The yield on corporate bonds rated AA and below is likely to fall around 5-10 basis points (bps) in the coming weeks, tracking easing yields on government securities and on the expectation of a further pause by the Reserve Bank of India (RBI) in its upcoming monetary policy, experts said.

They added that this will encourage investors in need of funds to tap the bond market for their working capital and financing needs.

“After the RBI policy, there are also other positive developments like oil prices coming down, US Fed coming closer to a pause, and inflation falling below 5 percent. Considering all these developments and the expectation of a further pause by the RBI, we expect rates to fall further,” said Mahendra Kumar Jajoo, Chief Investment Officer – Fixed Income, at Mirae Asset Mutual Fund.

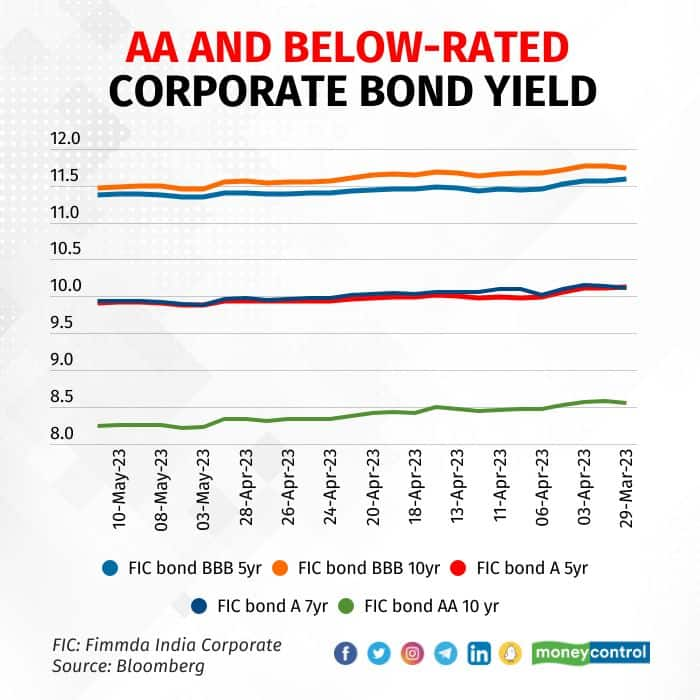

Since the RBI’s April monetary policy, yields on papers rated AA and below have fallen 18-34 bps across maturities. Similarly, yields have eased by 15-25 bps on AAA rated papers.

One basis point is one hundredth of a percentage point.

The fall in government bond yields was due to easing Brent crude oil prices and US Treasury yields, which have given comfort to other instruments in the fixed income market.

The yield on the benchmark bond has been below the 7 percent mark since last week, falling to a nearly 13-month low. Currently, the yield on the 10-year benchmark 7.26 percent 2033 is trading at 6.9860 percent.

Issuance trend

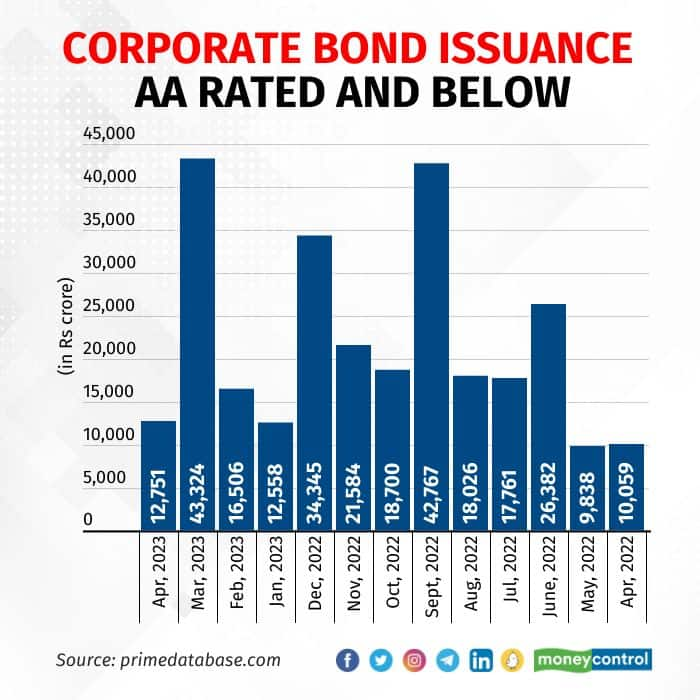

According to Prime database, fundraising through bonds rated AA and below in April increased approximately 27 percent on-year to Rs 12,751 crore.

However, on-month basis issuances plunged around 71 percent.

“Generally, the first few weeks of the fiscal are calm as issuers hit the market post announcing their financial results. But with the easing of borrowing costs, issuances are expected to increase,” said Ajay Manglunia, managing director and head of the investment group at JM Financial.

Meanwhile, in March 2023, fundraising stood at Rs 43,324 crore, the highest level in financial year 2022-23.

In FY23, data showed there were issuances worth Rs 2.72 lakh crore in the AA-and-below segment.

Also read: Adani-Hindenburg saga: Sebi warns on premature conclusion to probe

Easing yields

According to FIMMDA data sourced through Bloomberg, the yield on the 10-year AA rated corporate bond, which was trading at 8.5554 percent on March 29, had fallen to 8.2360 percent on May 11.

Similarly, the yield on BBB rated 10-year bonds fell to 11.4729 percent on May 11, from 11.7422 percent on March 29.

According to Vivek Ramakrishnan, VP, Investments, DSP Mutual Fund, the fall in yield for corporate bonds mirrors the drop in yields in Indian government bonds as well as AAA bonds, with the benefits coming into lower-rated bonds as well.

“The market has started pricing in cuts, whereas Central Banks have maintained that the pause in rates will be longer,” he said.

Further, Jajoo added that post the last RBI policy, the market was encouraged by the pause and further trades have also been happening in expectation of another pause at the next meeting.

The Monetary Policy Committee kept the repo rate unchanged at 6.50 percent in April, after raising it by 250 bps from May 2022.

Also read: Banking Central | As Inflation cools off, pause on rates may stay, but war is far from over

Will there be a pause in the next policy?

Money market dealers are of the view that considering the recent data, the RBI is likely to continue the pause at its upcoming monetary policy in June.

Manglunia said the central bank will look at incoming domestic data while being cognisant of decelerating global growth.

“After the unexpected pause in April, there is a good chance the RBI might continue with a pause in June, too,” Manglunia added.

Recently, RBI governor Shaktikanta Das said easing CPI inflation in April had bolstered the central bank’s confidence in its monetary policy. “The inflation numbers give me and my colleagues at the RBI a reasonable amount of confidence that monetary policy is on the right track,” Das said at the launch event of the book ‘Made in India’, authored by Amitabh Kant, the G20 sherpa.

India’s headline retail inflation rate dropped sharply for the second month in a row, hitting an 18-month low of 4.7 percent in April, according to data released by the Ministry of Statistics and Programme Implementation on May 12.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.