BUSINESS

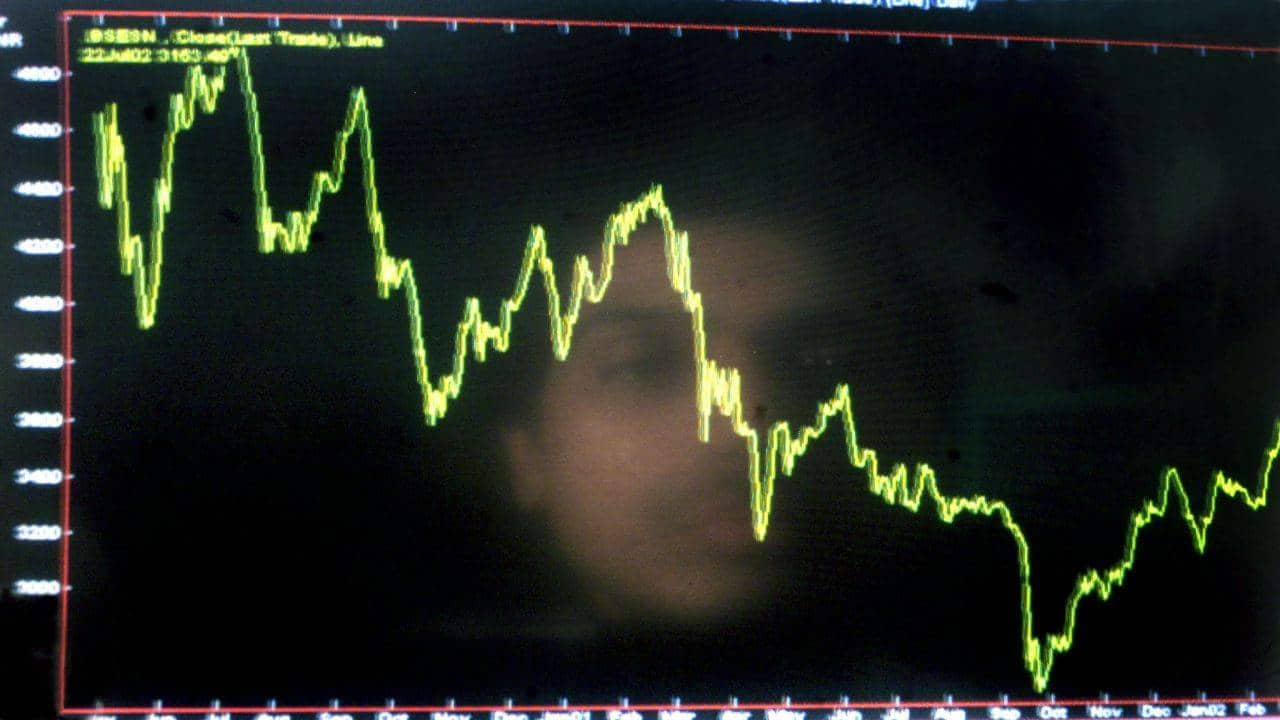

Technical alarms go off as Nifty breaks crucial 10,700: What traders should do

The turmoil was seen in the mid and the smallcap space as the broader market continues to underperform with S&P BSE Midcap index losing 1.5 percent while the S&P BSE Smallcap index was down 2 percent.

BUSINESS

Don’t miss them! Brokerages initiate coverage on these 5 stocks that can give 20-40% returns

The focus of investors should be on buying quality which could withstand the correction and outperform index when the market starts rising.

BUSINESS

Podcast | An evening walk down Dalal Street: Sensex ends flat but over 300 stocks hit 52-week low

Stocks which hit a fresh 52-week low on the BSE include stocks like Force Motors, Care Ratings, Century Textiles, UPL, Finolex Industries, Kajaria Ceramics, ICICI Securities, Tata Motors, NTPC, Aban Offshore etc. among others.

BUSINESS

Top 5 stocks in the mid & smallcap space could be hidden gems for value investors

Nitin Bhasin of Ambit Capital recommends banks with superior earnings growth such as IndusInd Bank and City Union Bank

BUSINESS

13 stocks available at a reasonable price; should you try your luck?

At a time when most companies are struggling to show a consistent track record of growth, these 13 stocks are priced to perfection at current levels in comparison to return on capital employed (RoCE).

BUSINESS

Technical View: Nifty forms bearish candle; 10,850 crucial for bulls to regain control

The index formed a bearish candle on the daily charts which also resembles a Bearish Harami kind of pattern.

BUSINESS

These 10 moneymaking ideas could offer 4-14% return in next 1-2 months

Nifty is likely to remain volatile ahead of expiry due on Thursday. Experts say investors should look for stock-specific opportunities to take advantage of the upside momentum.

BUSINESS

Over 260 stocks that hit fresh lows in June slip 80% in 2018, do you own any?

The BSE Midcap index has plunged a little over 11 percent and the BSE Smallcap index dropped nearly 14 percent in 2018. The carnage was similar on the NSE as well.

BUSINESS

June expiry may keep markets volatile this week; book profit on rallies: GEPL Capital

Given the small premium of 46-50, that the 10,850-CE governs, it would be worthwhile to buy it with possible targets around Rs 150-200 ahead of expiry, Pushkaraj Sham Kanitkar, AVP - Technical Research at GEPL Capital, said in an interview with Moneycontrol’s Kshitij Anand.

BUSINESS

Riding the momentum! Sensex ends flat but these 15 stocks rose 10-60% in a week

It has been a roller coaster ride for Indian markets thanks to trade wars woes, uncertainty OPEC meet and selling by foreign institutional investors which have pulled out over Rs 5,000 crore from Indian markets in the month of June.

BUSINESS

Crystal ball gazing on markets: 10 stocks which are likely to remain in Sensex till 2028

While constructing a portfolio, investors should only focus on bluechips displaying growth visibility.

BUSINESS

Pharma, IT, auto among 6 sectors that could see double-digit growth: UTI AMC

At this point in time, he prefers private sector corporate lenders over state run peers.

BUSINESS

Podcast | An evening walk down Dalal Street: Sensex cracks over 100 points; Nifty below 10,750

The S&P BSE Sensex closed 114 points lower or 0.32 percent at 35,432 while the Nifty50 closed 30 points down or 0.29 percent at 10,741.

BUSINESS

International Yoga Day: Top 5 healthy stocks handpicked by experts for your portfolio

With over 175 international countries supporting the Yoga practice, it has a clearly paved way to become mentally and financially healthy.

BUSINESS

Mutual fund managers bought & sold these 20 stocks in May

Relative valuations are attractive and around average, but midcap valuations are still looking stretched despite the recent drawdown, Morgan Stanley said in a recent note.

BUSINESS

Technical View: Nifty forms 'Harami' kind of pattern; bulls trying to make a comeback

On the options front, maximum Put OI is placed at 10,700 followed by 10,600 strikes while maximum Call OI is placed at 11,000 followed by 10,800 strikes.

BUSINESS

These 18 Bahubalis rose up to 1,000% in the last 10 years; Are they still a buy?

Shares of Maruti Suzuki rallied over 1,000 percent, followed by HDFC Bank (766 percent), TCS (713 percent), and M&M (540 percent) in the last 10 years.

BUSINESS

Technical View: Nifty forms a Bearish Belt Hold; use rallies to short with a stop 10,830

A ‘Bearish Belt Hold’ pattern is formed when the opening price becomes the highest point of the trading day (intraday high) and the index declines throughout the trading day making up for the large body.

BUSINESS

Which states topped the equity cash turnover and MF inflow list in 2017?

Net fund inflows in 2016-17 from the Mumbai region stood at Rs 1.5 lakh crore

BUSINESS

Over 150 stocks in BSE 500 trade below 5-yr average PE; Time to hunt for value?

Stocks with a lower PE are considered reasonably valued as their growth potential is still untapped whereas higher PE signals an over-priced stock.

BUSINESS

Technical View: Nifty forms 'Bearish Belt Hold' pattern; support placed at 10,755

Trading activity seen in the last three sessions suggest that indices are in a consolidation mode which shall eventually lead to a directional move with a breakout in either of the directions.

BUSINESS

Top 10 moneymaking ideas by experts which could give 4-12% returns in 30 days

Stock specific moves likely to happen in selective IT, pharma, NBFC stocks and heavyweights stocks are likely to take the lead while PSU, Auto, Cement, Mid and Small Cap stocks would be under pressure with limited upside.

BUSINESS

Stocks which are hitting 52-week highs likely to outperform once Nifty reclaims 11K

Rajesh Palviya of Axis Securities feels if Nifty crosses 10,900 levels then short covering can pull the indices to the 11,000 mark.

BUSINESS

Hunting for multibaggers? Here are 10 mistakes which one should avoid

Focus on the growth rate of the industry including future growth potential is a must