BUSINESS

RBI Policy: MPC retains repo rate at 6.5%, sounds caution on inflation

Since May 2022, the RBI has hiked the repo rate by 250 basis points to counter inflationary pressure, though high inflation, which has remained a key concern for policymakers, has begun cooling off in recent months

BUSINESS

Banking Central| MPC has all the reasons to pause, again. But what’s next?

In the last policy review in April, the rate-setting panel had opted for a pause despite expectations of a rate hike. This time, the chances are likely that the rate approach will continue.

BUSINESS

Dhanlaxmi Bank likely to propose new candidate as part-time chairman soon

Earlier the RBI had said no to a proposal by the bank to appoint G Rajagopalan Nair as its part-time chairman.

BUSINESS

Banking Central | Have fixed deposit rates already peaked?

Banks have been increasing rates on fixed deposits over the last two years. The cycle may have come to an end with the RBI signalling a pause

BUSINESS

Modi@9: The unmaking and making of Indian banks to face global challenges head on

Banking system had a tough phase during the 2020 Covid-19 pandemic but the interventions by the government and the RBI in terms of liquidity assistance and moratorium saved the industry from a bigger crisis.

BUSINESS

MC Exclusive | RBI junks Dhanlaxmi Bank proposal for Rajagopalan Nair as part-time chairman

The Kerala-based bank doesn’t have a chairman since the resignation of G Subramonia Iyer in December 2021. Nair has been on the board of Dhanlaxmi Bank since August 2020 as an independent director

BUSINESS

Banking Central | Black money menace, rampant fake currency behind Rs 2,000 note recall

These notes have been used rampantly by the fake currency mafia eversince introduced. Besides, going by the data from the IT department, these notes have constituted a major chunk of the black money seized in recent years. Was this the reason the RBI chose to withdraw it at this point?

BUSINESS

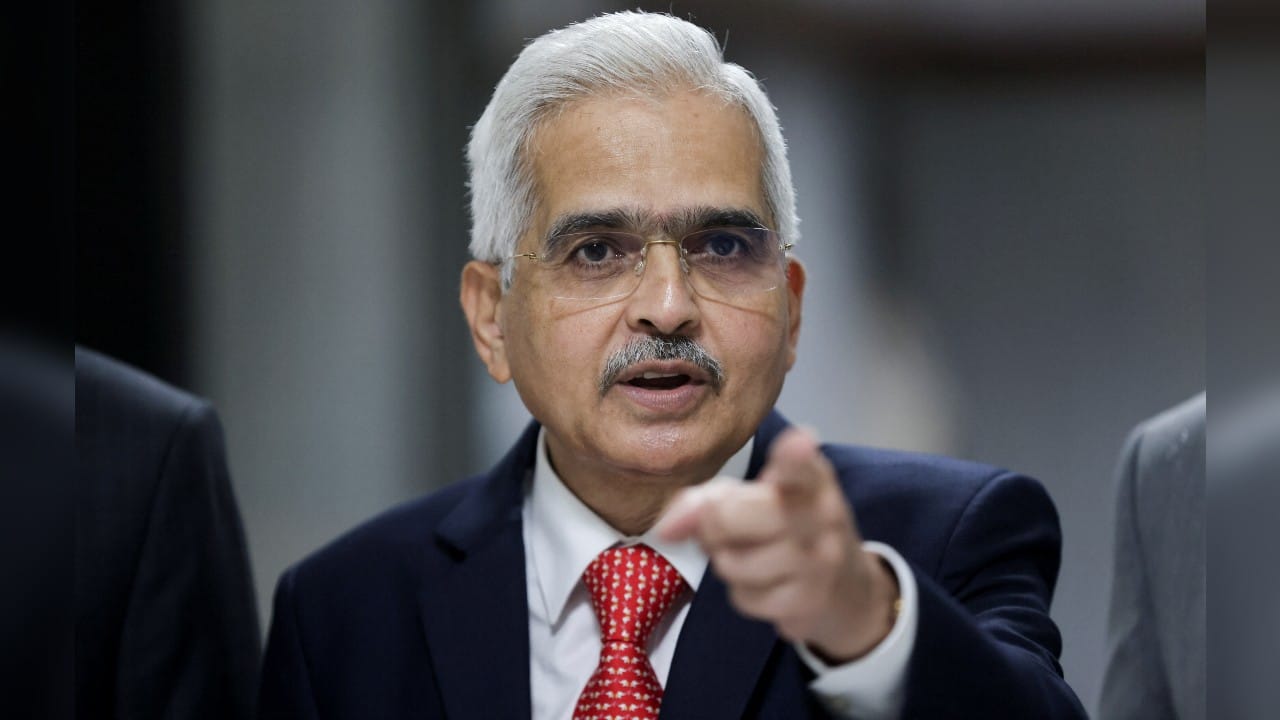

With his Rs 2,000 knock, Shaktikanta Das deals a body blow to black-money hoarders

The segment of society that will be hit by the RBI's decision to withdraw the Rs 2,000 note will be the tax cheats holding crores of these high denomination notes. They will now come under the lens of tax authorities

BUSINESS

Will Rs 2,000 currency notes remain legal tender after September 30?

It is expected that the Rs 2,000 notes will remain a legal tender even after September 30, going by a similar exercise conducted by the RBI in 2014 when it announced the withdrawal of all bank notes issued before the year 2005

BUSINESS

Five reasons why Rs 2,000 note withdrawal can't be compared to 2016 demonetisation

Going by the RBI press release, the Rs 2,000 notes will continue to remain a legal tender, meaning one can use it for transactions. This wasn’t the case during the 2016 demonitisation exercise, when notes were deemed invalid overnight

BUSINESS

Banking Central | Pause on rates may stay as Inflation cools off, but war is far from over

Most economists believe that decline in the overall inflation numbers will provide room for the rate-setting panel to continue with the pause in the next policy meet on June 6-8. If low inflation sustains, one cannot rule out a rate cut later this year

BUSINESS

Banking Central | Bank credit picks up momentum. But where is the money going?

Data suggests that bank lending to individual loans is picking up pace while that to industries is slowing.

BUSINESS

Banking Central | Das’ message to banks: In good times, we prepare for the bad

This isn’t the first time RBI governor Shaktikanta Das has asked banks to build an additional capital buffer and tighten risk assessment. Last time, it was during the peak of the coronavirus pandemic

BUSINESS

Why a sharp spike in KCC loans is a ticking timebomb for Indian banks

Kisan Credit Card loans have been a source of pain for state-run banks in the past on account of high default rates and the repeated loan waivers announced by politicians. A big jump in the quantum of such loans ahead of an election year may be bad news for banks.

BUSINESS

Banking Central | Two private lenders make the field for bulls in banking space

ICICI Bank numbers add to the optimism in the sector while RBI clarifications offer much needed clarity to HDFC Bank’s investors.

BUSINESS

HDFC-HDFC Bank merger: Why RBI clarification comes as a relief for the banking giant

More time to comply with PSL requirements takes away the immediate burden from the bank. Similarly, clarity on holdings in investments and subsidiaries will clear air for investors.

BUSINESS

Decoding MPC minutes: No one backs out from inflation fight. Then why a pause?

Minutes show inflation worries dominated the deliberations, yet the panel decided to pause. It is not clear why

BUSINESS

Banking Central | CPI inflation at 5.7% in March guarantees a pause in June but watch out for crude

If inflation doesn’t surprise on the upside and stays below 6 percent, the MPC could stay in the pause mode for the rest of the year, with even the possibility of a rate cut by end of the year

BUSINESS

Banking Central: Will RBI’s Monetary Policy Committee regret its early pause?

The assumption is that inflation will start easing in the period ahead. But what if it stays elevated? That would put the panel in an embarrassing position because of the early pause. Remember, crude is inching up following surprise production cuts by major producers and there is an El Nino threat over the monsoon

BUSINESS

Quick view | Dear RBI governor, why the reluctant pause now?

Overall, the tone suggests that the central bank is still cautious as far as inflation is concerned and doesn't want to signal to the market that the rate hikes are over. So, if inflation continues to surprise on the upside, a rate hike can't be ruled out this year

BUSINESS

RBI Policy: Surprise pause by MPC, repo rate kept unchanged at 6.5%

The central bank has hiked the repo rate by 250 basis points since May last year to contain inflationary pressure.

BUSINESS

Banking Central | What will be the MPC’s decision on rates?

That the MPC will go for another 25bps rate hike on April 6 is a given assumption considering the still high retail inflation.

BUSINESS

Exclusive| ‘No differences with the board’, clarifies South Indian Bank MD Murali Ramakrishnan on decision to not seek re-appointment

Shares of the bank had fallen sharply on 29 March post the bank’s communication to stock exchanges. At the time of filing this copy, the shares were trading at Rs 14.25 apiece, down 13.9 per cent from the previous close.

BUSINESS

Banking Central | Who wouldn’t love a bigger deposit insurance cover

Banks are dealing with public money and depositors deserve a safety net in the event of bank collapses. The higher cost of deposit insurance can be borne by the depositor instead of banks footing the bill alone