BUSINESS

Exclusive | Legacy issues behind us, says IDFC First Bank MD Vaidyanathan

The bank has brought asset quality issues under control and is ready for the next leg of growth, says Vaidyanathan

BUSINESS

Budget 2022: Crypto gets a backdoor entry in India

By recognising crypto as a taxable asset, the government has acknowledged its existence along with other virtual assets. A government cannot tax something that is illegal.

BUSINESS

Budget 2022 | No proposal for fresh capital infusion into PSU banks this year

In her last Budget, the FM had announced Rs 20,000 crore capital infusion for PSBs. In the year prior to that, there wasn't any. The government wants PSBs to find capital from the market

BUSINESS

Budget 2022: FM Sitharaman announces Digital Rupee. Here's how it will work

A CBDC is the digital form of fiat currency and will ease transactions. An RBI report had earlier described CBDC as something that will provides a safe, robust, and convenient alternative to physical cash.

BUSINESS

Economic Survey 2022: Cases worth Rs 1.48 lakh crore rescued under IBC; Rs 52,000 crore sent for liquidation

In value terms, around 74 percent of distressed assets were rescued. Of the CDs sent for liquidation, three-fourth were either sick or defunct and of the firms rescued, one-third were either sick or defunct, the Survey said.

BUSINESS

Economic Survey 2022 | Rs 1,500 crore paid to 1.2 lakh depositors after DICGC Act changes

The Budget 2020- 21 had increased the deposit insurance cover from to Rs 5 lakh from Rs 1 lakh per depositor per bank

BUSINESS

Economic Survey 2022 | Excess liquidity, stalled insolvency process bring longer-term risks

Since the outbreak of the pandemic, the monetary policy was calibrated to provide a cushion and support growth but carefully controlled to avoid the medium-term dislocations of excess liquidity, the survey says

BUSINESS

Economic Survey 2022: Banking system past the pandemic but some lagged impact remains in the pipeline

The stressed advances ratio of scheduled commercial banks increased from 7.9 per cent at the end of September 2020 to 8.5 per cent at the end of September 2021, the government's annual pre-budget survey released on January 31 said

BUSINESS

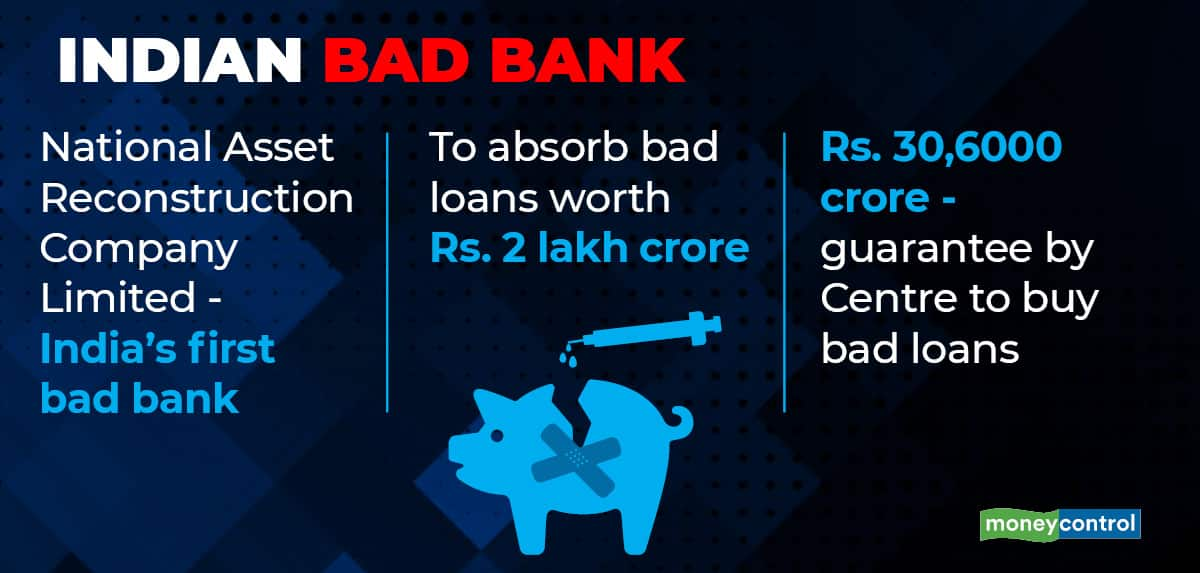

Banking Central | Bad Bank is ready; can it make a difference?

The Bad Bank will absorb bad assets from banks but proper execution and asset resolution will be key to make sure the project doesn’t meet the fate of some of the earlier initiatives.

BUSINESS

SBI withdraws controversial circular on pregnant women candidates

The move came after Delhi Commission for women intervened in the matter and asked the bank explain its action.

BANKS

SBI says pregnant women over 3 months unfit to apply, Delhi Women’s commission takes suo-moto cognizance

As per earlier rules of SBI, pregnant women candidates were eligible to be appointed in the bank for up to 6 months of pregnancy

BUSINESS

Bad Bank received all necessary approvals to commence operations: SBI Chairman Dinesh Khara

Bad Bank was announced by Union Finance Minister Nirmal Sitharaman in last Union Budget. This entity will absorb the bad assets of banks enabling banks to clean up their books.

BUSINESS

“We are not PMC Bank. We are Unity, we are a different institution,” Jaspal Bindra says in exclusive interview

Unity Small Finance Bank (Unity SFB) will try and help arrange some liquidity-- directly or indirectly-- for Punjab and Maharashtra Co-operative Bank (PMC Bank) depositors as and when they need it, the Centrum Group chairman said. The recent controversy over BharatPe founder Ashneer Grover’s personal conduct with a Kotak executive doesn’t affect Unity SFB, a joint venture between Centrum Group and the fintech firm, Bindra said.

BUSINESS

RBI remains committed to COVID fight, keeping inflation within target, says Deputy Governor Michael Patra

The RBI’s measures have contributed significantly in engineering the turnaround in the Indian economy, supported by rising financial inclusion and digitalisation, Patra said while delivering the C D Deshmukh Memorial Lecture organised by the Council for Social Development, Hyderabad

BUSINESS

Explainer: What ails the Bad Bank proposal unveiled in the last budget?

It’s not just the organizational structure and regulatory concerns. The proposed Bad Bank may also encounter valuation hurdles in a tough market.

BUSINESS

PMC Bank-Unity merger: What does the final scheme mean for depositors?

The scheme entails a repayment period spread across 10 years to PMC Bank depositors. This means a long wait for high value depositors in the bank

BUSINESS

PMC Bank merges with Unity SFB from today, says RBI

The RBI superseded PMC Bank board in September 2019 following a major fraud.

BUSINESS

Banking Central | Is privatisation the lone cure to save weak PSBs?

The government has been pitching privatisation of state-run banks as a key-action item but it ends up as a no-action event. But, why alone focus on privatisation?

BUSINESS

Rama Bijapurkar on ICICI Bank insider trading: Was an inadvertent error

Bijapurkar resigned as an independent director from the ICICI Bank board, citing likely conflict of interest and now reportedly faces a probe by market regulator Sebi.

BUSINESS

Is Vinod Rai Unity’s trump card to gain customer confidence?

Unity Small Finance Bank is fighting a twin battle. It needs to calm aggrieved PMC Bank depositors. The BharatPe-Ashneer Grover episode dented the JV’s image. Rai’s credentials could act as an antidote.

BUSINESS

Budget 2022: MFIs seek Rs 1,000 crore development fund, extension of credit guarantee scheme

Operations of microfinance institutions were severely hit during the first wave of Covid-19 as lockdowns affected collections. Also, the repayment ability of the borrowers were impacted following loss of livelihoods in many states. But, the impact was much less severe in the second wave.

BUSINESS

What do rising bond yields to signal to the markets?

A combination of factors including firming up of crude oil prices, risks to inflation and swifter-than-expected interest rate increases signalled by the US Federal Reserve have contributed to the hardening of bond yields.

BUSINESS

The return of Padmaja Reddy: Former Spandana Sphoorty boss forays into gold loan business, plans to acquire NBFC

Though Reddy had initially planned to seek a new NBFC licence, she later decided to acquire an existing NBFC and merge the existing business to speed up the process

BUSINESS

Kerala Bank looking for new MD & CEO; invites applications

According to the advertisement by Kerala Bank, the CEO candidate should have 20 years of experience in mainstream banking and at least three years of experience in senior management level in a public sector or private sector commercial bank.