INDIA

Solutions to invigorate India’s lacklustre arbitration system

India’s arbitration sector is overdue for disruption by market forces. Arbitration Council of India (ACI) should take over arbitrator appointments from courts—but only as a transitional measure. The goal is to nurture a competitive arbitration marketplace, where multiple competing platforms emerge—just like ride-hailing or food delivery services

INDIA

Negative spillover effect of Press Note 3 persists

Press Note 3 was introduced in 2020 to intensify scrutiny on FDI sourced from countries sharing a land border with India, which really means China. It did not define a key concept, ‘beneficial ownership’. The lack of clarity around what constitutes ‘beneficial ownership’ has created roadblocks for many private equity (PE) and venture capital (VC) firms based out of Europe and USA.

BUSINESS

Chart of the Day| Premium hotels rush to add capacity as the sector defies consumption slowdown

The healthy demand uptick is leading to pick-up in new room supply and commencement of deferred projects in the last 24-30 months

BUSINESS

Role of P2P lending platforms in empowering the underserved

Peer-to-peer lending (P2PL) offers a promising solution to India’s gendered credit gap. By bypassing traditional banking barriers, P2PL provides flexible, accessible loans tailored to rural women entrepreneurs, fostering financial inclusion and supporting their business growth and resilience

BUSINESS

Budget’s most far-reaching change is in tariff rationalization

Inverted customs duty structures have been one of the biggest impediments to competitiveness of Indian exporters. Imposed mostly ad-hoc, in response to specific demands for import protection, the duty inversions have adversely affected prospects. The Budget might have done for Indian exports what trade policy hasn’t been able to

BUDGET

Budget 2025 set to transform the insurance sector for growth

The Union Budget 2025-26 introduces significant reforms for India's insurance sector, including raising FDI limits, enhancing digital infrastructure, and expanding coverage for gig workers. These initiatives aim to drive innovation, growth, and greater accessibility, particularly in rural markets

BUDGET

India's strategic push for cleantech manufacturing and renewable energy growth

Budget 2025 outlines efforts to boost manufacturing, focusing on renewable energy (RE) and cleantech. The National Manufacturing Mission aims to enhance domestic production across key sectors, reducing import dependency, and fostering innovation, technology, and skills for future growth.

WORLD

Hamilton to Trump: America’s repeated dalliances with tariffs

Tariffs have often been viewed and used as tools to build domestic industrial strength. In displaying faith in them, Donald Trump is not an outlier in American political history. The question is whether tariffs are an unstoppable force or just another page in the economics textbooks. The next four years will answer that question for the U.S. and for the world at large.

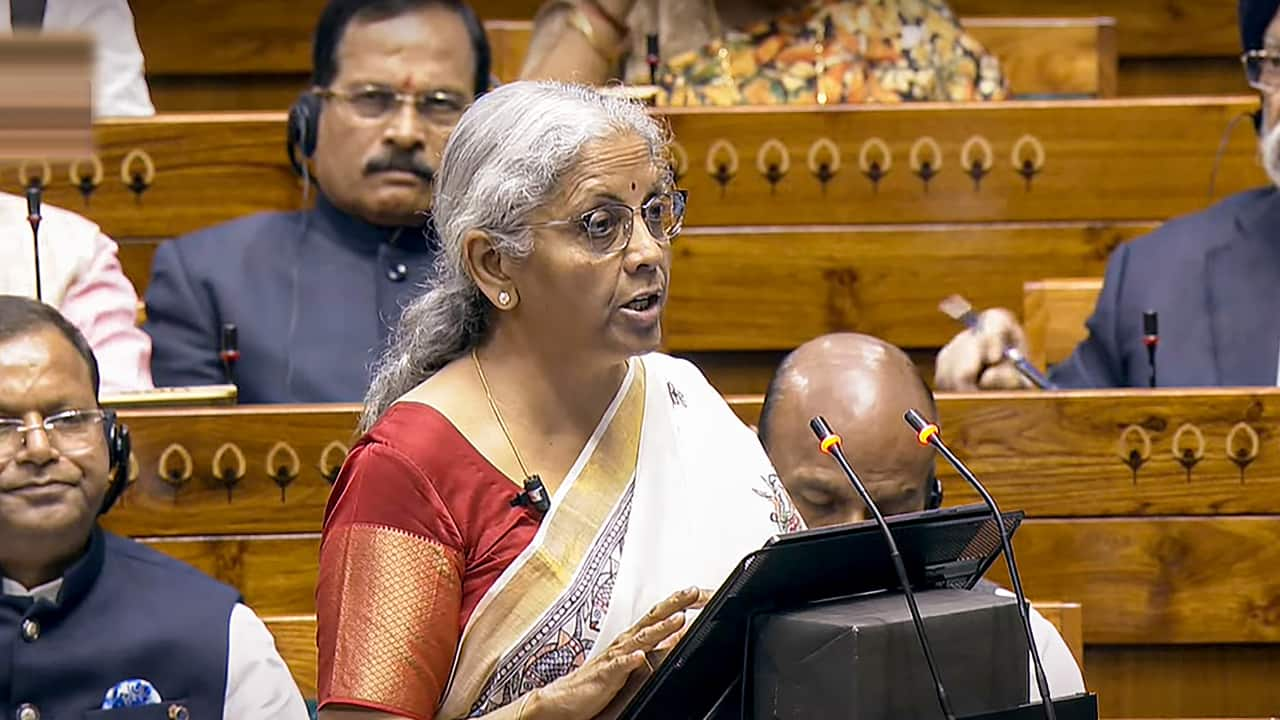

BUDGET

A budget that scores on four of five essential criteria

Budget does well on transparency, diluting intrusiveness in taxation, fiscal prudence and laying down a roadmap for more consolidation. It could have been more ambitious in its goals but the global uncertainty triggered by US policy could have nudged the government to err on the side of caution

BUDGET

India’s Middle Class Boom: How PM Modi’s budget is reshaping economic prosperity

At a single stroke, 70 million taxpayers have been wholly unburdened by the budget and the middle class has seen a substantial increase in its post-tax income. This will spur a consumption boom, pushing India’s GDP to an 8% range.

BUSINESS

Union Budget 2025 boosts consumption in urban and rural India

The Union Budget 2025 focuses on stimulating private consumption in both urban and rural India. By revising tax slabs, increasing rural support, and boosting agriculture and food processing industries, it aims to enhance growth, consumption, and farmer incomes

BUDGET

Tax-to-GDP Ratio: Strategic economic blueprint to tax proposals

Tax proposals spanning rate changes, process simplification and the imminent introduction of a new income tax bill to overhaul the system set the stage for creating a robust fiscal base.

BUDGET

Budget 2025 strengthens IFSC’s role as a global financial hub

Budget 2025 introduces key measures for GIFT City IFSC, enhancing tax incentives, regulatory clarity, and competitiveness. These changes, including simplified rules for fund managers and exemptions for non-residents, aim to attract global investments and position India as a leading financial centre

BUDGET

A budget to enable Viksit Bharat

Budget 2025-26 is a blueprint for the presence of India in the global high table in 2047. The direction of the Government is right

BUSINESS

The Reading List: January 31, 2025

Our research and opinion teams have curated a selection of articles and social media gems from the world of economy, business and finance for your weekend read.