BUSINESS

FPI utilization of investment limit in corporate bonds lowest in 10 years, shows data

Experts attribute the trend to a sharp depreciation of the Indian rupee, a lower spread between US Treasury yields and returns on Indian debt instruments and global uncertainties.

BUSINESS

Bank of India gets Rs 3,104 crore, City Union Rs 385 crore through deposit & exchange of Rs 2,000 notes: Sources

On May 19, the RBI announced the withdrawal of Rs 2,000 notes from circulation.

BUSINESS

'Effective governance, compliance practices essential in safeguarding bank's interests'

RBI Deputy Governor M K Jain delivered a speech at the Conference of Directors of Banks, organised by the RBI for Public Sector Banks on May 22 in New Delhi and Private Sector Banks on May 29 in Mumbai.

BUSINESS

RBI disposed 132.19 crore pieces of soiled Rs 2,000 notes in last 3 fiscals: Annual Report

The central bank disposed 48.24 crore pieces in FY23, 38.47 crore pieces in FY22, and 45.48 crore pieces in FY21 soiled bank notes of the currency

BUSINESS

Kanpur Municipal Corp to raise Rs 100 cr via 10-year municipal bonds in August: Officials

Municipal bonds are issued by civic bodies to finance urban infrastructure projects.

BUSINESS

Credit cards transactions rise 30.1% in FY23 in volume: RBI Annual Report

In value terms, payment transactions carried out through credit cards increased by 47.3 percent.

BUSINESS

RBI annual report: FPI investment in outstanding corporate bonds decline to Rs 1.04 lakh crore

In 2022-23, primary corporate bond issuances rose in the domestic market, while overseas bond issuances moderated.

BUSINESS

Rs 2,000, Rs 500 notes in circulation accounted 87.9% as on March 31 in value terms: RBI Annual Report

The Rs 500 denomination constituted the highest share at 37.9 per cent, followed by Rs 10 denomination banknotes, which constituted 19.2 per cent of the total banknotes in circulation as on March 31, 2023.

BUSINESS

MC Explains| Will your Rs 2,000 note be recycled into a banknote or will it fuel a furnace?

The RBI has a system in place for the disposal of out-of-use notes. They can come back as recycled banknotes or can be turned into briquettes. Read on to find out more

BUSINESS

10-year bond, repo rate gap shrinks to over 5-year low. Are we near a rate-cutting cycle?

Spreads have narrowed further as the market's terminal rate expectations might have changed with the RBI keeping the policy rate unchanged and inflation easing, say fund managers

BUSINESS

Rs 2,000 note withdrawal impact: CD, CP yield falls on expectation of improvement in bank deposits

The yields on CDs maturing in three months, which were trading in the 7.00-7.20 percent range on May 17, have now fallen to 6.80-6.95 percent.

BUSINESS

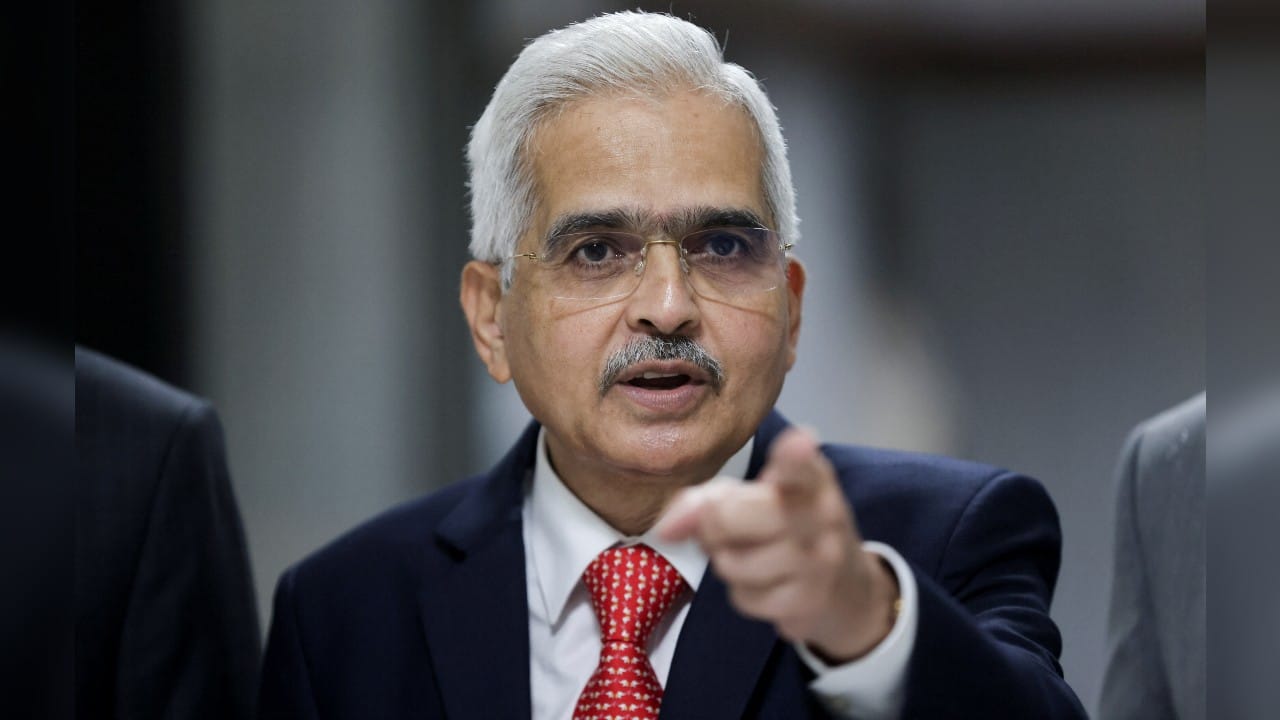

Scarce use, risk of collateral issues behind withdrawal of Rs 2,000 notes: Das

Das was speaking at the CII Annual Session 2023.

BUSINESS

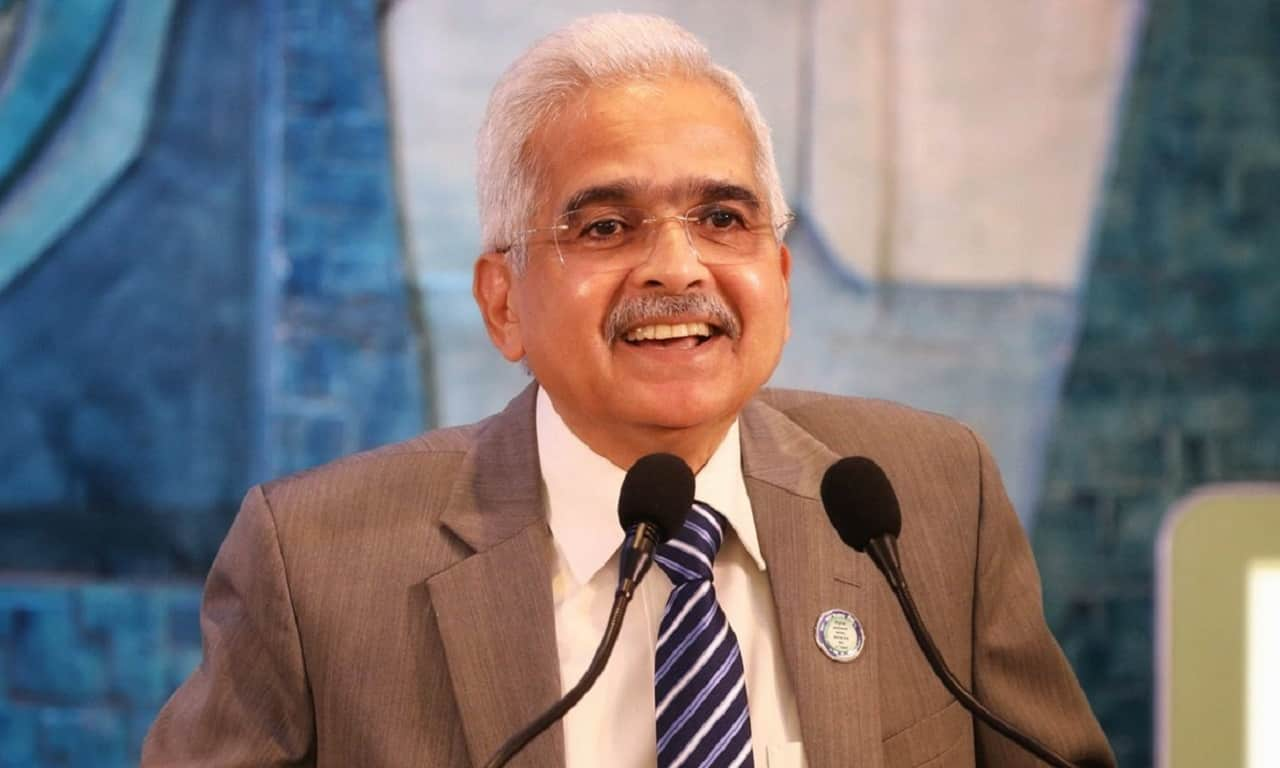

War on inflation not over, need to see how El Nino plays out, says RBI Governor Shaktikanta Das

Das was speaking at the Confederation of Indian Industry (CII) Annual Session 2023.

BUSINESS

Rs 2,000 note withdrawal: Banks see no rush for exchange, deposit

The RBI said people could visit bank branches from May 23 to exchange or deposit their Rs 2,000 notes.

BUSINESS

RBI sold $213 billion on gross basis in FY23, up 120% from FY22

As per latest RBI data, the central bank purchased $750 million worth of foreign currency in March on a net basis.

BUSINESS

Banking system liquidity to improve post Rs 2,000-note withdrawal, short-term rates may ease: Experts

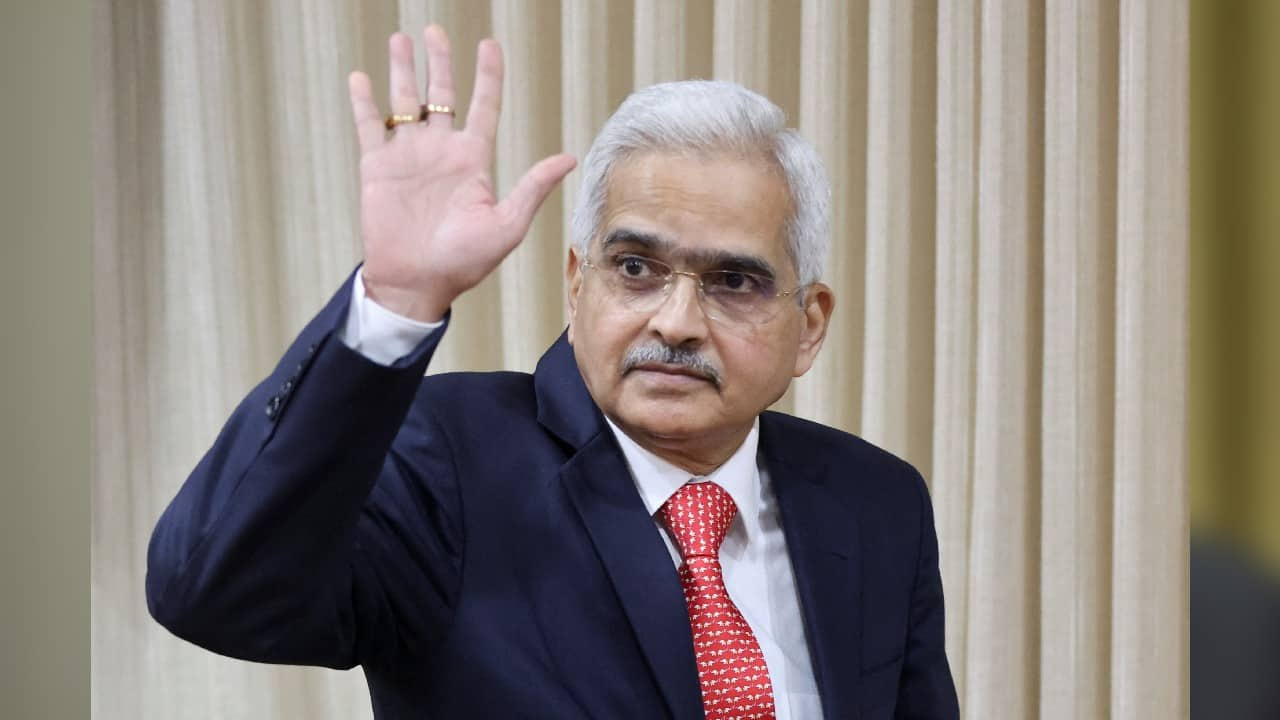

During an interaction with reporters, RBI Governor Shaktikanta Das said he expects most of the to-be-discontinued notes to return to the banking system by September 30.

BUSINESS

Online transaction to get added push post withdrawal of Rs 2,000 notes from circulation, say experts

Last week, the RBI has decided to withdraw Rs 2000 banknote from circulation in pursuance of the “Clean Note Policy”, and it advised bank to stop issuing these notes with immediate effect.

BUSINESS

Most Rs 2,000 notes will be returned by September 30, says RBI governor Shaktikanta Das

Das said Rs 2,000 rupee notes were introduced primarily to replenish the currency that was withdrawn following the 2016 demonetisation

BUSINESS

RBI will ensure adequate liquidity in system, says governor Shaktikanta Das

The uneven distribution of liquidity among banks led to a sharp rise in call money rates in the inter-bank market, Das has said

BUSINESS

RBI to withdraw Rs 2,000 notes: Here is what data shows on currency denominations in circulation

The latest release by the RBI showed the total value of Rs 2,000 banknotes was Rs 3.62 lakh crore constituting only 10.8 percent of notes in circulation as on March 31, 2023.

BUSINESS

RBI’s repo auction aimed at easing liquidity stress of banks: dealers

The central bank infused Rs 46,790 crore through a 14-day variable rate repo auction at a cut-off rate of 6.51 percent, just above the repo rate.

BUSINESS

Online bond platforms see sharp jump in retail participation. Here’s what data shows

During the last three years, yields on corporate bonds climbed by over 100 bps across tenures, following the rate hike cycle by the RBI in May last year.

BUSINESS

L&T Finance Holdings merger process expected to be completed in FY24: MD & CEO Dinanath Dubhashi

The number of entities within L&T Finance Holdings have come down from 16 in FY17 to nine in FY22. There are now only two lending entities, L&T Finance Limited and L&T Infra Credit Limited, Dubhashi said.

BUSINESS

Yields of corporate bonds rated AA, lower may fall 5-10 bps on rate pause in June: experts

Since the RBI’s April monetary policy, yields on papers rated AA and below have fallen 18-34 bps across maturities.