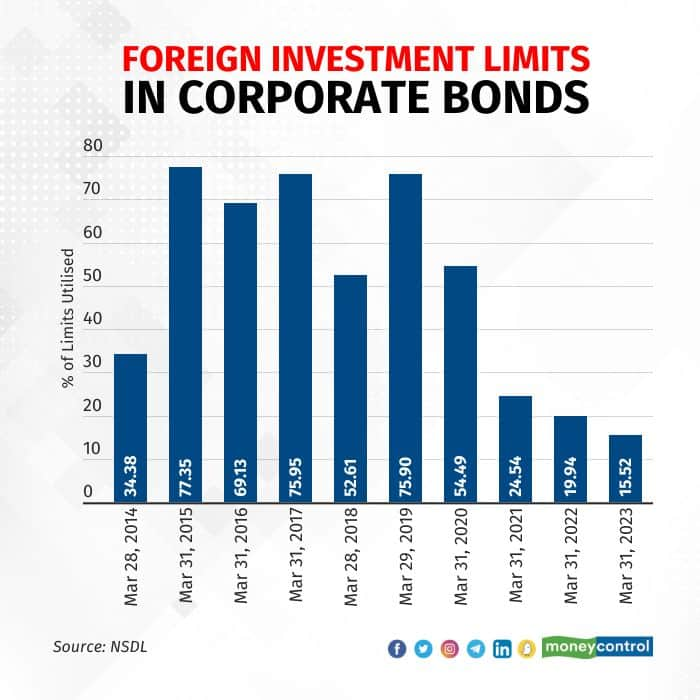

Foreign portfolio investors (FPIs) utilised 15.52 percent of their investment limit in corporate bonds in the year ended March 31, 2023, the lowest in 10 years, according to a Moneycontrol analysis.

This compares with utilisation of 19.94 percent in the previous year, data shows.

Since March 29, 2019, the utilisation limit by FPIs has been falling constantly. In the past 10 years, the limit reached a peak of 75.95 percent in the year ended March 31, 2017.

Experts attribute the trend to a sharp depreciation of the Indian rupee, a lower spread between US Treasury yields and Indian debt instruments and global uncertainties.

“The debt utilisation limit is low because the cost of hedging was high, India’s real interest rate was low, and spread between debt instruments of the US and India has also shrunk. Hence, FPIs moved out from emerging markets to developed markets,” said Sandeep Bagla, Chief Executive Officer of Trust Mutual Funds.

According to Vivek Iyer, Partner and leader of the financial services risk practice at Grant Thornton Bharat, it is wise to limit the investments in debt given the interest rate risk exposure on the bond portfolio on account of the expected rate hikes.

This is reflected in the low debt utilization limit of FPIs.

Also read: RBI annual report: FPI investment in outstanding corporate bonds decline to Rs 1.04 lakh crore

Rupee factorThe Indian rupee has depreciated against the US dollar due to multiple factors, including rising Brent crude oil prices and the Russia-Ukraine war.

According to the Bloomberg data, the rupee has depreciated 20.44 percent to date since April 1, 2018. Currently, the rupee is trading at 82.45 against the US dollar.

Dealers said the depreciation of the rupee has also impacted FPI flows because it reduces the returns of these investors.

Covid factorDuring the Covid-19 pandemic, there were heavy outflows from the debt market, leading to a drop in investment by FPIs in debt, experts said.

As per National Securities Depositories Limited data, FPI flows remained negative between FY19 and FY23, except in FY22 where there were marginal inflows.

In FY19, there were outflows of Rs 42,357 crore, followed by Rs 48,710 crore in FY20, Rs 50,443 crore in FY21, and Rs 8,937 crore in FY23. The inflows amounted to Rs 1,628 crore in FY22.

During that period, uncertainty caused investors to move from emerging economies to advanced economies in search of better returns, experts said.

Also, the rising yield on US debt instruments amid policy rate increases by the US Federal Reserve reduced the spread with Indian debt instruments. This usually leads to a sell-off in emerging markets.

According to the Reserve Bank of India (RBI) annual report, investments by FPIs in outstanding stock of corporate bonds decreased to Rs 1.04 lakh crore at end-March 2023 from Rs 1.21 lakh crore a year ago.

Also read: 10 things you should know about why SEBI wants FPIs to disclose full ownership details

Can FPI participation fall further?Dealers are of the view this limit is likely to reduce in the coming days as the spread between India and US debt instruments is narrowing.

“It may not surprise us if that utilisation reduces to 7-8 percent in the coming days,” a dealer with a state-owned bank said.

Iyer said India needs to consciously undertake reforms in deepening the corporate bond market and the corresponding derivatives market around credit swaps to garner greater interest from FPIs.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.